Industrial metals have performed poorly over the past year. The London Metal Exchange (LME) industrial metals index (LMEX) has dropped 17% since 2

nd

Jan to the time of writing on 18

th

December. However, analysts suggest that 2019 could be a good year for them, so long as the trade war fog clears.

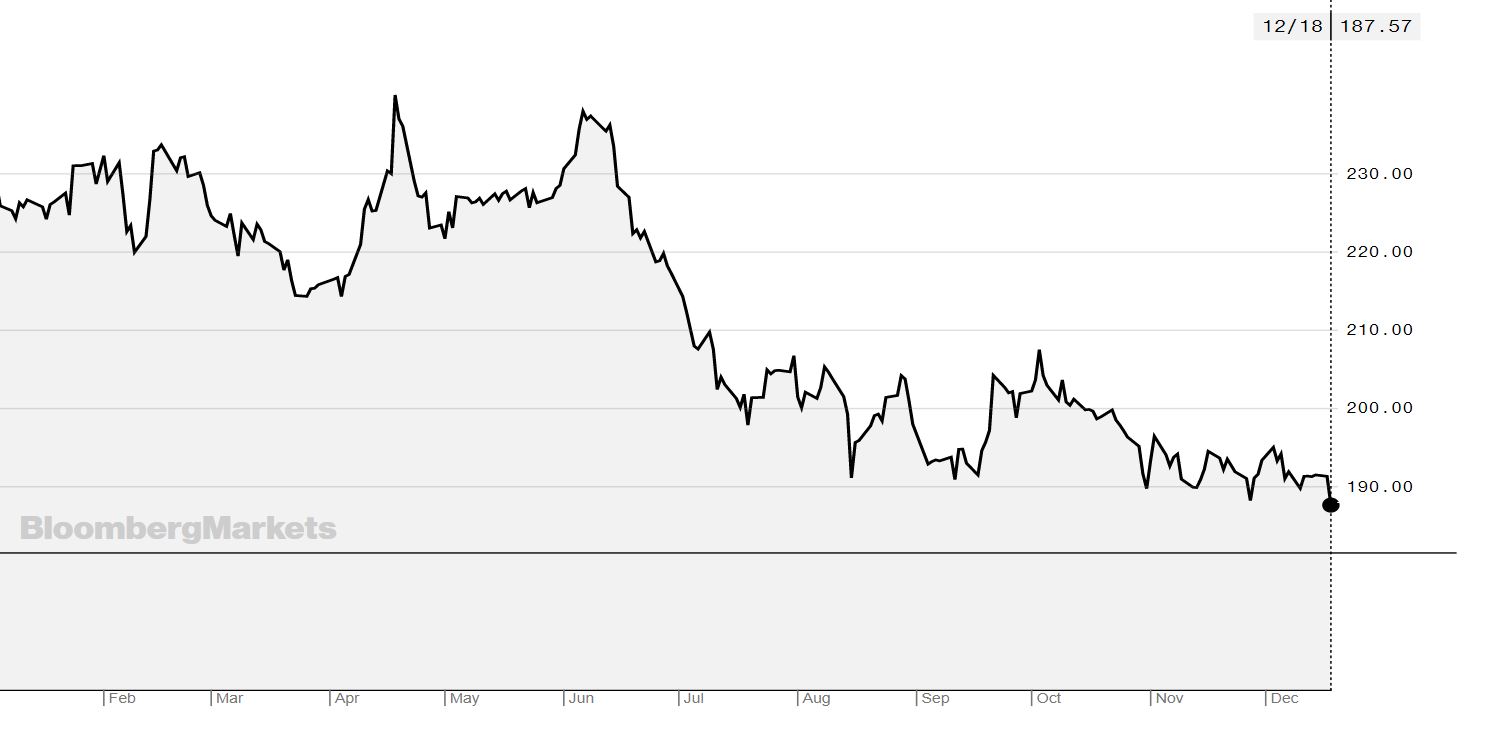

The graph below shows the Bloomberg Industrial Metals Spot Subindex, which measures the price movements of Industrial Metals included in the Bloomberg CI and select subindices. Although it does not account for the effects of rolling futures contracts or the costs associated with holding physical Industrial Metals, it gives some idea of how industrial prices have looked in the last year.

Source: Bloomberg 19-12-18 Bloomberg Industrial Metals Spot Subindex

Industrial metals include aluminium, cobalt, nickel, zinc, steel, iron, copper, lead and tin. Other metals such as platinum, palladium and silver are also used in industry.

Investors can get access through an ETF tracking an index that includes a selection of the metals listed above, or exposure to just one commodity through an exchange traded product (ETP). These ETPs are not covered by UCITS regulations because they're not diverse enough.

Seeking Alpha reported in early December that the materials sector was set to get a big boost led by industrial metals. Copper jumped after U.S. and China agreed to a cease-fire in their months long tariff fight over the weekend.

It appears that the trade wars may have been suppressing industrial metal prices more than first thought.

Nitesh Shah, commodity strategist at WisdomTree, said: "the industrial metal complex is in supply deficit at the moment, but for some reason the prices are ignoring it as a result of investor sentiment. The protection trade policies from the US are causing a fog around the fundamentals underpinning the industrial metal suite. The trade policies won't be as hard on demand as on supply, particularly in the US. All US manufacturers will have to find domestic sourced metals or find extra money to import them. This should be price positive for metals.

"The imports and exports with China are still good. The US are also going to need China as an ally in the near future, so the trade debates that are raging are likely to clear up soon, I'm quietly positive on the outlook."

The most aggressive supply deficit of the metals is nickel, which is going through a structural change, whereby it is increasingly being used in electric cars and this is likely to increase as they develop batteries that are more heavily weighted in favour of nickel, not cobalt, which is difficult to get.

Shah explains that battery demand currently accounts for 5% of nickel and we predict that by 2030 it will be at 50%.

He says: "China is also increasingly its use of pure nickel as it reduces reliance on lower quality nickel pig iron as it does less infrastructure building and considers environmental issues more. However, nickel ore comes from Indonesia and the Philippines and these have had issues in terms of bans on ore exports (Indonesia) or mine closures due to environmental policy violations (Philippines). While some of these have recently been lifted, they could easily be re-imposed."

Other metals worth noting are copper, which Shah believes is undervalued. "The copper price has done nothing over the last few years. There is now decent demand and it still isn't responding from a price perspective. Coppers price is not in line with its fundamentals. "

Platinum could recover somewhat. The World Platinum Investment Council (WPIC) reported in its quarterly reported that oversupply would grow this year to 505,000 ounces from 295,000 ounces, blaming weak demand for platinum jewellery, and said 2019 would see a surplus of 455,000 ounces.

However, WPIC's head of research said that "Supply will grow (in 2019) but demand will grow even more, and reduce the surplus slightly."

Silver is also likely to have a better year in 2019. Focus Economics reports: "Next year, industrial demand in the automotive and electronics sectors should remain robust, which should in turn support a rise in silver prices following a disappointing 2017. Risks include global trade tensions, higher global interest rates and the possibility of slower-than-expected growth in China."

Johann Wiebe, lead metals analyst on the GFMS team at Refinitiv, was reported as saying in Market Watch that "If you would want to invest in silver, you should assess the investment on macroeconomic reasons but also look at the part of demand that represents 65% of the total—industrial applications, which look very promising in the coming years," he says. It's used in solar-energy and electrical applications.

More broadly, the industrial metal complex is in supply deficit, which is good for price potential. It's just a case of being weighed down by trade issues at the moment. The sooner these clear up the better for the price correction in metals.

Shah adds: "The background noise of the economy is that growth is likely to slow, but a recession is not imminent. It's likely that investors are just focusing on risks so as not to be complacent. Industrial metals are cyclical to a point and so can be impacted by downward trending markets, this is some way off though."

There are only three industrial metal ETPs listed on the LSE, they are listed below along with the two nickel ETPs available.

NICK

NIKU

AIGI

FIND

INMG

ETFYTD RTNTERINDEXETFS Nickel-12.34%0.49%Bloomberg Nickel Subindex Total Return (previously DJ-UBS), allowing investors to invest in the commodity market. Counterparty credit risk is minimised as it is 100% collateralised with eligible securitiesUBS ETC linked to UBS Bloomberg CMCI Components USD Total Return Nickel Index-11.66%0.37%UBS Bloomberg CMCI Components USD Total Return Nickel Index which provides access to the Nickel market in USD.ETFS Industrial Metals-17.44%0.49%Bloomberg Industrial Metals Total Return (previously DJ-UBS) Index, allowing investors to invest in the commodity market. Counterparty credit risk is minimised as it is 100% collateralised with eligible securities.ETFS Longer Dated Industrial Metals-18.43%0.49%Bloomberg Industrial Metals Subindex 3 Month Forward Total Return (previously DJ-UBS)UBS ETC linked to the UBS Bloomberg CMCI Industrial Metals GBP Mth Hdg TR-17.46%0.49%UBS Bloomberg CMCI Industrial Metals GBP Monthly Hedged Total Return Index which provides access to the Industrial Metals market in GBP.