Rhodium – what on earth is rhodium?

If you are reading this, chances are you have never heard of the obscure 45th element of the periodic table.

Yet you have every reason to. The noble metal – and the single major ETF that tracks it – has had a truly gobsmacking year.

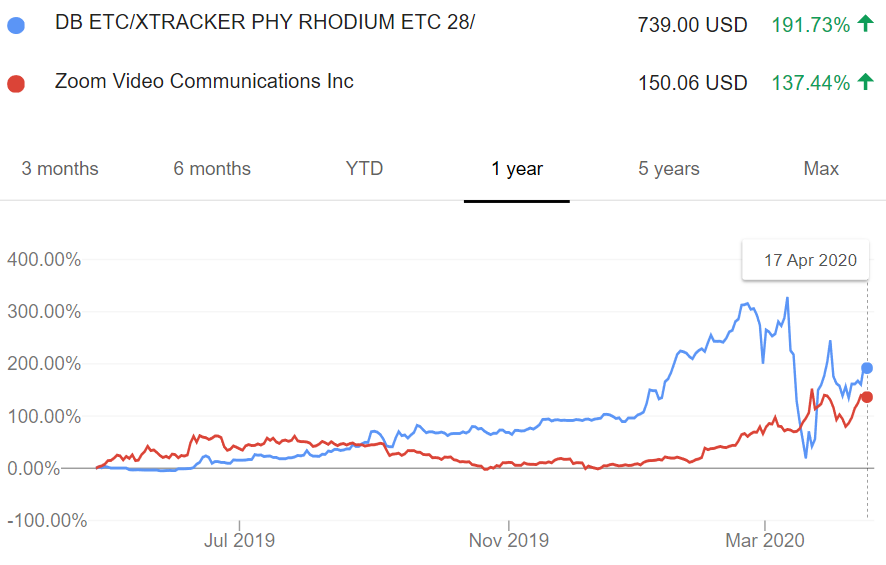

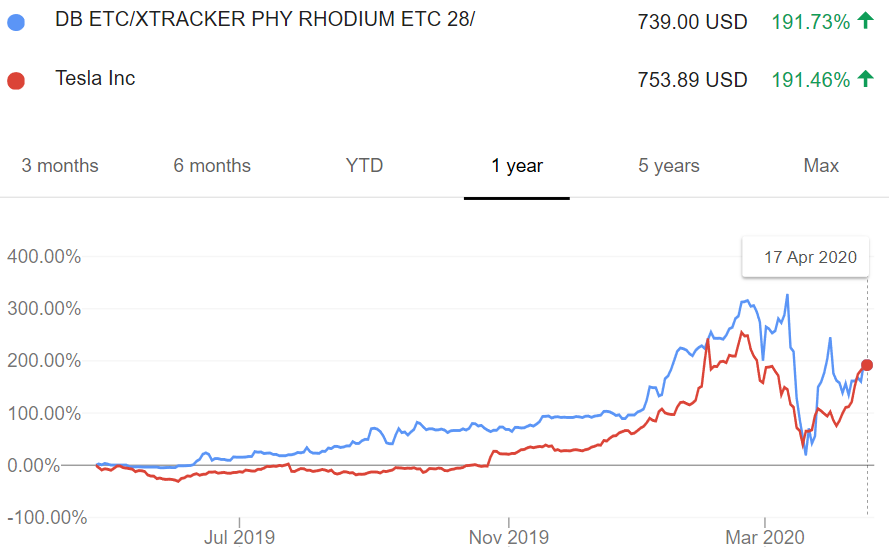

The past 12 months, DWS’s Rhodium ETF (XRH0) has defeated everything that trades. It has crushed the market, outshone gold, zoomed past Zoom and has even beaten Tesla.

Source: Google Finance

It has delivered a 1 year return of…194%!

The staggering returns have created windfall profits for DWS, which owns the fund and charges a cool 0.95% fee on assets managed.

In April 2019, the fund held $310 million – ETF Stream reported at the time, when the rhodium trend got going. This meant DWS made roughly $3 million a year in run rate revenue. Fast-forward to today, the fund holds $845 million in assets and makes $8 million in run rate revenue.

Nice!

Making things more interesting, all that asset growth the past 12 months comes from the price increasing. DWS indicated in 2016 that it would not create any new rhodium ETFs, for whatever reason. And to date, despite the surging price, XRH0 hardly trades.

Source: Google Finance

But why is rhodium doing so well?

A cursory look at the stock chart suggests that rhodium – a bit like Tesla – has potentially benefited from momentum traders/trend followers. These are people that think that in stock markets you are either a sheep or roast lamb and try to buy assets with rising - preferably quickly - prices.

But there are other reasons rhodium is doing well.

Rhodium’s industrial use is almost entirely as a catalyst in combustion engine cars, which may make its staggering rise seem at odds with Tesla. Yet rhodium’s price has been given a leg up by seemingly permanent political disfunction in South Africa. As mining strikes and power outages roll over the country, rhodium supply has been shot.

ETF Insight: Why gold's spreads widened to unprecedented levels

Seeing this, speculative traders have jumped in to try and front-run the price rises. Because rhodium has no futures market and trades only over the counter, the DWS ETF (or the one in Johannesburg from Standard Bank) – is one of the only good places to go.

Its success might make one wonder: should not DWS just create more? Yet there are good reasons to think DWS could not even if they wanted to. Because XRH0 is physically backed, issuing new ETFs can take rhodium supply out of the market. For commodities in high supply – this is fine. But for those suffering shortages, traders hoarding supply can create a doom loop of rising prices. Regulators do not like this.

Sign up to ETF Stream’s weekly email here