This article first appeared in ETF Insider, to read the full edition, click here.

In its simplest terms, factor investing involves investing in stocks with specific characteristics in a rules-based approach. There is a wealth of academic research on factor investing, and most agree on six key factors: value, size, momentum, volatility, yield, and quality.

Among these, the size factor has been somewhat neglected in recent years and rightfully so as small-cap stocks have significantly underperformed large-cap stocks. However, the increasing dominance of large-cap stocks in benchmark indices and market-cap index tracking funds has led to concerns about concentration risk.

Firstly, let us define the size factor: The size factor refers to the tendency of small-cap stocks to outperform large-cap stocks over the long term. The argument is that small-cap stocks carry more risk, which should, in theory, result in higher returns to compensate for this additional risk.

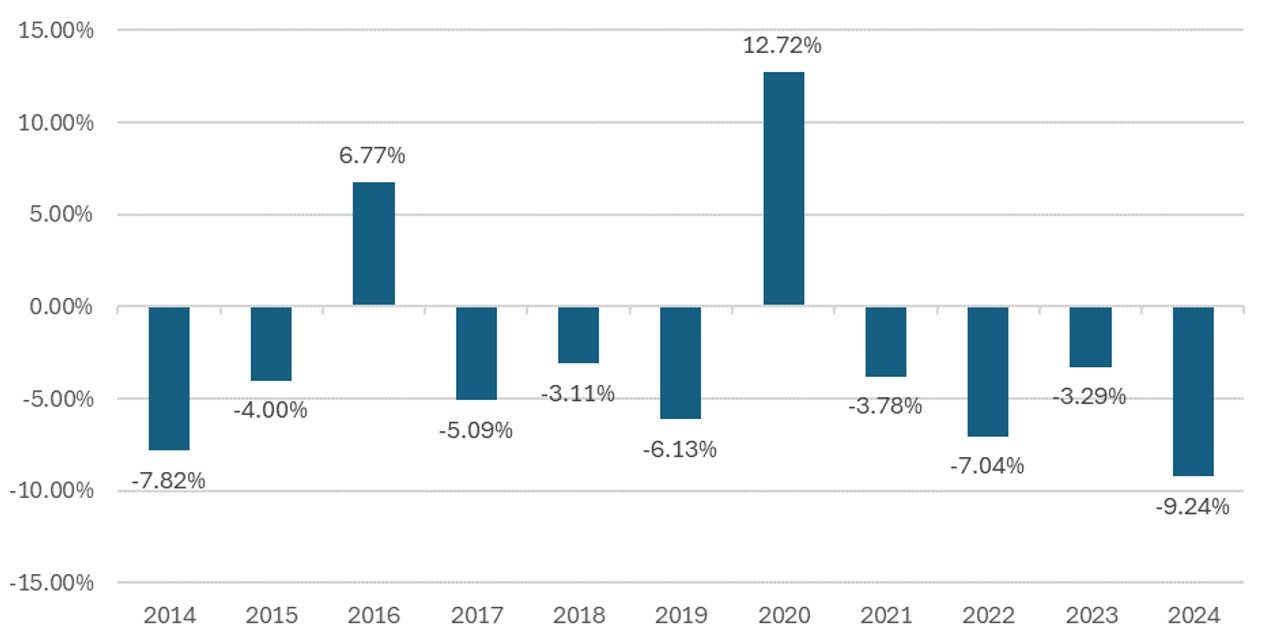

However, the past decade has defied this theory, with US small-caps significantly underperforming their large-cap counterparts. As shown in the figure below, there have been only two years – 2016 and 2020 – where small-caps outperformed large-caps in the US, challenging even the most patient investors.

Chart 1: US small cap minus large cap returns

Source: Elston Research, Ken French data, as of 31 August 2024

With the strange performance behaviour of the size factor, a growing number of academics have re-examined the data and some have come to conclude that the size factor never really existed in the first place.

What happened to small-caps over the last decade?

Several factors explain the diminished performance of small-caps over the past decade. For one, large-cap stocks like Apple, Microsoft, Google, Meta (formerly Facebook) and Amazon have grown even larger.

These companies benefit from robust business models with strong competitive moats. Massive investments in research and development have allowed them to dominate emerging technologies. Additionally, their access to capital enables them to acquire potential competitors before they become significant threats, as seen with Facebook's (now Meta) acquisition of Instagram.

Another reason for small-cap underperformance is that approximately 45% of small-cap stocks are unprofitable – delivered negative earnings – and this percentage has been steadily rising. Meanwhile, profitable small-caps are frequently targeted for acquisition by private equity firms or large-cap companies.

Current market conditions and concentration risk

Today's market presents a unique challenge with increased concentration risk among large-cap stocks. The top seven companies alone account for over one-third of the total market capitalization in the US equity market. Investors using passive, market-cap based index-tracking funds and ETFs are exposed to this concentration risk, but it is essential to remember that concentration risk is a choice, not an obligation.

However, the broader US economy is performing well. Real GDP growth is hovering around 3%, inflation is not far off the Federal Reserve’s 2% target and with potential interest rate cuts on the horizon, there is a tailwind for the broader market of 493 stocks beyond the top seven.

While these stocks are smaller in comparison to the large-cap giants, the landscape is different for small-cap stocks. A rising tide may not lift all boats, especially in the small-cap space, where a selective approach is crucial.

Investing in small-caps: What to look out For

Investing in small-cap stocks can be rewarding, but it comes with its own set of risks. Small-cap companies typically have more growth potential but are also more vulnerable to market volatility, economic downturns, and operational challenges. As such, it is vital to be selective when investing in this space.

Here are a few factors to consider:

Quality of earnings:

One of the key risks with small-cap stocks is that many of them are unprofitable. Focus on companies that demonstrate consistent earnings growth and have a sustainable business model. Look for profitability rather than just revenue growth.

Management and strategy:

Strong leadership is essential for small-cap companies, especially during times of uncertainty. Pay attention to companies with experienced management teams and a clear strategic vision. Companies that can efficiently allocate capital and adapt to changing market conditions tend to outperform their peers.

Balance sheet strength:

Financial health is another critical factor. Companies with excessive debt can struggle during periods of rising interest rates or economic slowdown. A solid balance sheet with manageable debt levels and sufficient cash flow can provide the cushion needed to weather downturns.

Market position and moat:

Small-cap companies with a competitive advantage in their niche market are more likely to succeed. Whether through unique products, services, or intellectual property, having a defensible position in their industry is crucial.

Conclusion

While small-cap stocks have underperformed in recent years, the size factor still holds potential for those willing to take a selective approach.

With concentration risk rising in large-cap stocks, investors may find opportunities among high-quality small-caps with strong fundamentals. However, careful due diligence is required to navigate the unique risks associated with investing in smaller companies.

By focusing on quality, management strength, financial health, and competitive positioning, investors can ride the next wave of momentum in the small-cap space.

Hoshang Daroga CFA, investment director at Elston Consulting