Lyxor was delighted to host a webcast on Future Mobility on 10 February with theme expert Lukas Neckermann (pictured) and Neeraj Kumar from MSCI. Below are a few edited highlights from the webcast, which you can watch in full here.

2020 was a breakout year for future mobility, and especially for electric cars. Shares in the US electric vehicle (EV) maker Tesla rose by 695%, catapulting it into fifth place in the S&P 500. Less famously but of similar magnitude, China’s electric carmaker Nio rose by 1,100%.*

However, from an investor standpoint, the future of mobility is about far more than just electric vehicles. The MSCI ACWI IMI Future Mobility index is diversified across the mobility ecosystem and is up 66% since February 2020.*

Lukas Neckermann, managing director of Neckermann Strategic Advisors and author of “The Mobility Revolution”, explains the rationale for this race towards a smarter, greener future for transport.

The new value chain

Lukas Neckermann

The future mobility theme comes with a whole new value chain, and that chain is radically different from the old automotive one.

We have stopped talking about tier suppliers – now we talk about systems and data, battery cells and packs, fleet management, mobility operators and mobility aggregators. This is a new conversation, and there are opportunities to be found for investors across the theme.

Within each element, we also have a great deal of value being generated. We count 900+ companies and expect the value of the chain to approach $1bn by 2030, according to Neckermann Strategic Advisors.1 This growth is being led by the US, Germany, and UK, increasingly joined by countries such as France, Israel, and China.

What is driving the future of mobility?

It starts with regulations. Country by country, air quality concerns and a growing focus on ‘green’, make it clear that EVs are inevitable. The UK has recently announced plans to ban new fossil fuel vehicles by the end of the decade.

Even more impactful than national efforts are city-level ones. Lots of city authorities are making decisions about which types of vehicle to allow in – and it is not looking good for traditional cars. If you cannot drive an internal combustion engine (ICE) vehicle into the city, there is no point in having one. A city mayor can have a huge influence on industrial policy.

There are other drivers, too. One is simply cost, and the movement towards the price parity of EVs versus traditional vehicles. This has been calculated at around $100 per kWh – and depending on who you ask, this could be reached as soon as 2022-2025, according to research conducted by Neckermann Strategic Advisors.2

We already see price parity in the fleet market. In this area, when you factor in the total cost of ownership of a vehicle including the cost of driving into cities, doing maybe 50-150 miles per day, and whether you can charge cheaply at a depot, there are often even more incentives to buy electric.

Across countries, there are also different tax exemptions and subsidies – some of them even greater for company car schemes.

How did EVs perform in 2020?

EVs had a great 2020. Sales of hybrid and full electric cars in Europe made up over 20% of total car sales, up from 6% in 2018 to 22.4% in 2020.

We asked our webcast audience to guess what percentage of new car sales in Europe in 2020 were electric (hybrid and full battery electric). Only 13% correctly said 20% or more.

As we look ahead through 2021, we can use Q4 2020 results as a benchmark. In Q4, hybrid and full battery electric were over 30% of new vehicles sold across Europe3. In a market where we saw a dramatic decrease in the number of vehicles sold, we had a dramatic increase in the proportion of plug-in vehicle sales.

These numbers should explain the high valuations we are seeing – and why there’s been such an upswing of interest in the area.

To watch Lukas’s full presentation, please follow this link to our replay. You will learn:

How to assess which new manufacturers have value and which do not

Where legacy Original Equipment Manufacturers (OEMs) like BMW fit in

The parts of the value chain most worth paying attention to

How to build indices that capture the future mobility theme

Neeraj Kumar

Once we understand more about the opportunity presented by the future mobility theme, the question is simple: how can we select companies to capture it?

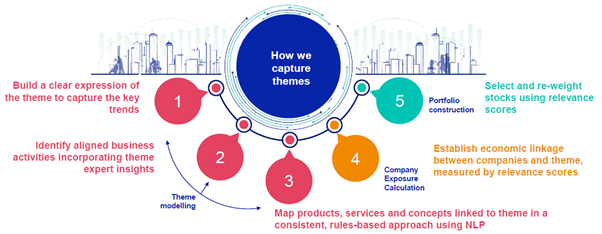

MSCI uses a five-step strategy for turning an idea into an investible index.

Articulate the theme or objective of the theme

For the future mobility theme, as Lukas explained, it’s not just about batteries or EVs, but an entire new value chain which has emerged. We articulate very clearly the scope of exposures that we intend to capture through our index. This process sets the index objective.

Expand that index objective and flesh out the sub-themes

We fill out the theme by unpacking it into smaller parts. For example, with future mobility, we include the sub-themes of batteries, smart mobility, the sharing economy, autonomous vehicles, and other related areas.

Build a dictionary of words around each sub-theme

We take each smaller sub-theme, i.e. batteries, and build a dictionary of words around it using Natural Language Processing techniques. This will include product services and concepts related to batteries, expanding the sub-theme into a collection of relevant keywords.

This step is taken for each subtheme identified in step 2. By the end of step 3 we have a set of words, synonyms, and concepts, all related to the theme and the subthemes expressed in step 2. These first three steps we call ‘theme modelling’, and they come before any analysis of real companies.

These investment themes can be described as ‘emerging’ – they are advancing and changing at a rapid pace. That’s why we have industry experts within each theme to advise on updating this dictionary, to stay relevant to the index objective.

Pick the parent universe and measure companies’ exposure to the theme

In step 4 we start to examine companies within our parent universe. For each company, we establish the link between their different economic activities and the objectives of the theme. This gives us a score showing the link between that activity and the theme, which we call the “relevance score”. Now, we can assign a score between 0 and 1 to each company for its exposure to the future mobility theme.

Use the relevance score to build portfolios

Once we have scored every company in our parent universe for its exposure to the theme in question, we have the tools to select stocks and combine them in different ways, add in ESG considerations, all within a completely transparent and rules-based methodology.

Source: MSCI. For illustrative purposes only. This is not a recommendation.

To watch Neeraj’s full presentation, please follow this link to our replay. You will learn:

How MSCI uses natural language processing and machine learning when building thematic indices

The rules governing stock selection, screening, and weighting in thematic indices

The view from Lyxor

Our world is changing. Technological breakthroughs, economic evolution and the climate emergency are reshaping reality for billions of people. Will your portfolio keep up?

Each of our thematic ETFs combines human insight, natural language processing and data analysis techniques in a unique way to identify the companies that matter most, and ensure your portfolio stays one step ahead. As a pioneering ETF provider with a history of innovation, we have gone the extra mile to build some truly state-of-the-art funds for a new state of mind.

We are incredibly excited about this range and hope you can join us in preparing portfolios for change.

Find out how you can stay one step ahead with Lyxor’s thematic ETFs

Target total expense ratios (TERs) for these thematic ETFs is 0.45% but has temporarily been decreased to 0.15% until September 2021.

*Source: Lyxor International Asset Management. Past performance is not a reliable indicator of future results.

1 Neckermann Strategic Advisors, 2021

2 Neckermann Strategic Advisors research; Deloitte, BNEF, McKinsey, UBS, Insideevs.com, thedriven.io

3 EV sales figures from ACEA, Statista, EV-Volumes.com

FOR PROFESSIONAL CLIENTS ONLY. CAPITAL AT RISK.

This communication is for the exclusive use of investors acting on their own account and categorised either as “Eligible Counterparties” or “Professional Clients” within the meaning of Markets in Financial Instruments Directive 2014/65/EU. These products comply with the UCITS Directive (2009/65/EC). Société Générale and Lyxor International Asset Management (LIAM) recommend that investors read carefully the “investment risks” section of the product’s documentation (prospectus and KIID). The prospectus and KIID are available free of charge on www.lyxoretf.com, and upon request to client-services-etf@lyxor.com. Except for the United-Kingdom, where this communication is issued in the UK by Lyxor Asset Management UK LLP, which is authorized and regulated by the Financial Conduct Authority in the UK under Registration Number 435658, this communication is issued by Lyxor International Asset Management (LIAM), a French management company authorized by the Autorité des marchés financiers and placed under the regulations of the UCITS (2014/91/EU) and AIFM (2011/61/EU) Directives. Société Générale is a French credit institution (bank) authorised by the Autorité de contrôle prudentiel et de résolution (the French Prudential Control Authority).