Société Générale has broadened its exchange-traded commodity (ETC) range with the launch of five strategies.

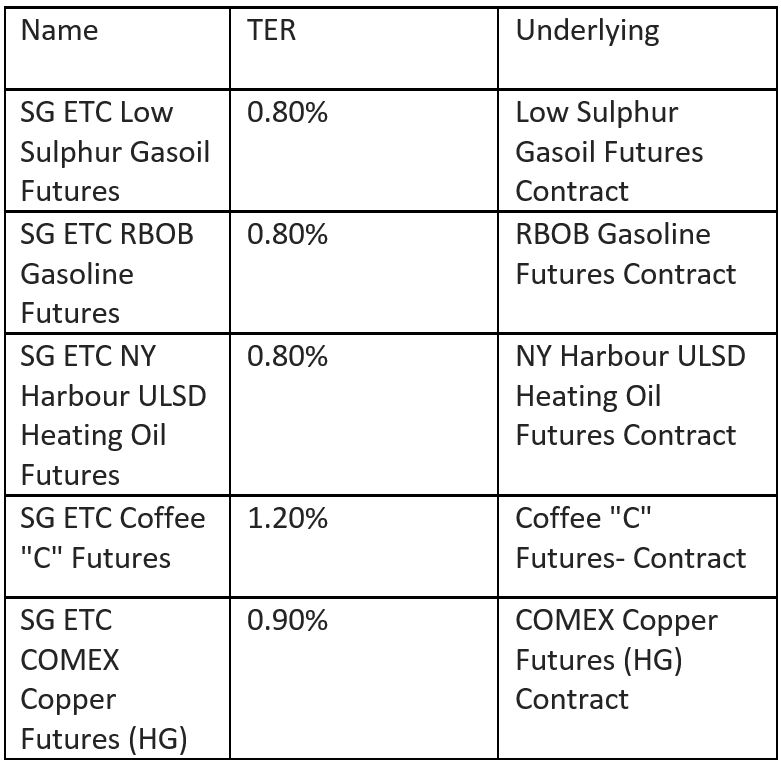

The five ETCs are listed on Deutsche Boerse with total expense ratios (TERs) ranging from 0.80% to 1.20%.

The five strategies are fully collateralised and track the performance of single commodity futures contracts on petrol, crude oil, heating oil, coffee and copper.

The rollover mechanism of futures contracts can have a positive or negative impact on performance depending on whether the market is in contango or backwardation.

Contracts must be exchanged for next-maturity futures before the expiry date to avoid physical delivery of the security they are tracking.

SocGen launched its first ETC, the SG ETC Light Sweet Crude Oil (WTI) Future (SN5DAS), on Deutsche Boerse last October with a fee of 0.85%.

This followed its acquisition of Commerzbank equity markets and commodities (EMC) business in 2020, with the bank looking to capitalise on its presence in Germany and existing expertise in product structuring.

Last December, it listed an additional five ETCs, the SG ETC EUA Future (ETC000) with a TER of 4%, the SG ETC Gold Future (ETC073) and the SG ETC Silver Future (ETC074) with TERs of 1% and the SG ETC Brent Oil Future (ETC069) and SG ETC Natural Gas Future (ETC070) with fees of 0.90%.

SocGen’s foray into ETCs mark its first launches since selling Lyxor to Amundi for €825m last January, however, the firm also has an existing range of ETCs listed on the Borsa Italiana.