The number of French retail investors using ETFs grew by over a third in Q3 in a sign the wrapper is starting to make in ways in the region.

Over 147,000 investors traded through ETFs over the quarter versus 108,000 in Q3 2022 – a 36% increase – according to the Authorite des Marches Financiers (AMF) Active Retail Investor dashboard.

It means the number of retail investors using ETFs in France could hit record levels this year, with 437,000 trading the wrapper, 11% higher than then the first three quarters of 2022.

The uptake of the wrapper in France is similar to other regions across Europe and is expected to grow dramatically in the coming years as investors start to embrace ETF savings plans.

Recent research published by BlackRock and extraETF forecasted there will be 32 million ETF savings plans executed monthly across Europe by 2028, up from 7.6 million in September.

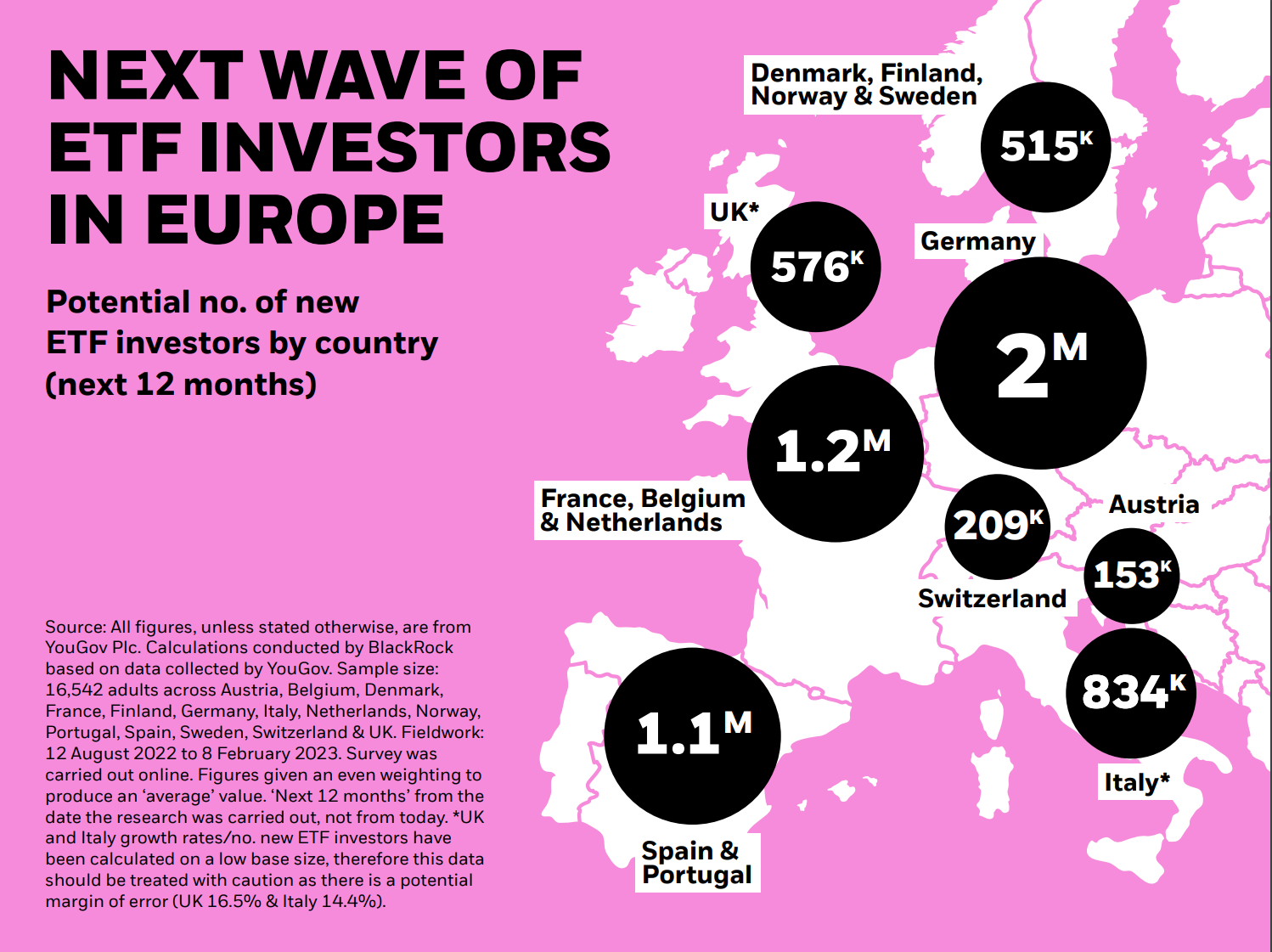

The asset management giant estimates France will see 1.2 million new ETF investors over the next 12 months as online investment platforms such as Trade Republic begin operating beyond Germany.

Source: BlackRock

Currently, Trade Republic, Scalable Capital and Bux are the three ETF savings plan providers in the French market, according to the report.

Many also believe a ban on inducements could also help drive retail investor usage of ETFs in a market that is heavily reliant on kickbacks.

French asset managers such as Amundi, which are against a ban on inducements, are looking to strengthen their distribution models to target retail investors.

Geatan Delculle, global head of ETF indexing and smart beta sales at Amundi, previously told ETF Stream: “In the last year, we have seen European companies coming into the French market and being vocal about ETFs, promoting them directly to the end investor.

“It is very educational and the way they are selling ETFs is completely different in its marketing than traditional distribution.”