The pace of Federal Reserve rate hikes is expected to accelerate this week as the US central bank attempts to get a grip on price pressures. According to economists and market measures, the Fed will hike its benchmark federal funds rate by 50 basis points on Wednesday, bringing it up to a range of 0.75% to 1%.

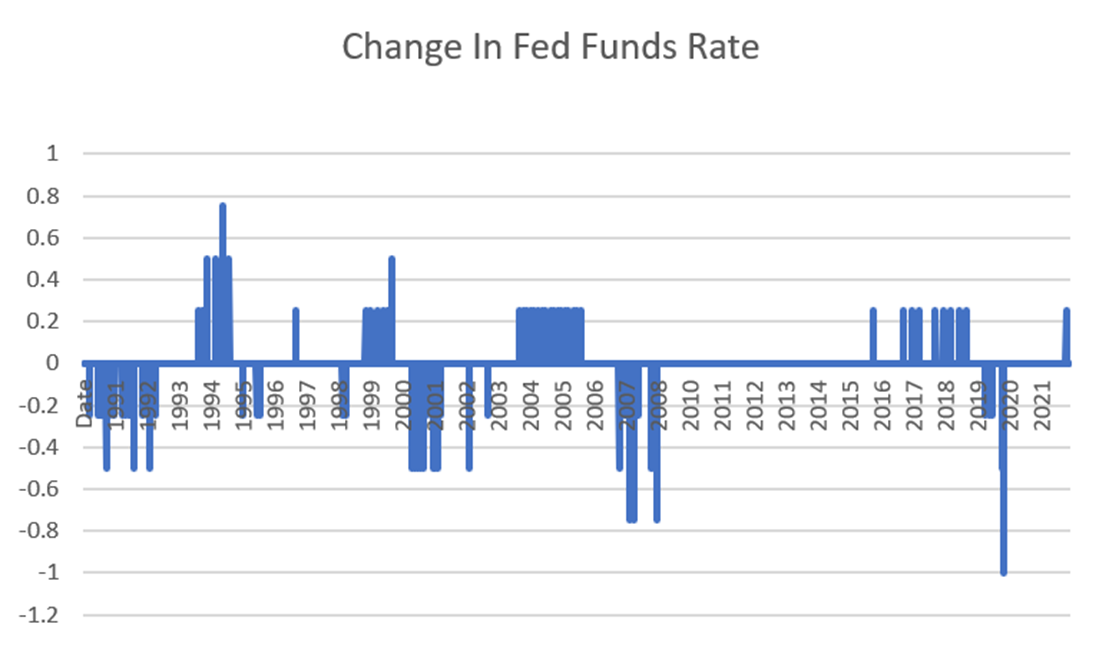

A 50-basis point hike would be a relatively aggressive act, double the 25-basis point increments the Fed usually moves with. The last time the Fed hiked rates by 50 basis points was in the year 2000, during the height of the dot-com bubble.

Behind the curve

While it is aggressive by historical standards, many believe a 50 basis-point hike is the least the Fed could do in an environment of historic inflation caused by the pandemic, supply chain bottlenecks and surging commodity prices.

The headline Consumer Price Index increased 8.5% year-over-year in March while the core CPI, which strips out food and energy prices, grew 6.5%. Both were the fastest rates of consumer price growth in four decades.

With a 50-basis point rate increase all but assured, investors will be more focused on the language in the press release that accompanies the hike. They will also be closely watching the post-rate-decision press conference with Fed Chair Jerome Powell.

In it, Powell may hint at how aggressive he expects the central bank to be in hiking rates throughout the rest of the year. Will we see a series of 50 basis point hikes? Is a 75-basis point hike possible? These are questions investors will want answers to.

Currently, the market expects the Fed to push rates to 2.75% by the end of the year, and 3.25% by mid-2023. Rates topping out just above 3% would arguably be a benign scenario, and one markets could live with. In 2018, during the end of the last rate hiking cycle, the Fed lifted rates as high as 2.5%.

Priced in?

Though the Fed will likely take several more months to get its benchmark fed funds rate above 2% and then to 3%, markets have already priced in much of that tightening. The 10-year Treasury bond yield briefly topped 3% on Tuesday, the first time it broke that level since 2018. The two-year yield, which is tied more closely to Fed actions, topped 2.75%.

Assuming the Fed sticks to the path laid out in market expectations, those yields might move a bit higher – though not dramatically so. On the other hand, if the Fed is not able to get a handle on price pressures and inflation remains stubbornly elevated, it could have to hike rates even higher than currently anticipated, to 4%, 5% or more.

A week ago, economists at Deutsche Bank forecast that the central bank would hike rates to 5 to 6%, triggering a deep recession.

That would spell bad news for bond ETFs, which are off to their worst start in history. The iShares US Aggregate Bond UCITS ETF (SUAG) is down by 9.5% year – to date; the iShares $ Treasury Bond 7-10yr UCITS ETF (IBTM) has lost 10.5% and the iShares $ Treasury Bond 20+yr UCITS ETF (IDTL) is lower by 19.3%.

If the Fed raises rates much beyond 3.5%, bond ETFs would probably continue to decline initially (bond prices and yields move inversely), though they could later rally if high rates caused a recession.

On the other hand, it is entirely possible that inflation has already peaked and could float lower throughout the rest of the year, necessitating fewer rate hikes than either investors or the Fed envision.

That would be a best-case scenario for both bond and stock ETFs. The iShares Core S&P 500 UCITS ETF (CSPX) is down by 11.8% this year, largely due to surging inflation and interest rates. Any relief on those fronts would certainly be welcome by investors.

For now, all investors can do is wait and see. The Fed is going to act, but even it does not know what will happen from here. It is at the mercy of economic trends – and particularly, inflationary trends – that are complex and evolving in brand new ways.

This story was originally published on ETF.com

Related articles