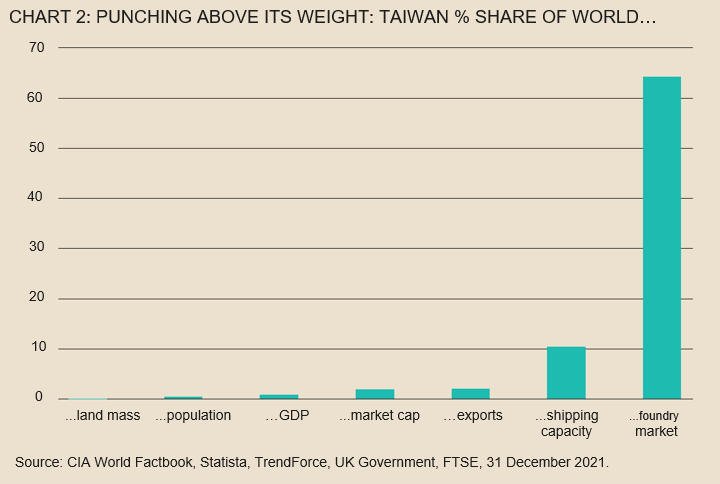

While Taiwan is widely known as a technology exporter, the country also controls about 10% of the world’s liner fleet. It plays a vital role in the global supply chains not only as a producer but also as a container ship operator.

This position is further enhanced by its strategic geographical location on the maritime trade route connecting east Asia with south-east Asia and access to the Suez Canal. With the US administration's strategic priority of “decoupling” some key industry supply chains from China, we believe the country is uniquely positioned to benefit.

Taiwan, also known as the Republic of China (ROC), is a small island nation in the South China Sea, less than 100 miles from mainland China’s Fujian province. The Communist Party (CCP) in Beijing considers Taiwan a “renegade province”, and most countries around the world adhere to the so-called One-China Policy. They maintain informal cultural, economic and even military ties with Taiwan but diplomatically only recognise the CCP as the sole legitimate government of China. This has been the status quo for over seven decades and a reality of daily life in Taiwan.

Along with Hong Kong, Singapore and South Korea, Taiwan is one of the Four Asian Tigers that represent outstanding economic success in a short period of time.

Specialisation and dependence

A key pillar of Taiwan’s success has been its strength in innovation and technological leadership. The country spends around 3.5% of its GDP on Research and Development – surpassed only by Israel and Korea – and boasts one of the highest labour productivity rates around the globe.1,2 With few exceptions, workers in Taiwan also put more hours in than their peers around the world: over 2,000 hours in 2020.3

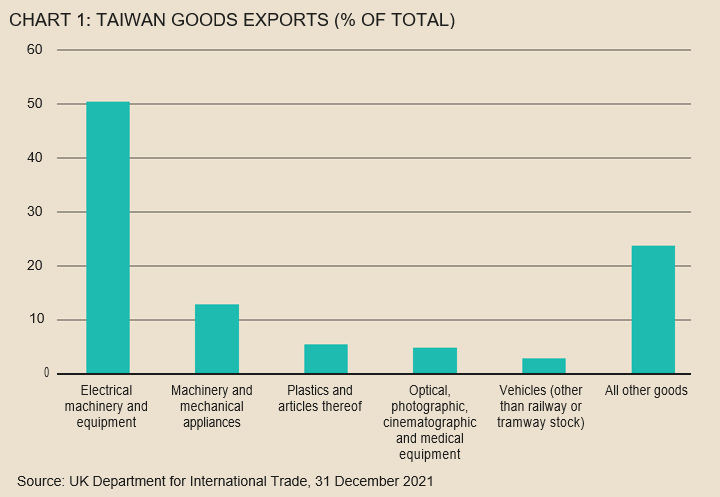

Taiwan ranks high on the Ease of Doing Business index, again ahead of economic heavyweights like Germany, France and Italy. High tech goods like electrical machinery and equipment, mechanical appliances and, to a lesser extent, optical and medical equipment account for more than two-thirds of all exports. Total goods exports stood at $347bn, with imports at $287bn. The country is subject to some concentration risks in the technology sector, especially since exports account for a large share of its GDP.

The government recognises the benefits of diversifying its economy and is actively promoting strategic industry partnerships in order to achieve its efforts including subsidies for R&D expenses in Taiwan-foreign joint ventures and the “5+2 Innovative Industries” programme.

China is Taiwan’s largest trading partner with a share of over 26% of total trade. The US comes second at 13%, followed by Japan (11%), the European Union and Hong Kong (both 8%).4 While improved diversification would likely bode well for the country, it has also found strength and success by leveraging its skill-based comparative advantage to focus heavily on electronics.

Strategic geographical location and geopolitical significance

Taiwan’s location is a risk in the face of China’s military prowess and increasing assertiveness on the global stage. At the same time, paradoxically, it may also be Taiwan’s life insurance and greatest intangible asset. Taiwan caps the northeastern fringe of the South China Sea.

According to calculations by the Australian Strategic Policy Institute, a think-tank, roughly a third of global shipping – and therefore almost one-quarter of the entire global trade by volume – passes through these waters.5 With Japan and Singapore, Taiwan connects two of the most critical destinations for the global economy. From Singapore, ships venture on toward India and the Middle East or into Europe through the Suez Canal. Two of Taiwan’s own ports, Kao-hsiung and Taipei, are among the largest in the world. Taiwanese ship operators, notably Evergreen, Yang Ming Marine and Wan Hai control more than 10% of global container capacity.6

Both the US and China, have a vital self-interest in friction-free operations in and around the Taiwan Straits, and that necessarily includes Taiwan’s stability and security. Conversely, Taiwan itself wields considerable soft power given its delicate position in the South China Sea.

Dominance in electronic circuits and semiconductors

Taiwan’s tech companies dominate near two-thirds of the semiconductor foundry market share. Taiwan Semiconductor Manufacturing Company, TSMC, controls 84% of the production for the most advanced and efficient chips.7,8 The COVID-19 pandemic has only accelerated what was already an established trend toward digitisation and an ever more electronics-dependent world. In such a world, semiconductors will experience high demand for years, if not decades, to come.

Taiwan has a highly skilled workforce, vast capital resources to build and maintain foundries and the capability to withstand market cycles. It can take over two years to build a new semiconductor factory, a venture that in itself is prohibitively expensive for most companies. At the end of 2021, for example, TSMC announced a new plant in Phoenix, Arizona that will cost $12bn and not start production until 2024.9

Decoupling the US from Chinais a tall order

One of the current US administration’s strategic goals under President Joe Biden is what has come to be known as “decoupling” from China, and in particular, insulating global supply chains from Chinese interference or, in some cases, dependence.10

One way to bypass China is to strengthen ties with alternative suppliers of raw materials like rare earths and production capacity owners for chips. There is not a huge choice; the first category will likely include Brazil and India, the latter must include Taiwan and South Korea.

Given Taiwan’s ancillary strengths in shipping and global trade, we expect the country to be in a very strong position under most scenarios of the American decoupling efforts. That is an underlying fundamental advantage because these efforts will last for years.

We believe that with Taiwan’s strong financial fundamentals, its leading positions across a number of key industries and moderate equity valuations, investors with a medium-term horizon should find the country a worthwhile consideration for 2022.

There are some latent risks, but the most important one, an escalation of China Taiwan or China-US tensions up to and including military conflict, can be considered a tail event.

All parties have a natural interest in preservation of the status quo, most fundamentally because any change would be incredibly costly to all sides.

Taiwan is poised to benefit from the continuing semiconductor squeeze in the short term. In the long run, increased chip making capacities on the one hand and improved diversification of the economy overall may unlock significant growth potential.

With moderate valuations, a low debt burden and strong reserves it could be an attractive market even as the global economy comes off the liquidity high after COVID-19.11

Absent a severe slowdown in global trade or recession, the country should also be able to monetise the secular trend towards digitisation, the metaverse, and, last but not least, the opening up of economies around the world with more trade, more tourism – and more boba tea.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here

1 OECD, 2019, https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm2 https://tradingeconomics.com/country-list/productivity3 https://focustaiwan.tw/business/2021101600054 International Trade Administration, 2021, https://www.trade.gov/country-commercial-guides/taiwan-market-overview5 ASPI, 2020, https://www.aspistrategist.org.au/southeast-asia-will-take-a-major-economic-hit-if-shipping-is-blocked-in-the-south-china-sea/6 Statista, 2021, https://www.statista.com/statistics/198206/share-of-leading-container-ship-operators-on-the-world-liner-fleet/7 TrendForce, 2021, https://www.trendforce.com/presscenter/news/20210305-10693.html8 The Economist, 2021, https://www.economist.com/business/2021/04/29/how-tsmc-has-mastered-the-geopolitics-of-chipmaking9 CNBC, https://www.cnbc.com/2021/10/16/tsmc-taiwanese-chipmaker-ramping-production-to-end-chip-shortage.html10 Foreign Policy, 2022, https://foreignpolicy.com/2022/01/11/us-china-economic-decoupling-trump-biden/11 Bloomberg, 2022 and Franklin Templeton Deep Water Waves, 2021

Important Legal InformationThis material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risk. We recommend professional investment advice before making an investment. The value of an investment can go up or down. Investors may not be able to get back the amount invested. Find out now about the opportunities associated with investing in our funds opportunities and risks: www.franklintempleton.co.uk. Sales brochures and other documents are available free of charge from Franklin Templeton Investment Management Limited (FTIML), Cannon Place, 78 Cannon Street, London EC4N 6HL, Tel: +44 (0) 20 7073 8500, franklintempleton.co.uk. © 2022 Franklin Templeton. All rights reserved.