UK equity fund managers comfortably outperformed their benchmark and other geographies for a second consecutive year.

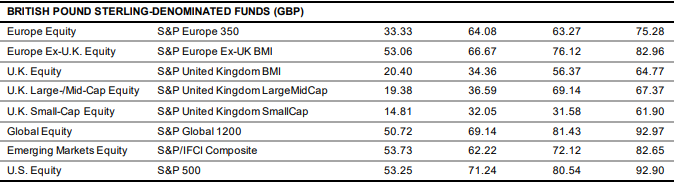

According to the S&P Dow Jones Indices’ 2020 SPIVA Europe Scorecard, some 79.6% of sterling-denominated active UK equity managers beat the S&P United Kingdom BMI index, up from 72.5% the year before.

This continues active managers’ trajectory of outperformance since 2018, where only 26.6% of UK equity funds outperformed their benchmarks.

In a change of fortunes, 85.2% of UK small cap equity funds beat the S&P United Kingdom SmallCap index, up from just 40% the year before.

Not to be outdone, UK large and mid-cap equity funds also benefitted from the increasing volatility levels during pandemic volatility, with 80.6% outperforming the S&P United Kingdom LargeMidCap benchmark in 2020, versus 63.4% in 2019.

Andrew Innes, head of global research and design, EMEA, at SPDJI, said: “The year 2020 proved to be a tumultuous one for European investors, with the uncertainty surrounding the pandemic providing an ideal opportunity for active fund managers to prove their worth in what was an extremely volatile period.”

The success of UK active fund managers was also mirrored in other geographies, even if to a lesser extent.

European equities funds, for instance, saw the number of funds underperforming the S&P Europe 350 benchmark swing from a 64.1% majority to a 33.3% minority, year-on-year.

However, the majority of US equity managers (53.3%) underperformed the S&P 500, a traditionally extremely difficult benchmark to outperform.

Innes concluded: “While a number of funds may have outperformed the benchmark in 2020, the year was notable for its high dispersion in the performance across funds, with some funds having significantly underperformed others in the same category.

“Therefore, a minority, but not insignificant number, of investors in actively-managed funds may have felt considerably short-changed.”