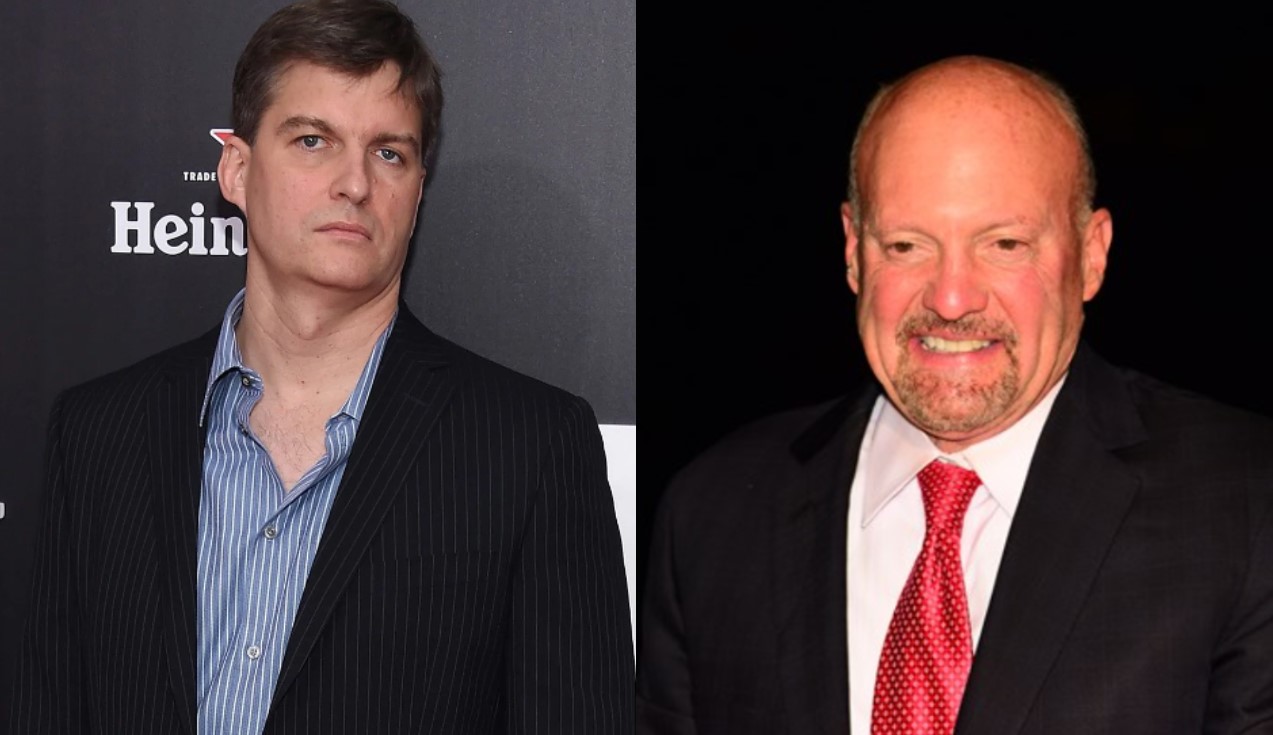

Michael Burry, the hedge fund manager immortalised inMichael Lewis’s book The Big Short, published an ominous tweet on Tuesday simply warning investors to “sell” ahead of the Federal Reserve’s meeting on Wednesday.

While ambiguous taken on its own, the impactful one-word instruction caps off a month Burry spent trying to smother investors’ shift to risk-on sentiment since the Fed started slowing the pace of interest rate hikes.

After four consecutive 75 basis point hikes last year – the fastest hiking cycle in four decades – the policymaker began moving towards tapering with a 50-point hike to cap off 2022.

Reacting to this, US year-on-year core price inflation (CPI) readings falling from 9.1% to 6.5% in six months and surprisingly strong Q4 data, tech and speculative bets have soared in recent months.

Among these were Burry bugbears including the Ark Innovation ETF (ARKK), which booked its best month on record in January, while Tesla shot up 68% over the past month. In Europe, some blockchain ETFs have rallied as much as 74%.

Unconvinced, Burry compared the recent rally to the ‘dead cat bounce’ of the ‘dot-com bubble’ in a tweet posted eleven days ago. Incidentally, January was the Nasdaq composite’s strongest month of performance since the January period circled in Burry’s tweet.

The founder of Scion Asset Management revealed the reason for his bearish stance at the start of the year, forecasting inflation would continue to fall but the US economy would enter a recession “by any definition”, prompting the Fed to over-compensate with interest rate cuts and risking a second spike in inflation.

Interestingly, Burry was not alone in these concerns. While International Monetary Fund (IMF) managing director Kristalina Georgieva warned the largest three economies were all slowing down in tandem, central bank policy tapering and China reopening could add upward pressure to the price of commodities such as oil.

Last December, the Fed also noted it was aware of such a scenario playing out, much like the double inflation peak of the 1970s.

Unfortunately, Burry has a knack for calling market unrest. He famously identified the property bubble and structural issues with credit default swaps (CDS) in 2008.

Also, in mid-2021, he said markets were in the “greatest speculative bubble of all time in all things” and headed for the “mother of all crashes”. Later that year, he said markets had more “speculation than the 1920s. More overvaluation than the 1990s. More geopolitical and economic strife than the 1970s.”

A vanilla US 60/40 equity-bond then booked its worst year of returns in more than eight decades in 2022.

However, not everyone shares Burry’s penchant for morbid predictions. TV personality Jim Cramer said on his Mad Money show before the Fed meeting that he thinks the US is in a “bull market”.

Speaking on bearish investors, Cramer argued: “Their mistaken selling creates opportunities for you to buy the dips. You need to have conviction that the sellers are wrong and you are right. You need to believe in your view, not the view the tape gives you — that the bears give you.

“It no longer makes sense once the Fed says the rate hikes are working and we are pretty far along in the tightening cycle, even as they are still seeing some wage inflation.

“Those who keep fighting the bull, as they did today, think they are in a bear market and they get trampled. Today was a real trampler, and the bears — they still do not know what hit them,” he said.

The Mad Money presenter is often the subject of ridicule for his outlandish predictions, including being confident in Meta stock recovering last year, before being reduced to tears and apologising for trusting Mark Zuckerburg in a CNBC interview last October.

In the same month, Tuttle Capital Management, the firm behind the short ARKK ETF, filed with the Securities and Exchange Commission (SEC) to launch short and long strategies mirroring Cramer’s stock picks.

Related articles