Factor ETFs with defensive characteristics have delivered the strongest performance so far this year amid soaring inflation, recession fears and geopolitical headwinds.

In the first half alone, the prospect of lower company earnings was compounded by Russia’s invasion of Ukraine, which contributed to Bloomberg’s Agriculture subindex doubling while the price of oil increased six fold in less than two years.

By June, investors were staring down the largest rate hike from the Federal Reserve in two decades, US consumer prices were surging 9% in a year while automotive loan delinquencies were spiking and US 30-year mortgage rates posted their largest one-week jump in 35 years.

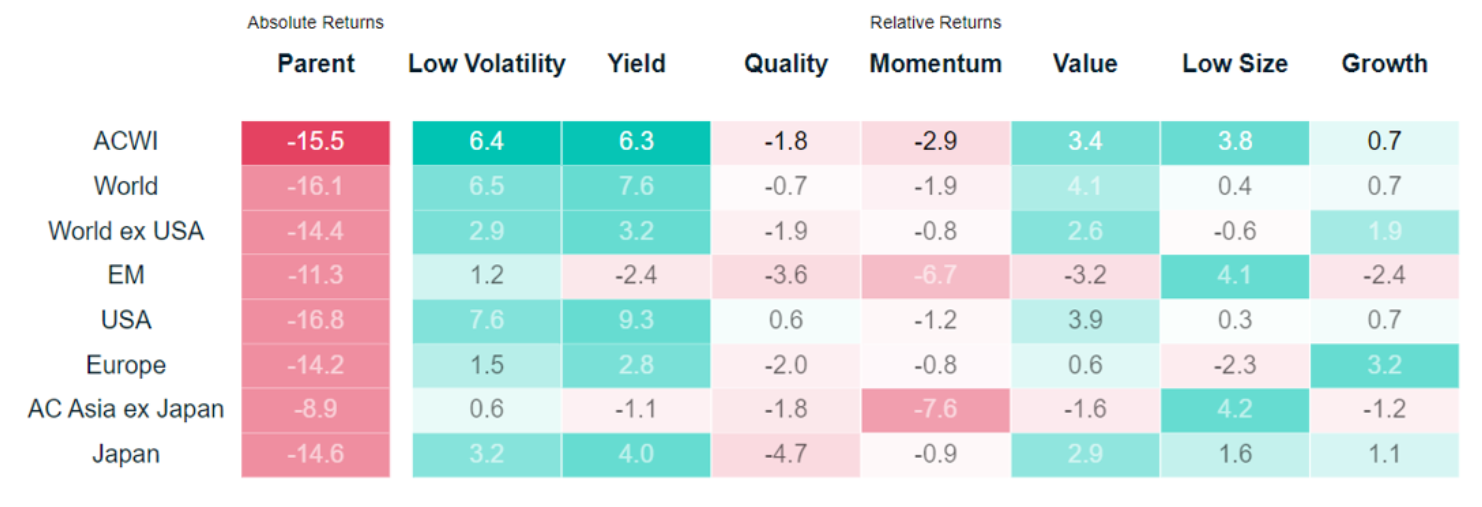

Against the backdrop of JP Morgan pricing in a recession with 85% probability, low volatility and high dividend ETFs have been the best performing factors so far this year, as at the end of June.

Source: MSCI

This success has been reflected in strong returns and inflows for European-listed ETFs. For instance ETF Stream’sETF of the month for April, the $440m Invesco S&P 500 High Dividend Low Volatility UCITS ETF (HDLV), has returned 1.8% and seen $342m inflows so far this year, as at 29 July, according to data from ETFLogic.

Some of the top-performing pure low volatility and high-income US equity exposure have also easily outstripped vanilla US market cap-weighted benchmarks.

While the S&P 500 has fallen 13.9% in the first seven months of the year, the WisdomTree US Equity Income UCITS ETF (DHSP) and Invesco S&P 500 Low Volatility UCITS ETF (SPLW) have returned 4.6% and -5% over the same period.

High dividend ETFs have also booked particularly impressive inflows. The two largest ETFs in class, the $4.5bn SPDR S&P US Dividend Aristocrats UCITS ETF (SPYD) and the $2.8bn Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYL), have seen $1.1bn and $1bn inflows this year, respectively, by the end of July.

Explaining why these more defensive factors come into their own during periods of strife, Investment Metrics said in a note in May: “We would expect more defensive companies to perform well as the economy slows because these companies have a stronger balance sheet to weather the storm.

“Value, growth and small size companies, which are more dependent on a stronger economic environment and easier access to financing, should struggle during such an environment.”

Outside of broad factor plays, other investors have also chosen to go down the route of low beta, high income-paying ETFs capturing individual sectors.

Evidencing this, the three most popular consumer staples ETFs so far this year have welcomed a combined $783m new assets while the top three inflowing healthcare ETFs booked a combined $597m.

Interestingly, after the two best-performing utilities sector ETFs booked 17% returns apiece in the first seven months of the year, Europe’s largest utilities play, the $289m iShares STOXX Europe 600 Utilities UCITS ETF (EXH9) saw a $247m exodus in July, perhaps showing investors believe utility sector outperformance is nearing an end.

It could also be part of the surprise rotation many have been undergoing in recent weeks on the belief a recession could as a firebreak for inflation and prompt the Federal Reserve to end its aggressive hiking cycle.

This bet on a ‘Powell pivot’ by the Fed chair and his team is a bet that carries risk, but one being carried out with conviction with $394m into the SPDR S&P U.S. Technology Select Sector UCITS ETF (ZPDT) over the past month while individual investors bought the FAANGs at their highest volume since 2014 in late July, according to Vanda Research.

Related articles