US equity managers suffered their

since 2001 last year, according to S&P Dow Jones Indices' (SPDJI) bi-annual SPIVA US scorecard.

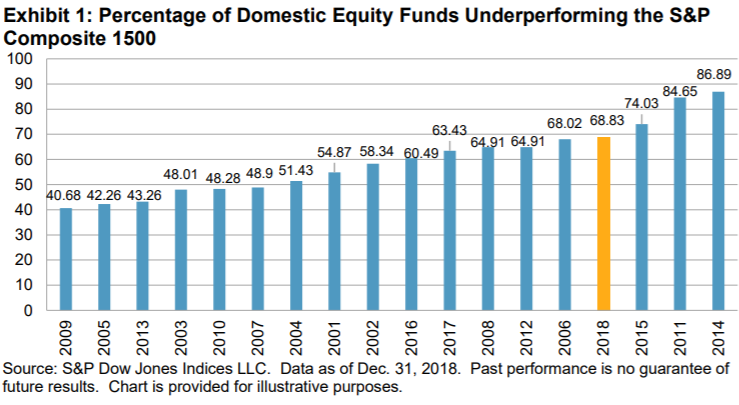

Some 68.8% of US equity managers lagged the S&P Composite 1500 over the one-year period to 31 December 2018, the fourth worst year on record for active managers behind 2014, 2011 and 2015.

Furthermore, for the ninth year in a row, the majority of large-cap funds underperformed the S&P 500, with just 35.5% outperforming the benchmark.

Small-cap managers also struggled in the more volatile market last year with 68.5% of funds falling behind the S&P SmallCap 600. Small-cap value and small-cap core funds were particularly poor with just 16.7% and 12.4% of managers outperforming their benchmarks, respectively.

Aye Soe, managing director, global research and design, at SPDJI and co-author of the report, said the results highlight that heightened market volatility does not necessarily result in improved relative performance for active managers.

A bright spot for active management was in US mid-cap funds for the second consecutive year with 84.4% of managers beating the S&P MidCap 400 Growth. Meanwhile, US large-cap value funds also performed well with 54% beating the S&P 500 Value.

It was a challenging year for international equity funds as well, with 70.6% of global funds underperforming the S&P Global 1200, while 78.1% emerging market funds failed to beat the S&P/IFCI Composite index.

In the fixed income space, short-dated funds struggled amid uncertainty over the future of Federal Reserve policy with 87% of government short funds underperforming the Barclays US Government (1-3 Year) index last year.

However, there was a dramatic improvement in performance towards the longer end of the curve in 2018 with 83% of government long managers beating their benchmark and 90.9% of investment-grade long funds outperforming theirs.

Results for SPDJI's SPIVA Europe scorecard are expected to be revealed in early April.