The month of October was a positive one for Europe’s ETF industry as all asset classes received positive net flows for the period, according to a recent report by Lyxor.

Fixed income ETFs continued to have a strong 2019, pulling in a modest €2.7bn however, it was equity ETFs which drove the most amount of inflows with some €5.3bn.

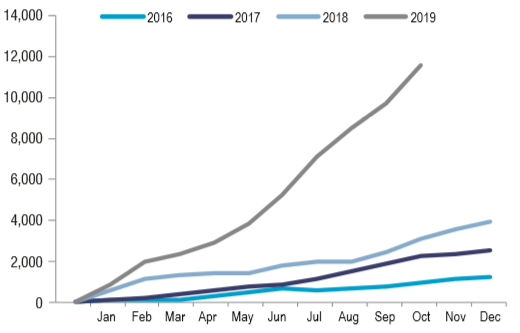

Just behind fixed income ETF flows was ESG which managed to attract €1.9bn in new assets, a record month for the factor. This followed on from a strong Q3 and bolstered its year-to-date flows to €11.7bn, pulling away from previous years by a significant margin.

ESG ETFs YTD Flows

Source: Lyxor

More broadly, smart beta saw inflows of €492m albeit weaker than previous months. Nonetheless, YTD flows steadied at €6.8bn.

With equity and fixed income ETFs netting €7.7bn and €43bn YTD, respectively, European ETFs have enjoyed a total of €70.3bn in new assets.

Laird leaves Lyxor after three years

In tandem with the UK’s Brexit discussion and postponements with European Union, ETFs exposed to the country managed to gain more flows, with €2.3bn, than their US counterparts, with a muted €52m.

Despite equity gaining significant inflows, commodity ETFs maintained their momentum by seeing the fourth consecutive month of inflows with €229m. Gold unsurprisingly was the biggest contributor for commodity ETFs, capturing roughly €210m of the month’s flows.