The outlook for BlackRock’s two clean energy ETFs remains unclear as a Société Générale report raises questions about S&P Dow Jones Indices’ (SPDJI) clean energy index facelift.

Following its consultations with investors on 4 and 12 March, SPDJI said it would increase the target number of constituents in its S&P Global Clean Energy index from 30 to as many as 100.

It also proposed changes to the criteria for companies to be eligible for inclusion in its index so that companies scoring 0.5 – meaning they have ‘some’ clean energy exposure – can be featured up to a weighting of 4%.

Furthermore, the index provider added a new rating tier of 0.75 for companies with ‘significant’ involvement in clean energy. Companies in this group are able to claim weightings of up to 6% apiece in the new index.

Responding to the proposals, SocGen said they expect the number of index constituents to increase to 77 – rather than the 100 target – but added these changes would be a positive step for a 14-year-old index no longer suited to the large capital flows into the ETFs tracking it.

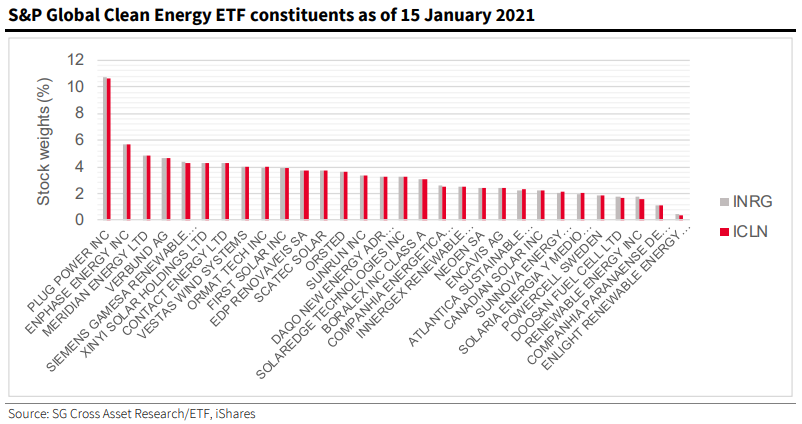

However, the investment bank also highlighted issues that could create bumps in the road for the iShares Global Clean Energy UCITS ETF (INRG) and the iShares Global Clean Energy ETF (ICLN), going forwards.

Liquidity funnel

The first of these issues was highlighted in February regarding the liquidity of the small cap stocks that make up the clean energy index.

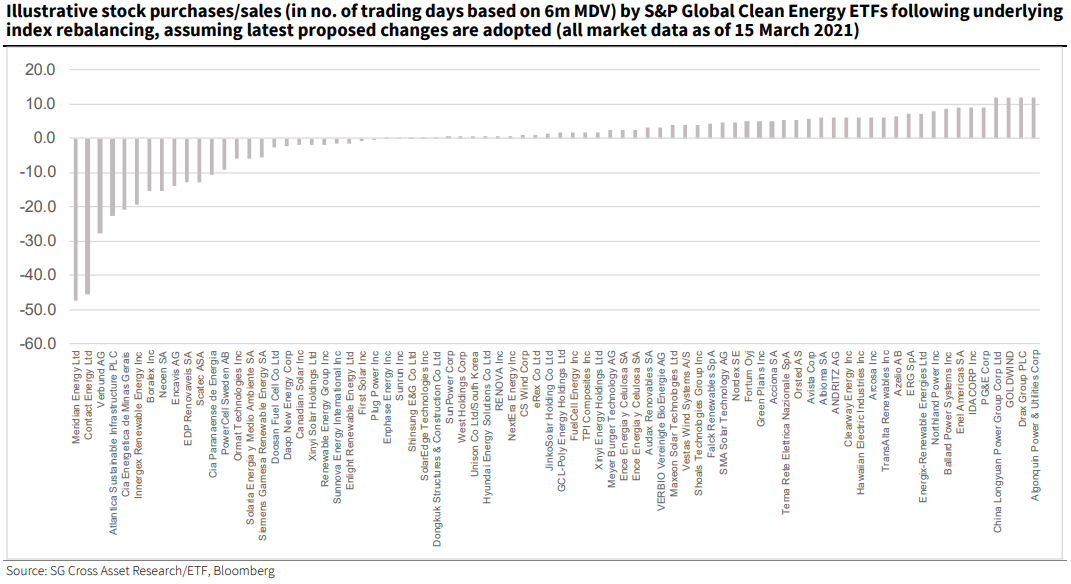

While SPDJI proposals will introduce some non-small-cap equities and reweight existing constituents, the issue of selling off some of the existing roster will be a key concern for ETF managers.

By SocGen’s estimation, there may be a substantial drop in some of the largest weightings currently held by INRG. These include Meridian Energy, which could see its weighting cut from 4.5% to 0.9%, as well as Contact Energy, which will be cut by 3.2%, and Verbund, which will shrink by 3.5%.

Having enjoyed a flurry of support towards the end of 2020, many small clean energy stocks are returning to trading volumes which more closely resemble normality.

This is an acute problem for INRG’s largest holdings, such as those mentioned, which at a median daily trading volume of 6m, could take as long as 48, 46, and 28 days to clear, respectively, according to SocGen forecasts.

These considerable outflows will not just create volatility for the stocks themselves but also – seeing as some weighting in each will be kept – clean energy ETFs themselves. As strategies such as INRG sell off large portions of stocks such as Meridian, a feedback loop will ensue that could put downward pressure on their performance for at least as long as it takes for them to rebalance.

How clean?

Alongside an issue that the SPDJI proposals did not resolve, there is another they created. Namely, the vague new criteria for index inclusion.

While companies may face exclusion if their S&P Trucost carbon-to-revenue footprint exceeds a score of three, SocGen concluded the definitions of different levels of clean energy exposure lack clarity.

For instance, SPDJI listed several eligible energy sources from which a company may derive revenues to be considered for inclusion but goes on to say that constituents may not be limited to this list.

Realising this grey area, SPDJI intends to publish an additional consultation that could broaden the definition of clean energy to include marine energy, alternative fuels for vehicles, energy storage, energy efficiency, and smart grid solutions.

A more pressing concern, perhaps, is the index’s scoring system does not specify the metric by which it measures a company’s exposure to clean energy. With exposure scores key to index weighting, SocGen fears the process may become subjective, especially when financial disclosure is light.

With non-pure-play clean energy stocks set to be included in the index, investors would be right to question quite how diluted the clean energy exposure of clean energy ETFs will get.

These concerns are ongoing and will hopefully be addressed by SPDJI in its next consultation, before the rebalancing of its clean energy index, and INRG, in April.

Further reading