Amundi has been undertaking some ‘housekeeping’ of its ETF range since the acquisition of Lyxor last year, leaving it with a huge product range full of duplicates and crossovers.

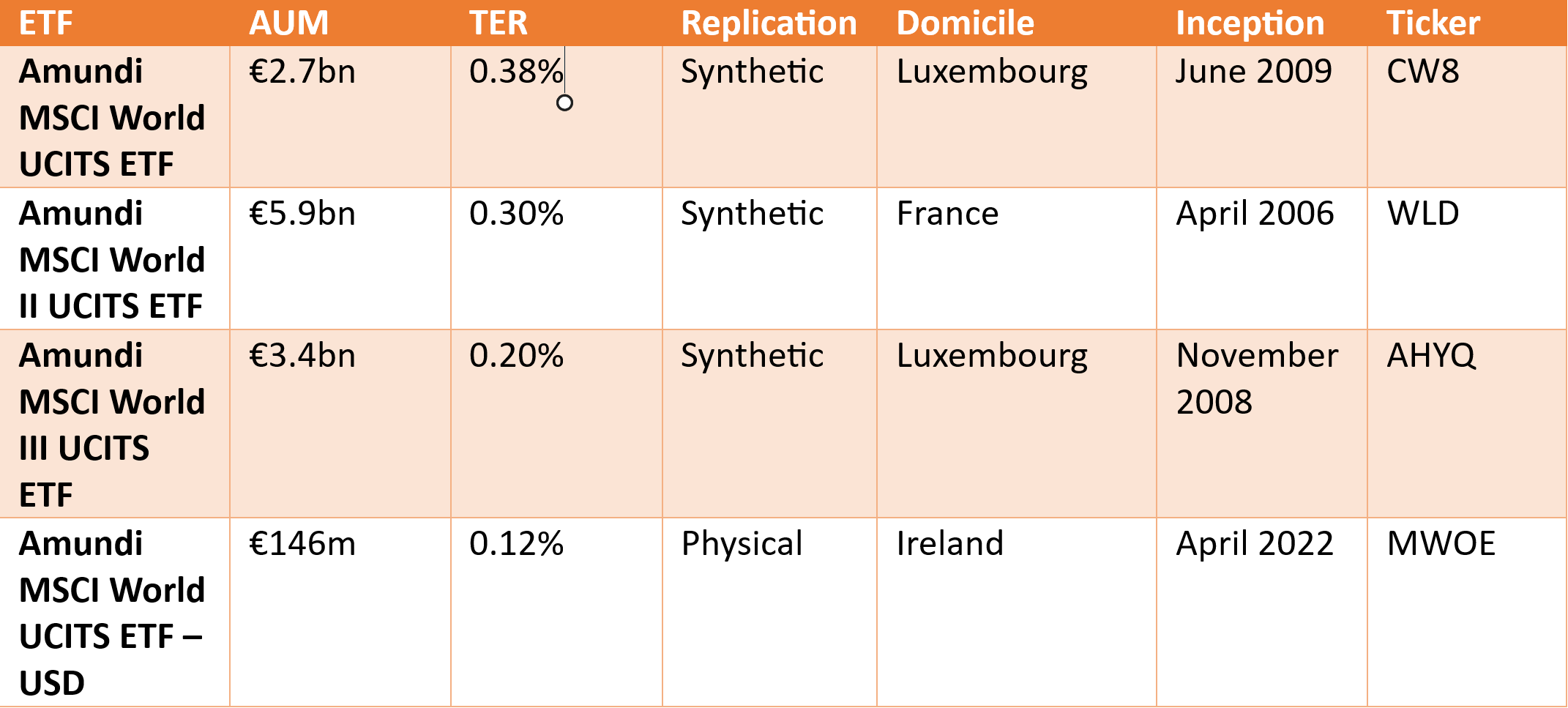

Despite its attempted streamlining of over 300 ETFs over the past 18 months, the issuer still has four products tracking the MSCI World index, most of which house billions of euros in assets under management (AUM).

With this in mind, ETF Stream analyses the key differences between the ETFs and why it has four.

The ETFs differ substantially in their total expense ratio (TER), domicile and replication, meaning investors are given the flexibility to choose which one suits them.

For example, Amundi’s legacy global equity ETF – WLD – was launched on its multi-unit France Sociétés d'investissement à Capital Variable (SICAV) and has grown to be its largest global equity ETF.

CW8 is the group’s other original ETF but is domiciled in Luxembourg and is eight basis points more expensive. According to Amundi, investors are able to choose an ETF based on ease of access or other needs.

Meanwhile, AHYQ – inherited from Lyxor – was merged within a newly created sub-fund in April this year.

The ETF has some obvious advantages over the others, chiefly that it comes in at almost half of the price of CW8.

Another clear benefits is its eligibility for the French equity savings plan (PEA), similar to an ISA in the UK, making it tax-efficient for French investors.

Investors who hold investments in a PEA for longer than five years do not pay capital gains tax while earned income is also free.

All three are synthetically replicated, meaning that while the total cost of ownership is often higher, US equities in the basket swaps are not income deriving and are therefore not subject to withholding tax.

The global equity ETF in Amundi’s range with some of the biggest differences is the most recent addition to its range, MWOE.

Domiciled in Ireland, the ETF's advantage is the tax relief under the US-Ireland tax treaty, resulting in a net withholding tax rate of 15% on US dividend income, as well as its 0.12% TER, over three times cheaper than CW8.

This is especially beneficial to investors that are not comfortable with synthetic replication, a hangover from the Global Financial Crisis (GFC) in 2008.

Over the past year, Amundi has expanded its range into Ireland based on the favourable tax treaty.

Commenting on its MSCI global exposure, an Amundi spokesperson said: “We always had duplicates in our ETF range to meet the variety of our clients’ needs.

“Two ETFs tracking the same index may still have some differentiated features such as domicile, replication technique or fund size and liquidity.”

Amundi is looking to be all things to all investors with its global equity ETF offering, compared to other issuers that have a more streamlined approach.