For private investors, the coronavirus brought to the forefront a long-standing concern in their relationship with financial institutions: the potential downside of a margin call. When stock markets plunged by over 25% at the beginning of 2020, banks and wealth managers were compelled to liquidate investors’ positions in the face of margin calls, imposing heavy losses on the latter.

Leverage Shares offers a solution in the form of single-stock short and leveraged exchange-traded products (S&L ETPs). These ETPs are built around some of the most heavily traded US tech and finance stocks, which collectively account for a quarter of the S&P 500 and nearly half of the Nasdaq 100. The products include names like Amazon, Apple, Microsoft, Tesla, and others – offering both leveraged (2x and 3x) and short (-1x) exposure to individual equities.

Initially listed on London Stock Exchange in different currencies, Leverage Shares now brings these powerful ETPs to an even wider market. As Brieuc Louchard, head of ETFs at Euronext, said: “We are delighted to continually offer a wide range of innovative products, expanding the pool of trading instruments for global investors. The listing of Leverage Share ETPs will bring advanced tools to investors of all types, allowing them to benefit from stocks trends. We are delighted to welcome the physically replicated ETPs from Leverage Shares on our markets.”

The global S&L ETP landscape

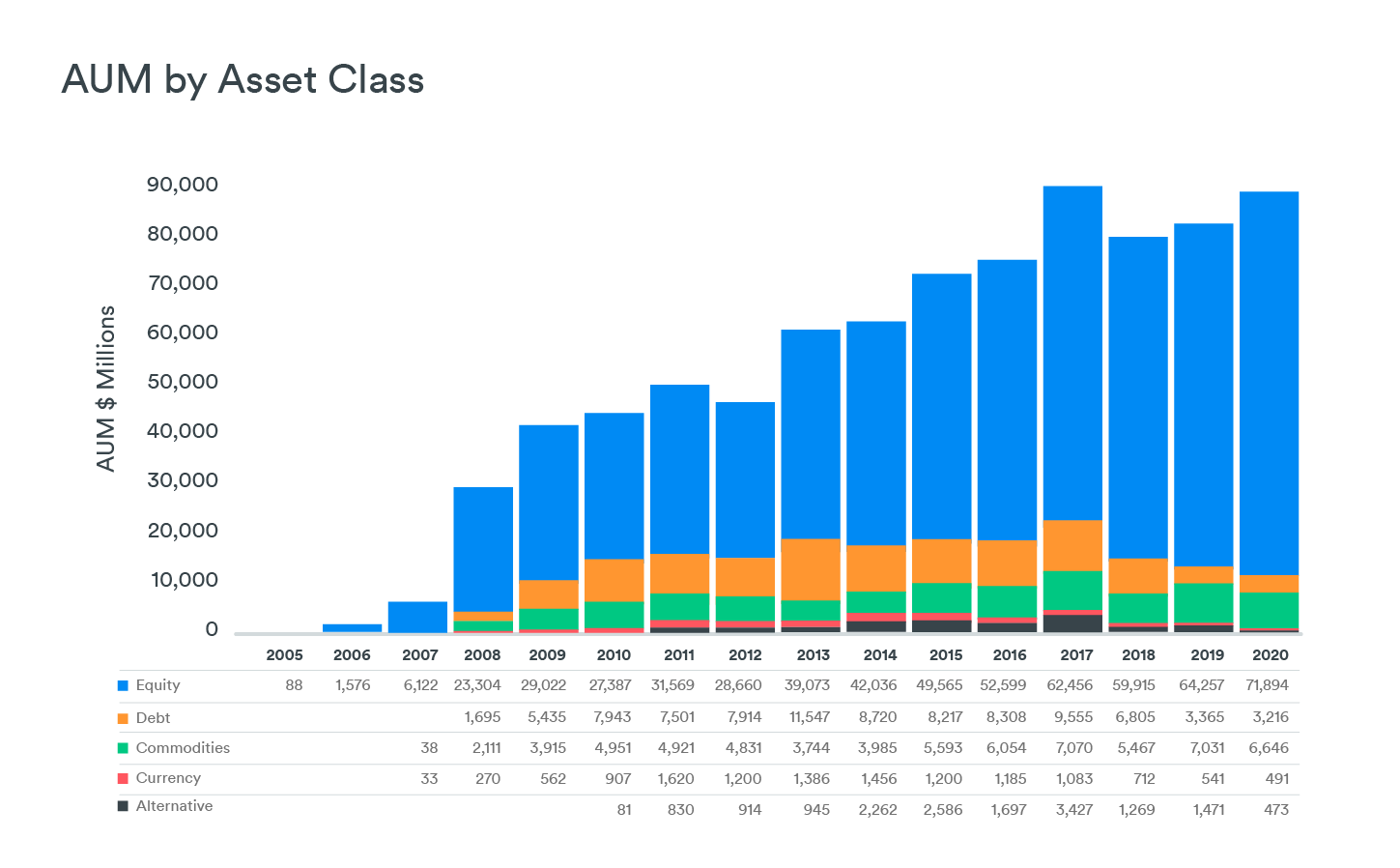

The global S&L ETP space is made up of nearly 900 products with $89bn in assets under management (AUM). Equities make up 86% of the AUM in this space, as at August 2020, equities with the most popular leverage factors being 3x, 2x and -1x.

Figure 1: Growth in S&L ETPs

Source: WisdomTree

Most of the existing products in the S&L ETP space are constructed around broad indices, commodities, and bonds. Leverage Shares has tweaked this approach and pioneered ETPs that provide magnified exposure to individual stocks. They are designed to mimic the daily returns of the underlying stock being tracked, multiplied by a leverage factor. For example, if Apple stock rose 3% on a given day, the 2x Apple ETP would aim to increase by 6% and the 3x Apple ETP by 9% (and vice versa, excluding fees). They then “reset” at the end of trading and aim to offer the same exposure the following day.

According to Leverage Shares, their products do without the counterparty risk found in existing leveraged ETPs since all of their products are fully backed by the underlying stocks. This means they have no exposure to derivatives, like swaps, with major banks (if 2008 has taught us anything, it is that no bank is risk-proof).

Instead, they use the issuance proceeds and a matching margin loan to offer leveraged exposures. Therefore, our range of S&L ETPs provide investors with an enticing and risk-controlled trading tools while also offering enhanced collateral protection and reduced credit risk.

Using single-stock ETPs to capitalise on momentum

Looking back at the last 12 months, it has been a rollercoaster year for the markets. While both the S&P 500 (SPX) and Nasdaq (NDX) fell victim to the sell-off, the former fell nearly three times as much from their peaks in February to the trough in late March. The tech heavy NDX has subsequently outperformed SPX almost 4 to 1, going back one year, as at 29 September 2020. Considering that many investors prefer to invest into major indices such as SPX and NDX as the “core” portfolio, this trajectory leaves them with very little in gains over the year.

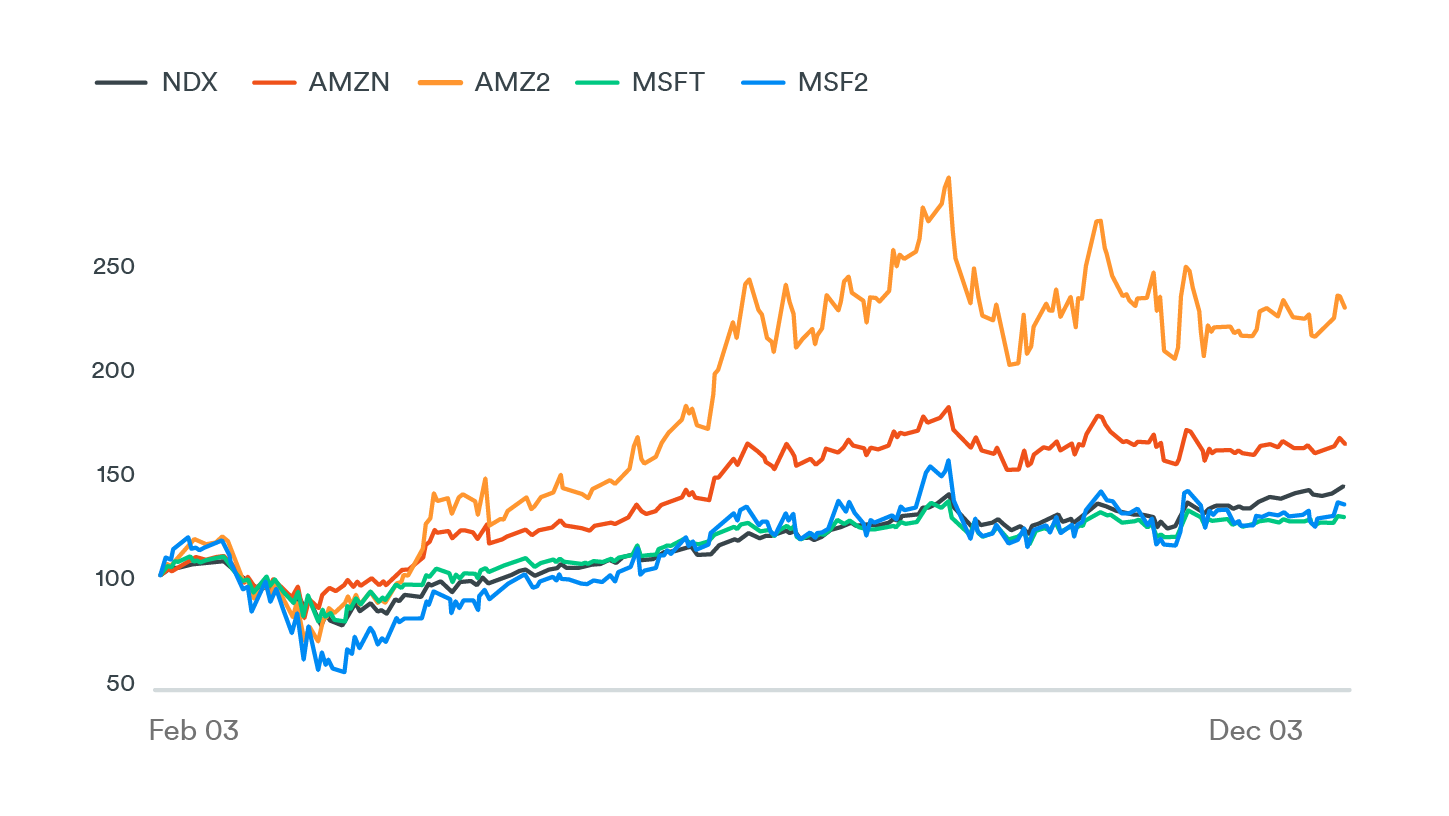

As the global economy re-adjusted in line with “stay at home” orders, it proved that the companies that weathered the storm were also the ones that stood to gain the most in its aftermath. This can be seen from examining two ‘tech’ behemoths that hold nearly the same weight in NDX: Amazon (AMZN) and Microsoft (MSFT).

While MSFT gained in tandem with NDX through the past 12-month period, AMZN began to post steadily increasing gains over the index from March onwards (see below).

Assuming that the 2x leveraged instruments for both these stocks were invested into in February 2020, the resulting performance of these ETPs vis-à-vis their underlying stocks are quite interesting.

Figure 2: 2x investments into AMZN and MSFT outperforms both the underlying as well as the index

While both AMZN and MSFT both outperform the NDX, the two ‘2x’ leveraged instruments take slightly different paths. While the 2x Amazon ETP shows an explosive increase, the corresponding 2x instrument for Microsoft displays a relative underperformance.

A judicious use of S&L ETPs would constitute an invaluable and relatively inexpensive choice for an investor’s “satellite” portfolio which, in return for some active management by the investor in ETP selection, can provide valuable gains to supplement their total portfolio value. But, as will be demonstrated, the daily “reset” feature of S&L ETPs is as rewarding on upticks as it is punishing on downturns.

Daily compounding of ETPs: A primer

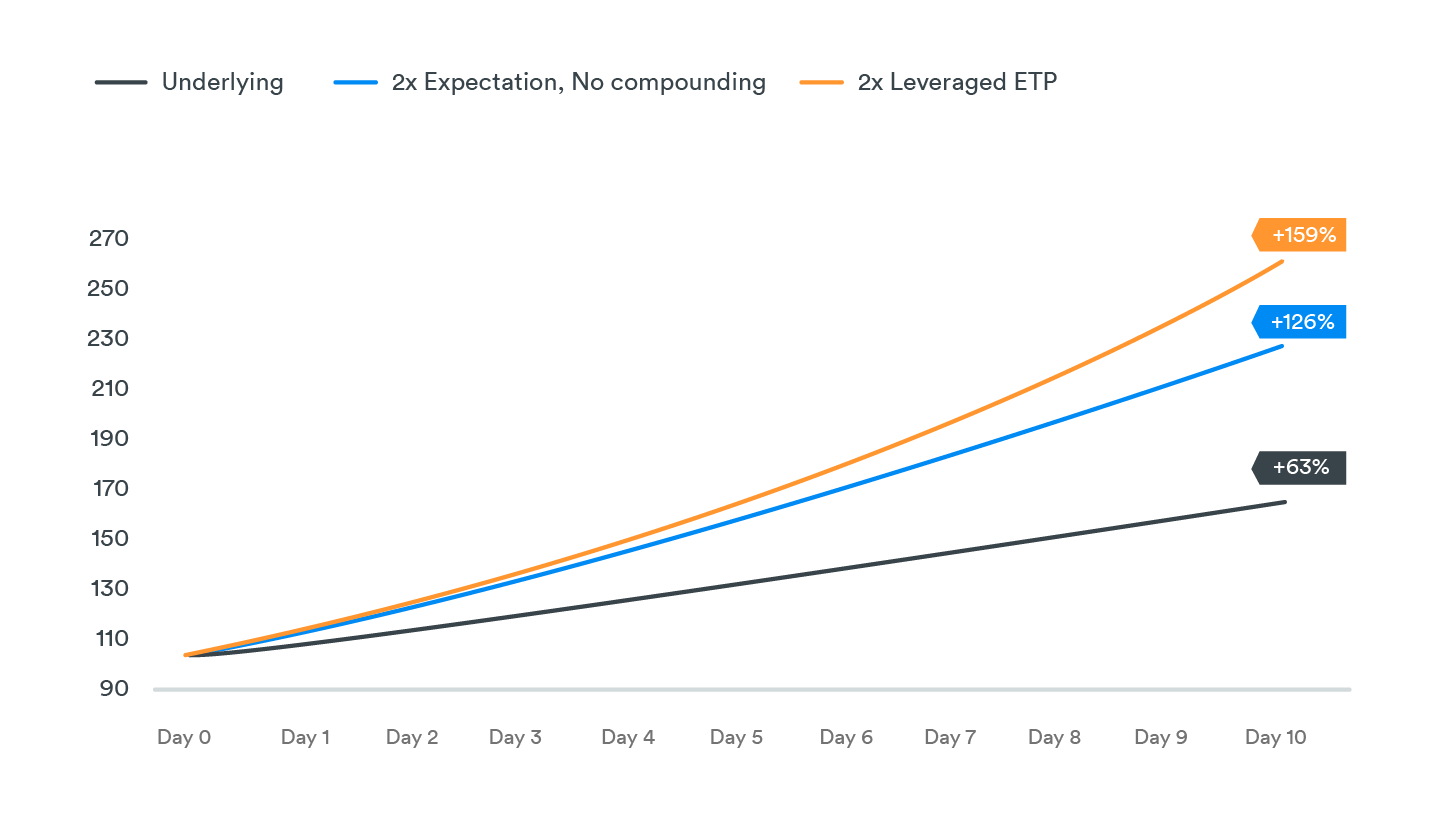

In the hypothetical example below, we are considering a 2x Leveraged ETP in an upward trending market, where the underlying stock rises 5% every day. Starting from day zero with an investment of €100, the 10-day performance would be as thus:

It can be seen that the daily compounding formula adds nearly 33% in gains over a 10-day period when compared to expectations of a 2x investment in the underlying asset.

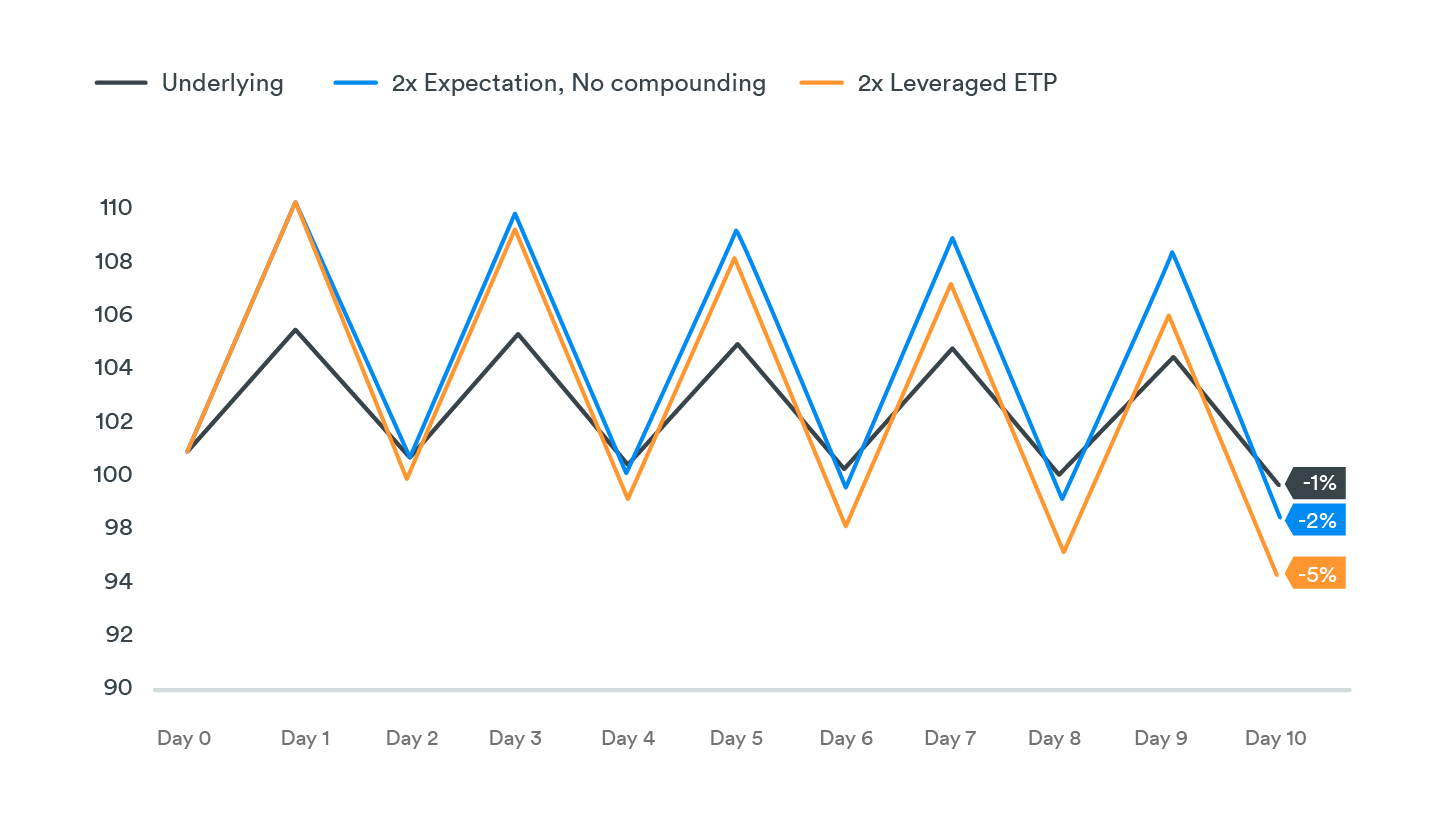

During days with choppy markets, the continuous oscillations would have a negative impact on the leveraged ETP’s performance. Assuming a rise of 5% in a single day followed by a drop of 5% in the next would result in a 10-day performance as follows:

From these illustrations, it can be summarised that when it comes to leveraged ETPs, “the trend is your friend”.

Volatility view for tech stocks

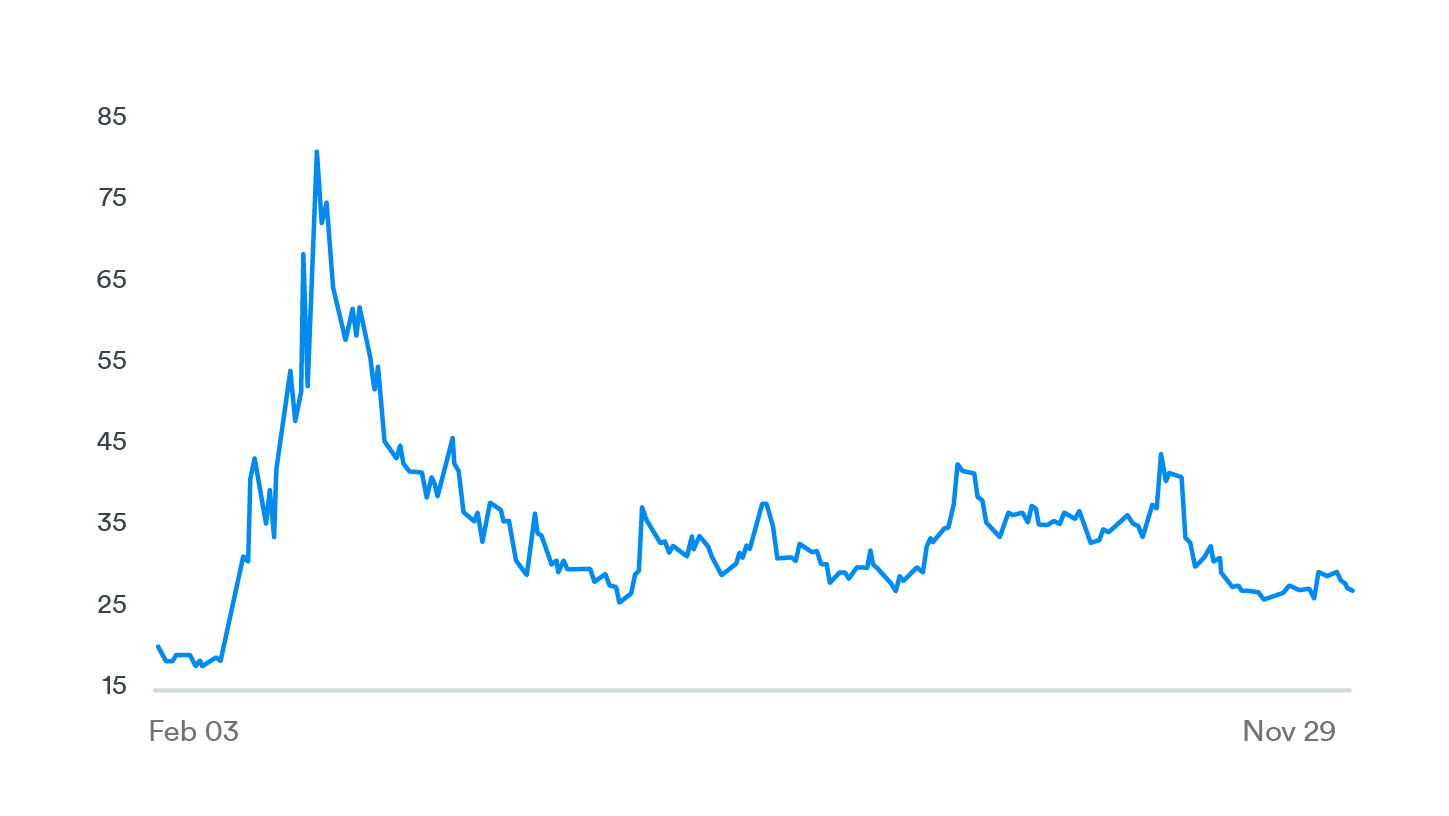

At present, the CBOE Nasdaq 100 Volatility Index (VXN), a gauge for market expectations of 30-day volatility for the Nasdaq 100 index, indicates neither a declining trend in volatility nor a steep spike like the one seen earlier this year.

Figure 5: CBOE’s volatility indices are widely known as “fear indices” since they represent traders’ sentiments about the future

The VXN’s levels in March were similar to those seen during the 2008 Global Financial Crisis. Since then, the index has reverted to the 30s range – indicating a return to normality. This range is considered to be the average expected range, a historical indication of traders’ consensus that they expect to see a healthy amount of diversity in the movement of asset prices. This presents an ideal environment for day traders to utilise S&L ETPs, which are of the highest utility when used in a short-term duration under active supervision. A fall below the 30s into the 10s would imply that price ranges for underlying assets would be very tight, making trading very restrictive

The current volatility levels signal an ideal environment for day traders to utilise S&L ETPs, which are of the highest utility when used in a short-term duration under active supervision. With substantially reduced risks and costs, a discerning private investor utilising these products certainly has a lot more to gain. If, however, volatility levels were to spike again, our -1x ETP range could be used to hedge downside risk in tech-heavy portfolios.”

Tightening regulations around leveraged products simply reiterate another industry trend – a shift towards transparency and safer trading vehicles. Leverage Shares physically-backed ETPs trade like any other stock or ETF while capping losses at the amount invested. Plus, having a dedicated market maker ensures that investors can get in and out of positions at tight spreads throughout the trading day. During these challenging economic times, we are proud to offer powerful tools for investors to capitalise on stock volatility, both the upside and the downside, all without the hassle of a margin account or the risk and expense of trading OTC products like CFDs.

Raj Sheth is sales director at Leverage Shares