The small-cap effect – the idea that smaller companies offer higher risk-adjusted returns than larger ones – has been a topic of interest since Rolf Banz’s 1981 paper.

While the concept has influenced investment strategies and academic research for years, it has also faced its share of challenges and revisions.

This article revisits the small-cap effect, examining its historical significance, its evolution over time and its relevance in today’s economic environment.

The genesis: Rolf Banz’s seminal paper

In 1981, Rolf Banz’s seminal paper, The Relationship Between Return and Market Value of Common Stocks, introduced the financial world to the size effect. This phenomenon suggested that smaller firms’ common stocks tend to yield higher risk-adjusted returns than those of larger firms.

Banz’s empirical tests were rooted in a generalised asset pricing model, which posited that the expected return of a common stock is influenced not just by risk but also by the market value of the equity. While the paper concluded that the size effect exists, it left the question of its underlying causes unanswered. Banz himself cautioned that the size effect might be a proxy for other, as-yet-unknown, factors correlated with market value.

The impact and evolution: From theory to practice

Banz’s work had a ripple effect on both financial theory and practice, sparking further research and debate. It even suggested that the size effect could be a basis for theories like mergers, where larger firms might pay a premium for smaller firms’ stocks. However, Banz also warned that such interpretations should be made cautiously.

The paper’s influence extended beyond academia; institutional investors began allocating significant portions of their portfolios to small-cap stocks. This led to the creation of specialised small-cap funds and influenced the investment mandates of pension funds, endowments and other large pools of capital.

The reality check: Small-cap underperformance

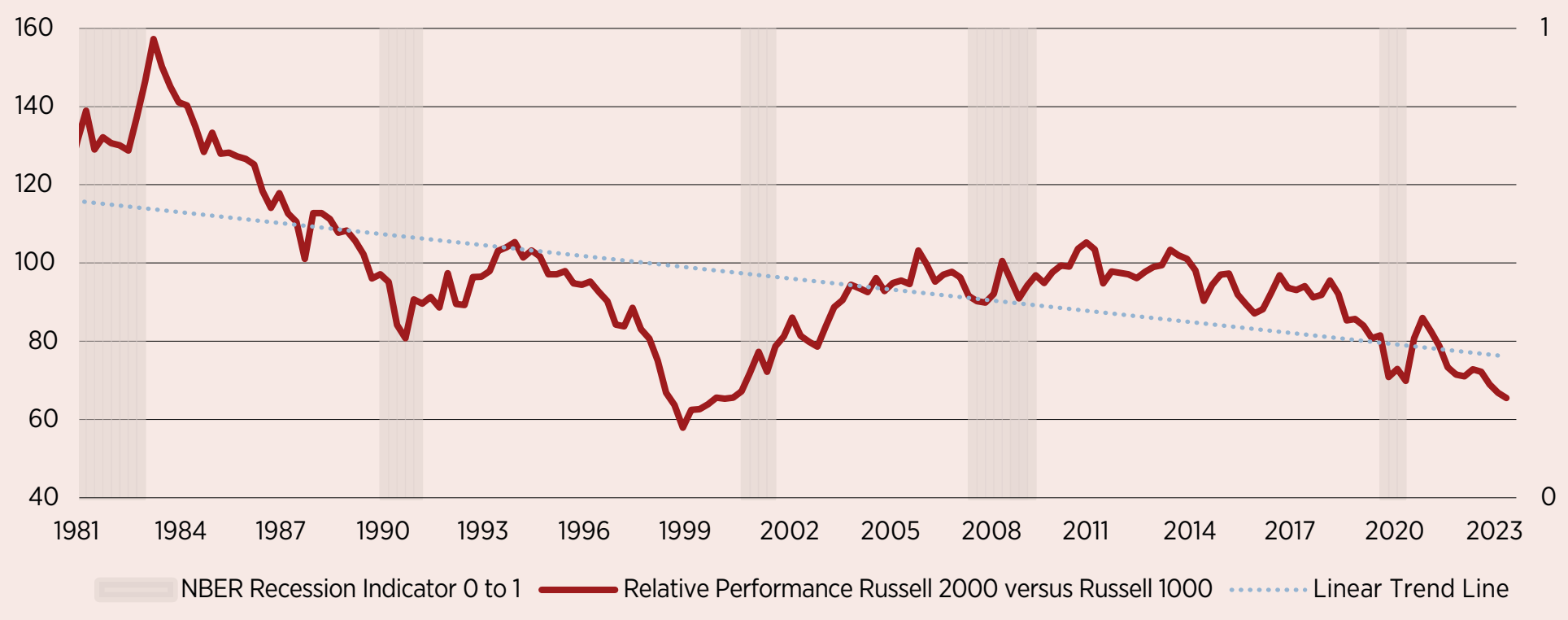

Since Banz’s paper, the investment landscape has evolved, challenging the original thesis about small-cap stocks’ outperformance. In fact, small-cap stocks have largely underperformed their large-cap counterparts since his paper was published.

However, there have been periods, generally post-economic slowdowns such as after the dot-com bubble burst or the recovery from the Global Financial Crisis, where small-cap stocks have outperformed. This episodic performance suggests that the size effect may not be a consistent phenomenon but rather one influenced by specific market conditions.

Rolling five-year Sharpe ratio

Chart 1 illustrates that, since the release of Banz’s paper, the large-cap Russell 1000 has outperformed the small-cap Russell 2000 in terms of risk-adjusted returns in most time periods, as measured by five-year rolling Sharpe ratios.

Chart 1: Relative performance: The large-cap Russell 1000 vs the small-cap Russell 2000

Source: Parala Capital

The long-term underperformance of small-cap stocks can be attributed to a myriad of factors, both market-related and behavioural. One of the most compelling explanations is that once a risk factor like size becomes well-known and widely accepted, it tends to lose its potency. In other words, as more investors become aware of the size effect and allocate more capital to small-cap stocks, the increased demand can drive up prices, thereby reducing the expected return.

This phenomenon is not unique to the size effect. It has been observed with other factors like value and momentum as well. The dilution of the size effect over time can also be attributed to the increased efficiency of financial markets, facilitated by advancements in technology and the proliferation of information.

Furthermore, the rise of globalisation and technological advancements have disproportionately benefitted large-cap companies, allowing them to scale more quickly and efficiently than their smaller counterparts. These larger firms often have the resources to invest in research and development, market expansion and other growth drivers, giving them a competitive edge that small-cap companies often lack.

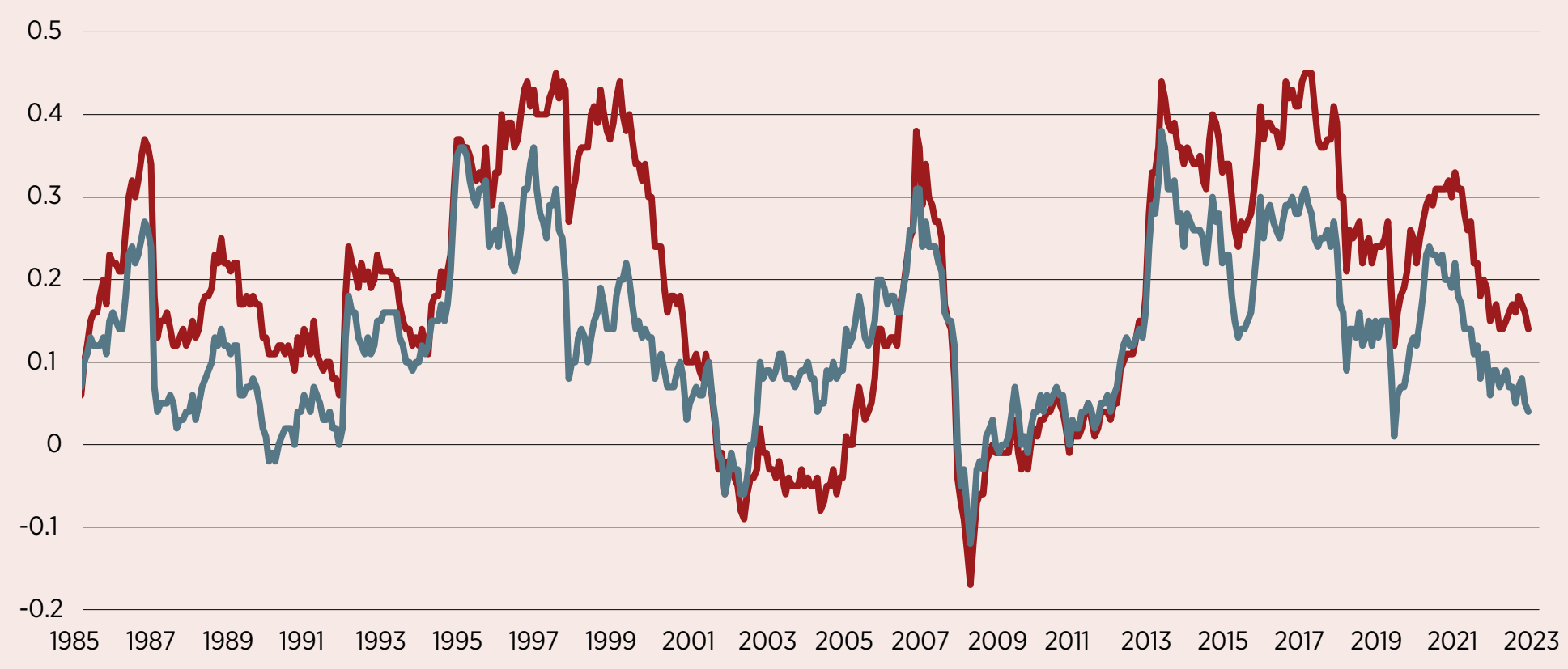

Chart 2: The underlying factors: Why small-cap stocks underperform

Source: Parala Capital

The modern perspective: Timing risk factors

Although Eugene Fama and Kenneth French have been instrumental in shaping our understanding of stock returns through factors like size, value and market risk, they also acknowledged that these factors can exhibit varying performance across different stages of the business cycle.

This recognition opened the door to a more dynamic understanding of asset pricing, one that considered the cyclical nature of the economy. Fama and French’s work laid the groundwork for considering how macroeconomic conditions can influence the risk and return profile of various asset classes, thereby adding an additional layer of complexity to investment decision-making.

Building on the foundational work of Fama and French, university researchers such as Allan Timmermann, Russ Wermers and Ben Gillen, partners at Parala, have delved deeper into the cyclical behaviour of risk factors. Their research employs advanced statistical methods to model the time-varying nature of risk premiums, effectively adding a dynamic layer to traditional static factor models.

This line of inquiry not only enriches our understanding of asset pricing but also has practical implications for portfolio management. By recognising that risk factors are not static but fluctuate based on economic conditions, investors can adopt more flexible, adaptive strategies that capitalise on these cyclical variations, thereby potentially enhancing portfolio performance over time.

Conclusion: A cyclical approach to small-cap investing

The implications of this research are profound.

Investors looking to capitalise on the small-cap effect should consider a more nuanced, cyclical approach. By understanding that risk premiums fluctuate based on broader economic trends, investors can make more informed decisions about when to enter or exit small-cap investments. This dynamic strategy could potentially offer a pathway to higher returns, without the pitfalls of a static asset allocation based solely on company size.

In a world where financial markets are more interconnected and complex than ever, a nuanced approach to small-cap investing is not just advisable – it is essential.

Therefore, financial professionals should exercise due diligence and adaptability when considering the small-cap effect as a strategy for portfolio enhancement.

Reza Vishkai is a founding partner at Parala Capital