Investors are divided over the outlook for inflation over the next 12 months with some pointing to a regime change while others believe it will be transitory, according to a survey conducted by ETF Stream and Amundi.

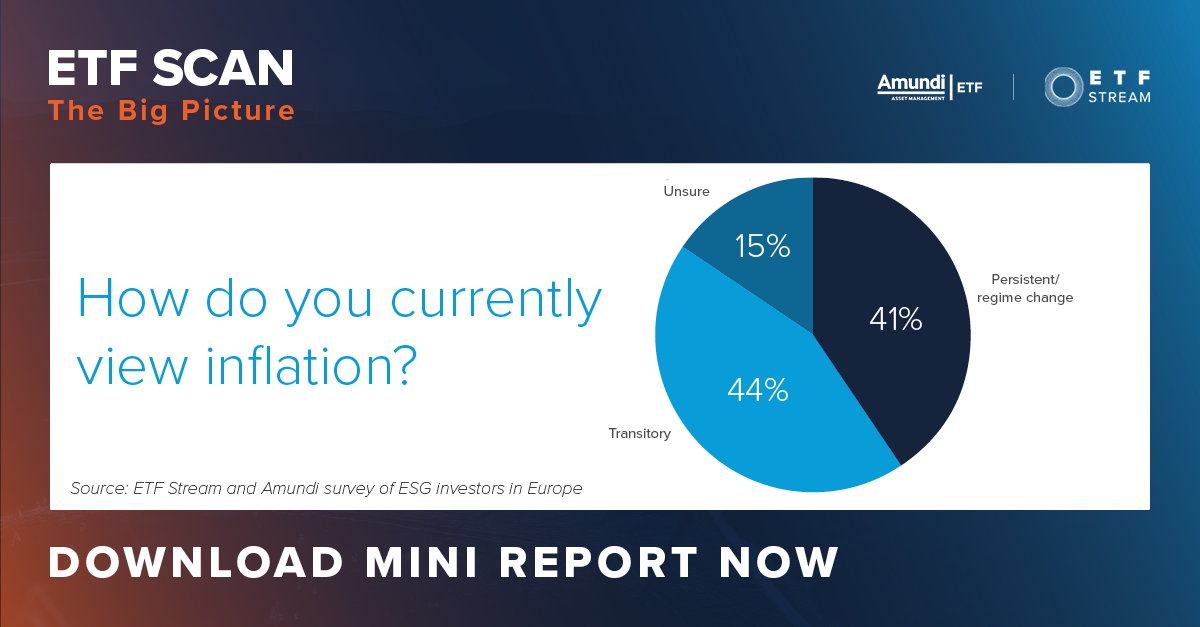

The survey of 105 investors across Europe, which featured in a report of initial findings titled ETF Scan: The Big Picture, found 44% believe inflation will be “transitory” while 41% are forecasting a regime change.

Meanwhile, some 15% said they were “unsure” about the direction of travel for inflation in 2022, further highlighting how uncertain the outlook for markets is over the next 12 months.

Where inflation heads over the next year will be crucial in determining investors’ asset allocation decisions. A spike in inflation could cause central banks to tighten monetary policy faster than market expectations while acting too slow could cause economies to overheat.

CPI in the US is currently up 4% year-on-year, double the Federal Reserve’s inflation target, which is signalling as many as two rate hikes in 2022.

Elsewhere, 56% of respondents said inflation was the biggest investment challenge in 2021, the highest across all options provided while 81% said 2022 will be the year of inflation versus just 11% citing deflation.

Commenting on the results, Laurent Trottier, global head of ETF, indexing and smart beta management at Amundi, said: “In a broadly good environment for global growth, we have moved away from the re-opening euphoria seen in the earlier part of 2021 and global economic momentum is slowing down to potential.

“Furthermore, we believe that inflation, which made its comeback in 2021, will remain structurally higher than in the previous decade. We enter 2022 with the assumption that this new year will mark a critical juncture on the road to a new economic and financial regime.”

The initial findings of the survey conducted by ETF Stream and Amundi have been published in a report. To read the full report, click here.

Related articles