Environmental, social and governance (ESG) indices help investors form a sustainable portfolio, by deciding where to allocate capital and understanding the level of risk when investing. However, the “devil is in the details” when it comes to assessing ESG indices.

As part of their portfolio construction, institutional investors and asset managers are taking into consideration ESG factors such as climate-change risks as part of their investment process.

The Index Industry Association (IIA) argued indices play an important role in capital allocation decisions. The IIA’s 2021 survey showed 80% of respondents agreed that indices help direct investment quickly to companies and sectors with strong ESG performance; 78% agree indices give them greater confidence in the reliability of ESG data; 75% agree indices help them respond quickly and flexibly to new ESG issues and concerns.

According to the IIA survey, indices are highly relied upon, with 84% of respondents stating they trust index providers to push financial services ESG innovation and standards.

There is no doubt ESG is here to stay. In Q1 this year, global inflows into sustainable funds reached an all-time high of just over $185bn, with Europe accounting for the lion’s share of these inflows, about 79%, according to data from Morningstar. Globally, assets in sustainable funds stood at a record-breaking $1.9trn in Q1, almost double the value from the same period in 2020.

Ambiguity around ESG indices

When it comes to index providers’ approaches to constructing ESG indices, there is a difference. There are also a wide variety of ESG-focused benchmarks available such as Sustainalytics, MSCI, RobeoSAM and Bloomberg MSCI ESG indices in the market but there can be a lack of consistency around ESG data.

As Todd Rosenbluth, head of ETF and mutual fund research at CFRA, explained: “With ESG investing, the devil is in the details even when the underlying index is run by the same firm.”

ESG benchmark ratings are formed using a range of data from several sources. For example, MSCI ESG ratings use data from mandatory company disclosures such as financial statements and regulatory filings.

MSCI ESG ratings measure an individual company’s resilience to ESG risks and use a rules-based methodology.

CFRA’s Rosenbluth said, for example, the iShares ESG Aware MSCI USA ETF (ESGU) and the iShares MSCI KLD 400 Social ETF (DSI) both track MSCI-based ESG indices, but the DSI ETF does not own Apple, Exxon, Facebook or JP Morgan, which are all key positions in ESGU ETF. There is some ambiguity.

“It is hard for an investor to understand why a stock is excluded and whether it might add to the mix in the future,” Rosenbluth stressed.

What are the ESG ratings based on?

Bob Jenkins, Lipper global head of research, at Refinitiv, said ratings emanate from corporate ESG disclosure data as interpreted by ratings providers.

“These providers all have unique taxonomies that map the disclosed data into descriptive categories that speak to various ESG factors,” Jenkins added.

Taxonomy includes economic activities with performance criteria to assess the activities’ contribution towards environmental objectives such as climate change.

According to Jenkins, most of the taxonomies also include a materiality construct that attempts to weight the importance of these factors to the overall score based on the industry or sector that a given company resides in.

For example, this would theoretically make carbon emission factors more important to carbon-intensive businesses – like oil and gas – and less important to other businesses – like software.

Detlef Glow, head of Lipper EMEA research at Refinitiv, said the way ESG ratings are derived depends on the methodology of the respective rating provider.

“Some ratings are derived from qualitative data, while others only use quantitative data, and obviously there are ratings using both qualitative and quantitative metrics,” Glow added.

According to data from Lipper, while the quantitative data are mainly sourced from the respective company reporting, qualitative data is sourced via questionnaires and surveys which are proprietary research owned by the respective agency.

“That said, there are some issues with the completeness of ESG data for different industry sectors and company sizes. For example, not all industries or companies report all possible data,” Glow continued.

“Some of these gaps can be explained by the materiality of the respective data point since not all data make sense for all industries/companies and therefore are not reported from the respective companies.”

Although some ESG ratings providers use the same approach to calculate ESG scores, investors need to be aware of the divergences and different frameworks.

“Some rating agencies try to fill the gaps with estimates which they derive from sector averages and other parameters,” Glow explained.

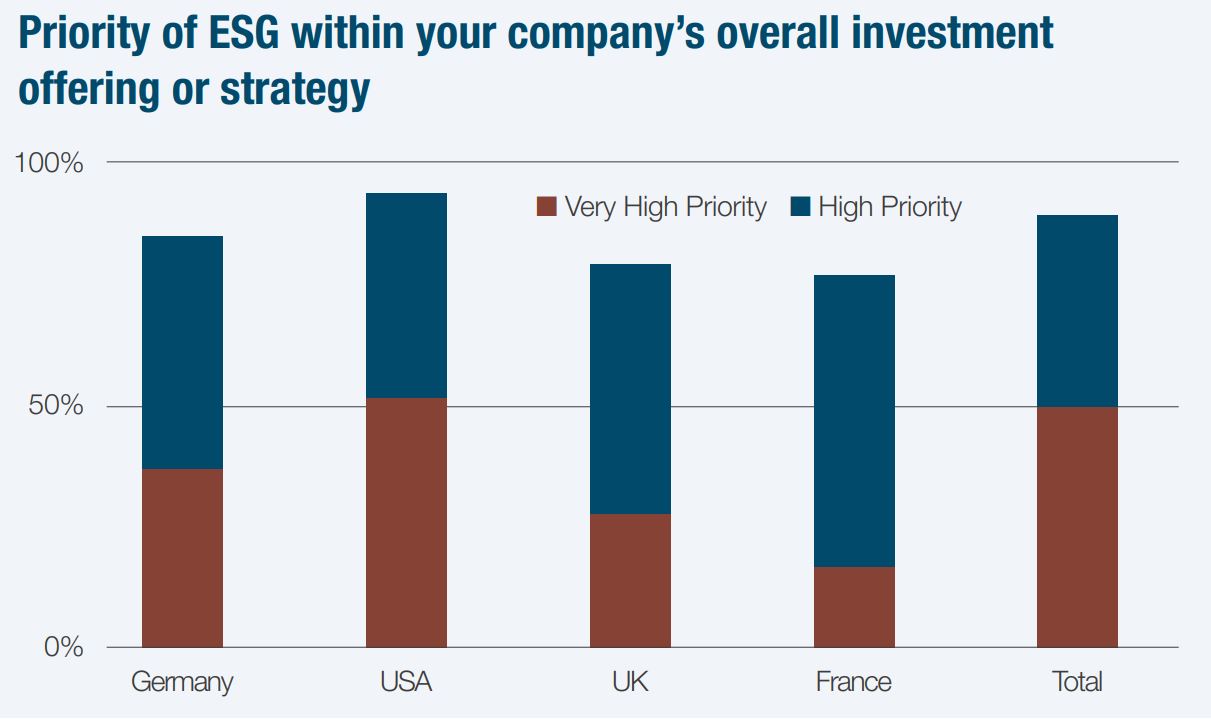

ESG impact on asset management ESG has certainly been changing the asset management landscape. According to the 2021 IIA survey, the increasing centrality of ESG factors in the asset management sector – with 85% of companies surveyed stating ESG – is a high priority for their company’s overall investment offering or strategy.

Some 37% said it is a “very high priority”, rising to around 50% for respondents in the US and Germany. In terms of respondent role, CIOs and CFOs were somewhat more likely than portfolio managers to assign “very high priority” to ESG factors, although support generally was very high.

Source: IIA

There are still a number of challenges confronting ESG investors, which include the accuracy of data being more standardised, and that comparable data on the ESG performance of companies and asset types is needed.

The wide range of ESG reporting organisations and ESG benchmarks can also be confusing, and this means many companies vary widely when it comes to choosing how to report their ESG activities and metrics.

The 2021 IIA survey found that 58% of respondents highlight a lack of data as either a major (23%) or moderate (35%) challenge to ESG implementation; while 61% point to the lack of agreement around how to rate ESG performance.

Similar proportions of respondents show concerns regarding a lack of transparency around ESG reporting and insufficient public disclosure by companies of their ESG activities.

This article first appeared in ESG Unlocked: Sustainable Revolution In Full Swing, an ETF Stream report. To access the full issue,click here.

Related articles