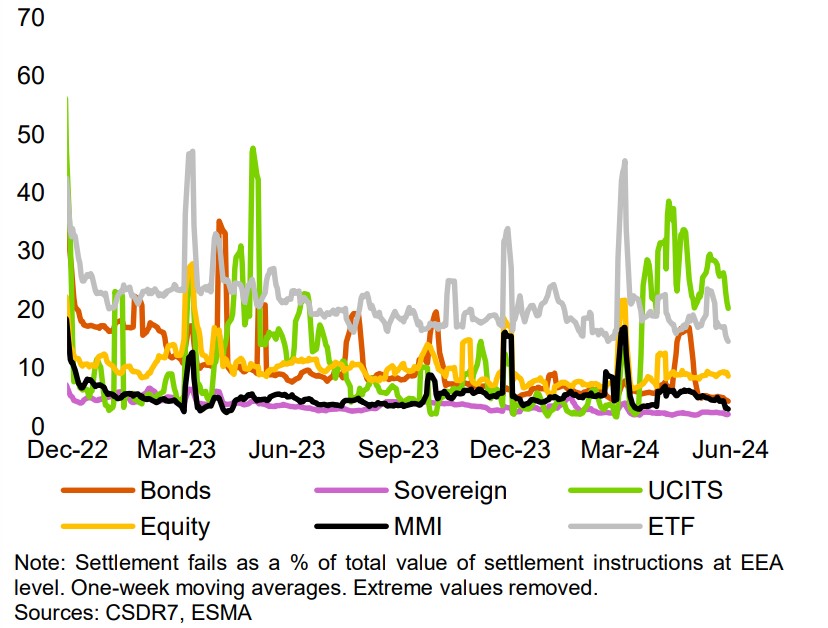

Settlement fail rates for ETFs remained at “high levels” in the first half of 2024, according to the European Securities and Markets Authority (ESMA).

The warning comes as Europe’s financial regulator launched a consultation at the end of last year about the introduction of progressive penalty rates for settlement fails under the Central Securities Depository Regime (CSDR) following concerns rates were not improving.

ESMA said cash penalties have “gradually decreased” settlement fails since the introduction of ‘level 2’ of CSDR in February 2022, but that ETFs specifically continue to experience elevated fail rates.

It comes as the controversial mandatory buy-in regime – which contractually requires authorised participants (APs) to source securities elsewhere in the event of a settlement failure – continues to loom over the industry.

Chart 1: Settlement fails in EEA central securities depositories

According to a recent survey conducted by ETF Stream and Calastone, 44% of APs said CSDR was their top concern, noting that the introduction of progressive penalties could result in high costs for end investors due to the increased pressure of securing funding.

Increased fails also risk higher costs for investors with APs likely to pass on the cost of settlement fails with wider bid-ask spreads.

No T+1 impact

ESMA also said it had seen “no noticeable” trend in settlement fails in Europe since the introduction of T+1 in the US in May.

The regulator added it will continue to monitor the risks associated with change.

“Even though the impact on EU markets seems limited so far, ESMA will monitor for different risks associated with such a change,” it said.

The introduction of T+1 in the US was a daunting prospect for the industry, particularly when combined with CSDR given the increased spotlight on settlement rate fails.

The introduction of T+1 means primary market trades involving US equities will need to settle a day earlier, creating a misalignment between primary and secondary markets that must be carefully managed.

Issuers face increased risk of falling foul of UCITS cash and overdraft rules while APs could be hit with additional funding burdens.