Today's new ETF listings from around the world.

USA

Short-term reversal effect ETF from Vesper

Vesper Capital, a new quant startup with a James Bond-inspired business name, is teaming up with white labeller Exchange Traded Concepts to list an ETF that attempts to capture the short-term reversal effect.

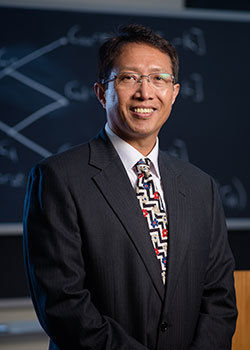

The Vesper US Large Cap Short-Term Reversal Strategy ETF (UTRN) has been put together with the help of Victor Chow, a professor of finance at West Virginia University who helped "discover" the "effect".

The short-term return reversal in stocks is an asset pricing anomaly, Prof Chow's research indicates. It is where behavioural biases bump short-term stock prices into disarray, and prices fail to reflect fundamentals cash flows, risk, discount rates, etc.

Behavioural biases that cause the anomaly can include overreaction to news, loss-aversion as well as emotional bias. An example and proof of this, Prof Chow writes, is that fire sales are common, whereas fire purchases are rare. Absent a bias, the distribution of fire sales and purchases should be 50/50.

"Although most of the academic literature shows that the profits from short-term reversal strategies may disappear once transaction costs are taken into account, my research found that the impact of trading costs on profitability is mainly contributable from the illiquidity of small-cap stocks," Prof Chow wrote.

"Thus, by limiting the investment population to the largest, most liquid companies, such as S&P500, the investment products based on the short-term reversal strategy can be profitable."

UTRN will invest in 25 stocks picked from the S&P 500 that Vesper believes are most likely to experience short-term reversal. To determine this, UTRN will apply "Chow's Ratio" - a proprietary algorithm developed by Prof Chow - to short-term price data to see which S&P 500 companies are most likely to reverse.

The index rebalances weekly, with only those that have either reversed or no hope of reversing removed. Stocks chosen are equal weighted.

Analysis - very interesting

This is a very interesting listing. We had never heard of the "Chow Ratio" or Professor Victor Chow.

It will be very interesting to see how UTRN performs. Plenty of scholars identify new anomalies and factors, but few survive real-world transaction costs. But its really encouraging to see this academic finance work get brought over to the ETF industry. It also great to see a professor put his money where his mouth is and try running a live empirical test on his theories. Let's see how this goes.

Canada

Desjardins lists actively managed ESG bond fund

Desjardins, a $280bn Quebecois credit union, is listing an actively managed ESG bond ETF that appears to be the first of its kind in Canada. The Desjardins RI Active Canadian Bond - Low CO2 ETF (DRCU) will invest in debts primarily issued by Canadian governments and companies that meet certain ESG criteria determined by the manager, the prospectus says.

The fund will invest in investment grade bonds selected in order to achieve a stable income return that is better than that of the FTSE Canada Universe Bond Index. The fund may invest up to 10% of its assets in foreign debts as well. DRCU will charge 0.35%.

There are several more "Low CO2" ETFs also detailed in the prospectus, suggesting today's listing could be the first of many Desjardins funds to hit the market.

Korea

Leveraged and inverse copper

Shinhan Investments, the Korean finance giant part-owned by BNP Paribas, is listing two ETNs that give leveraged and inverse exposure to North American copper. They are:

Shinhan Investment Shinhan Inverse 2X Copper Futures ETN 41 (500041)

Shinhan Investment Shinhan Leverage Copper Futures ETN 40 (500040)

Both funds will track indexes from Dow Jones. They will charge 1.05%.

Cross-listings

Switzerland

Lyxor is cross-listing two currency-hedged ETFs into Switzerland. They are:

Lyxor Japan TOPIX DR UCITS ETF (JPNH, JPNC)

Lyxor EURO STOXX 50 DR UCITS ETF (MSEG, MSEU)