US-listed ETFs recorded inflows of $45bn for the month of November, according to a report by Deutsche Bank. This brings the total YTD flow for the US to $261bn. November's high was the second largest of the year so far, signalling strong investor appetite for year-end positioning, Deutsche said.

In tandem to the large ETF inflows, November's secondary trading slipped from the previous month's performance. Last month's turnover was $2.2tn, down from $3tn in October.

Asset returns were for the most part positive for equities and fixed income while commodities were experiencing negative performances. However the World Gold Council has released a report for last month's performance saying, gold-backed ETFs thrived while other commodities, such as oil, struggled.

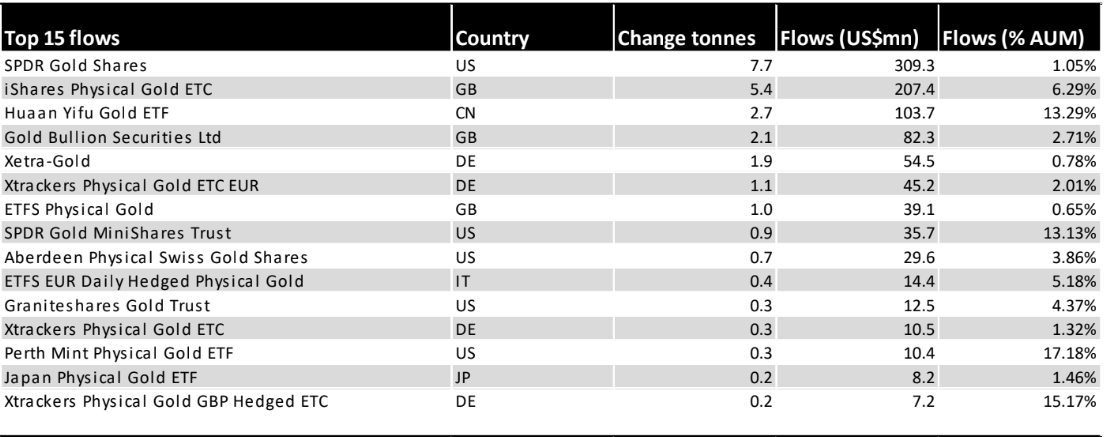

Gold ETFs globall attracted around $804m in inflows in November, the majority of which came from Europe and North America, contributing $371.9m and $352.7 respectively. This was the second consecutive month of inflows.

Source: World Gold Council

Investors new found love of Gold ETFs will be welcomed by ETF providers. The October-November inflows come after six straight months of outflows. The six months worth of outflows mean that YTD, North America and Asia have experienced net outflows of $2.1bn and $46m from gold ETFs. But globally the flow remains positive due to Europe's positive outlook and having inflows nearing $3bn.

In contrast, oil's performance slipped by 22 per cent due to supply concerns and investor's move out of institutional grade and high yield credit and into Money Markets, according to Deutsche.