When turning the story of Joseph Penso de la Vega’s 1688 book on the stock market, the earliest one known, into an ETF-themed article, I was ready to immerse myself in confusion.

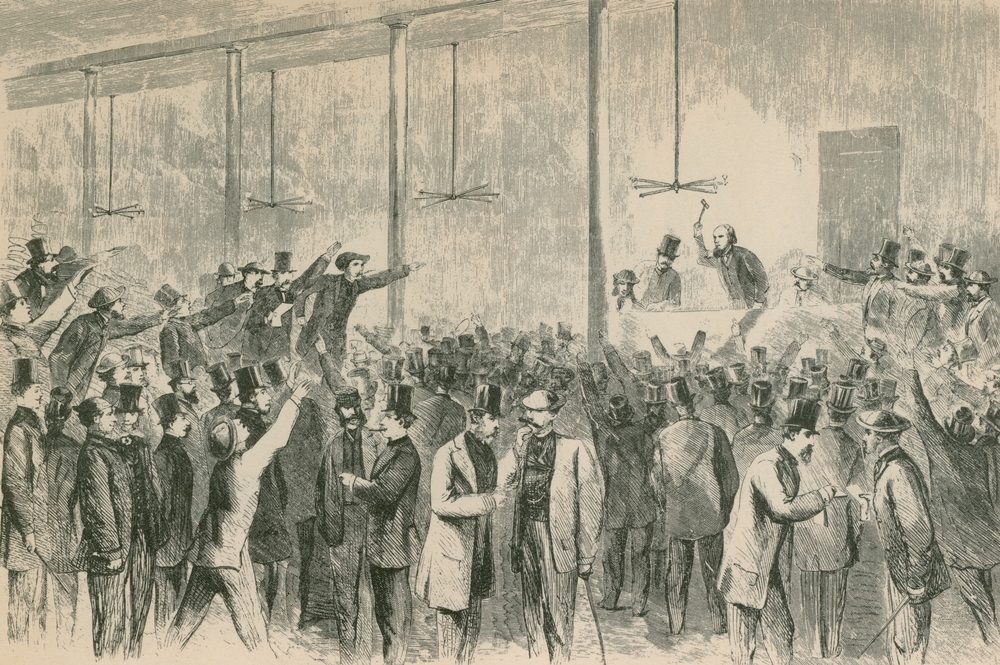

Because that is the name of the book. Confusion de Confusiones, written in Spanish and printed in Antwerp, Belgium, was the author’s observations about the history of investment speculation, including his experience as an active participant at the Amsterdam stock exchange.

He wrote about contemporary market elements such as overconfidence and herd behaviour, which have not changed. Investors are as overconfident as I have seen in 38 years on Wall Street. We see it in the stock market, crypto and even bonds, and it is all captured through flow into ETFs.

Safety in numbers is at odds with the Benjamin Graham/Warren Buffet approach to investing. But that is what makes it a market. If everyone thought the same way all the time, it would be hard to have buyers to match sellers.

The author of that first book on investor behaviour even wrote about options and futures. Those have been at the core of the growth plan for several savvy ETF issuers have seized on in recent years, to offer a much wider “tent” for investors to place their assets. That feeds into the speculation aspect of what de la Vega cited more than 300 years ago, more than 100 years before the New York Stock Exchange opened.

Investing principles endure

Among De la Vega conclusions about speculation which are relevant to today’s ETF investor, given how markets have developed over the decades. They include:

Never advise anyone to buy or sell shares.

De la Vega would not have been popular at 21st century ETF conferences, which bring together product producers and investment advisers who buy them…on behalf of clients! Still, the revolution in self-directed investing makes me wonder if the pendulum will swing further toward the “do it yourself” version of using ETFs.

Accept both your profits and regrets, but do not expect favourable circumstances will last.

To me, this is the most significant statement about modern markets one could make. Apart from a couple dozen stocks, what is more common today are sharp but unsustained price gains. The average stock has been volatile but unprofitable in recent years. This is more a characteristic of modern markets than a passing phase. And now that I have written this, hopefully, in the year 2360, 336 years from now, someone will refer back to it.

Money and patience are required to become rich from “this game.”

That sounds like a bit of a catch-22 if the patience part can only follow having the money to start with. However, this is perhaps the most relevant of de la Vega’s observations of the ETF industry. No longer are huge sums of money needed to invest in indexes that in turn, access a seemingly unending range of markets.

An ETF investor’s 336-year-old playbook

A book on investing can be an aid to any investor. I have penned a couple myself. But the idea of a book written before the founding of US and the French Revolution still having this much relevance goes to show that investing is not some foreign concept.

It is just one application of our biases, motivations, and personalities, and our greed and fear. The same basic instincts about investor behaviour de la Vega wrote about just four years before his death at age 42, are as contemporary an investment guideline as ever.

This article was originally published on ETF.com