The sharp rise in demand for thematic exchange-traded funds (ETFs) is directly impacting the liquidity of underlying holdings and causing bubble-like increases in their share prices, a significant risk for investors if flows reverse.

Demand for thematic ETFs skyrocketed in 2020 as investors looked to capture the latest megatrend from cybersecurity to clean energy in portfolios. According to data from Morningstar, the segment in Europe saw a record €9.5bn inflows nearly doubling its overall assets under management (AUM) to €22.7bn.

The picture was even more pronounced in the US with thematic ETFs seeing $57bn inflows, according to data from Citi, driven by the significantly larger retail market across the pond.

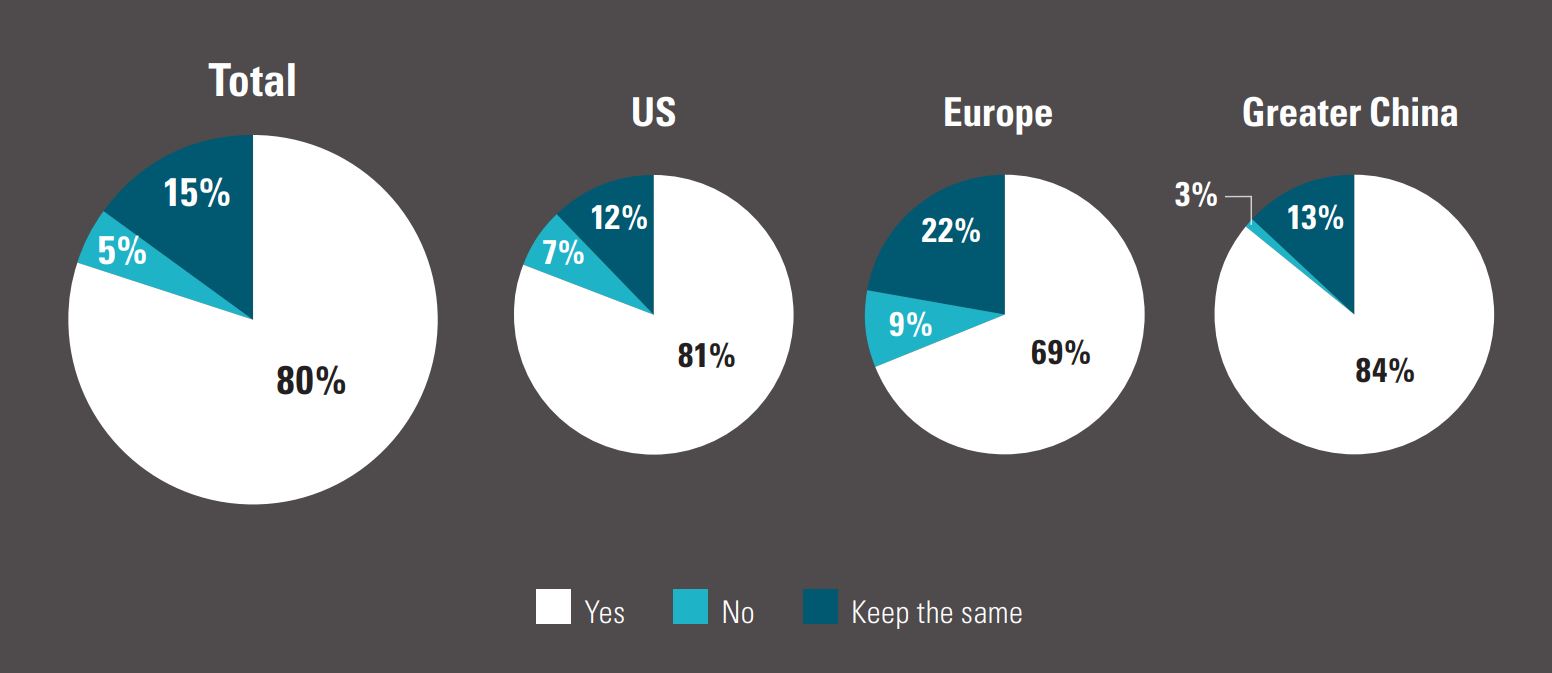

Demand shows no sign of slowing down as thematic ETFs have booked some $32bn inflows in the US in January and February alone, according to data from Bloomberg. Meanwhile, a recent Brown Brothers Harriman survey of 382 global ETF investors found 80% of respondents are planning to increase their exposure to thematic ETFs.

Chart 1: Do you plan on increasing your exposure to thematic ETFs?

Source: Brown Brothers Harriman

Flows into thematic ETFs have certainly been helped by the strong performance seen across the board. To name just a few, the iShares Global Clean Energy UCITS ETF (INRG) returned 136% in 2020 while the VanEck Vectors Video Gaming & eSports UCITS ETF (ESPO) and the L&G Battery Value-Chain UCITS ETF (BATT) jumped 87% and 82%, respectively.

What has made thematic ETFs so attractive, especially in Europe, is issuers have teamed-up with specialists in those specific industries to pinpoint the companies having the greatest impact in that particular megatrend.

Working with experts leads to an index with an intense exposure to that particular theme as the companies are included based on their role in the space, a certain positive when investing in thematic ETFs.

Highlighting this, WisdomTree partnered with Nasdaq and Bessemer Venture Partners in September 2019 to create the index for its $644m WisdomTree Cloud Computing UCITS ETF (WCLD). This led to an ETF that avoids big names such as Amazon and Microsoft which have their returns derive from other industries, not just cloud computing.

However, focusing on more niche companies that offer a more intense exposure to the megatrend can cause liquidity risks and high ETF ownership if the strategy sees significant inflows in a short space of time.

The poster child for this phenomenon were BlackRock’s two clean energy ETFs, INRG and the US-listed iShares Global Clean Energy ETF (ICLN), which have seen a combined $8bn inflows over the past year, as at 16 March, according to data from ETFLogic, following President Joe Biden’s $2trn pledge to climate-related infrastructure investments.

The two ETFs were tracking an index with just 30 stocks including small cap names such as Plug Power which has seen its share price driven as high as 1,970% since the start of January 2020 to the end of January before falling back in February.

According to data from ETFLogic, ETF ownership in Plug Power is 20.6% meaning any reversal in ETF flows could cause significant liquidity issues.

In an admittance of the potential risks involved, S&P Dow Jones Indices issued a market consultation earlier this year which finished with the index provider proposing to increase the S&P Global Clean Energy index’s minimum holdings from 30 to 100.

Is this saga among clean energy stocks a one-off for thematic ETFs or a sign of things to come? If other megatrends see the same inflows that BlackRock’s clean energy ETFs did, there is no reason why the same liquidity risks cannot come to fruition.

James McManus, CIO at Nutmeg, who documented the reasons why the firm sold INRG in February, warned this is the nature of investing in niche areas of the market.

“Investors have to be careful about the potential concentration risks in these types of markets,” McManus continued. “There can be a significant impact on share prices from inflows so if the flows reverse, this can be very painful.”

Clean energy ETFs: Can these volatile products power on?

Clean energy stocks are not the only thematics facing high ETF ownership risks. Small cap Israeli company Compugen has 36.1% ETF ownership while First Solar has 23.1% highlighting the risks these two companies face if flows reverse.

This was highlighted by Scott Chronert, managing director at Citi, who co-authored a research note entitled Thematic Comes of Age, which highlighted the huge inflows into thematic ETFs but also the resulting risks.

“It is concentration market participants should be wary of, especially as it pertains to potential ETF impacts on liquidity and performance,” Chronert stressed.

For ETF issuers, striking a balance is tricky. Small caps are naturally going to provide the purest exposure to a given theme but significant inflows can cause liquidity risks and high levels of ETF ownership.

One solution has been to equally weight the index in order to remove any dominant few stocks, however, this only gives the ETF a natural bias towards small caps.

“For thematic ETFs, investors need to think about metrics such as ETF ownership, how much an ETF can trade on any day and the liquidity the ETF uses up,” McManus added.

While questions remain about whether thematic ETFs can continue to shoot the lights out like last year, a bigger focus for investors must be around ETF ownership and the impact that can have if a trend falls out of favour.