The ETF industry has massively outperformed the S&P 500.

The founding wisdom of the ETF industry is that it's better to track the index than try to beat it. The S&P 500 is a formidable opponent, so why not ride the wave rather than try beat it to shore?

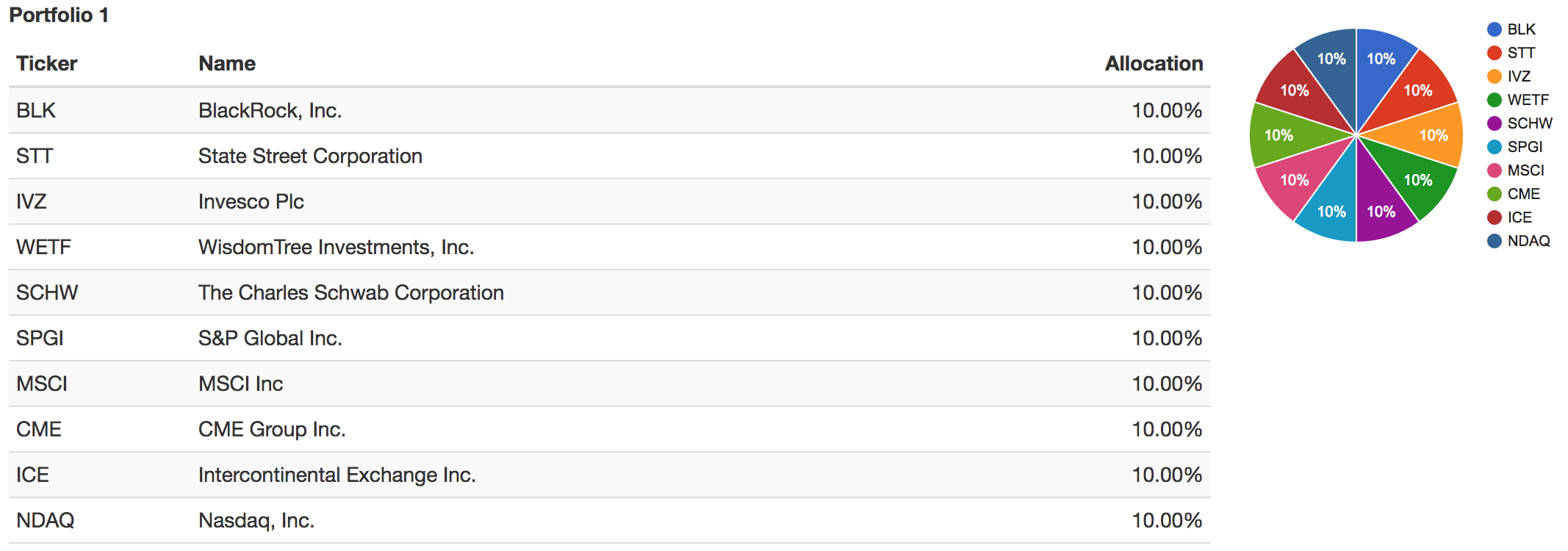

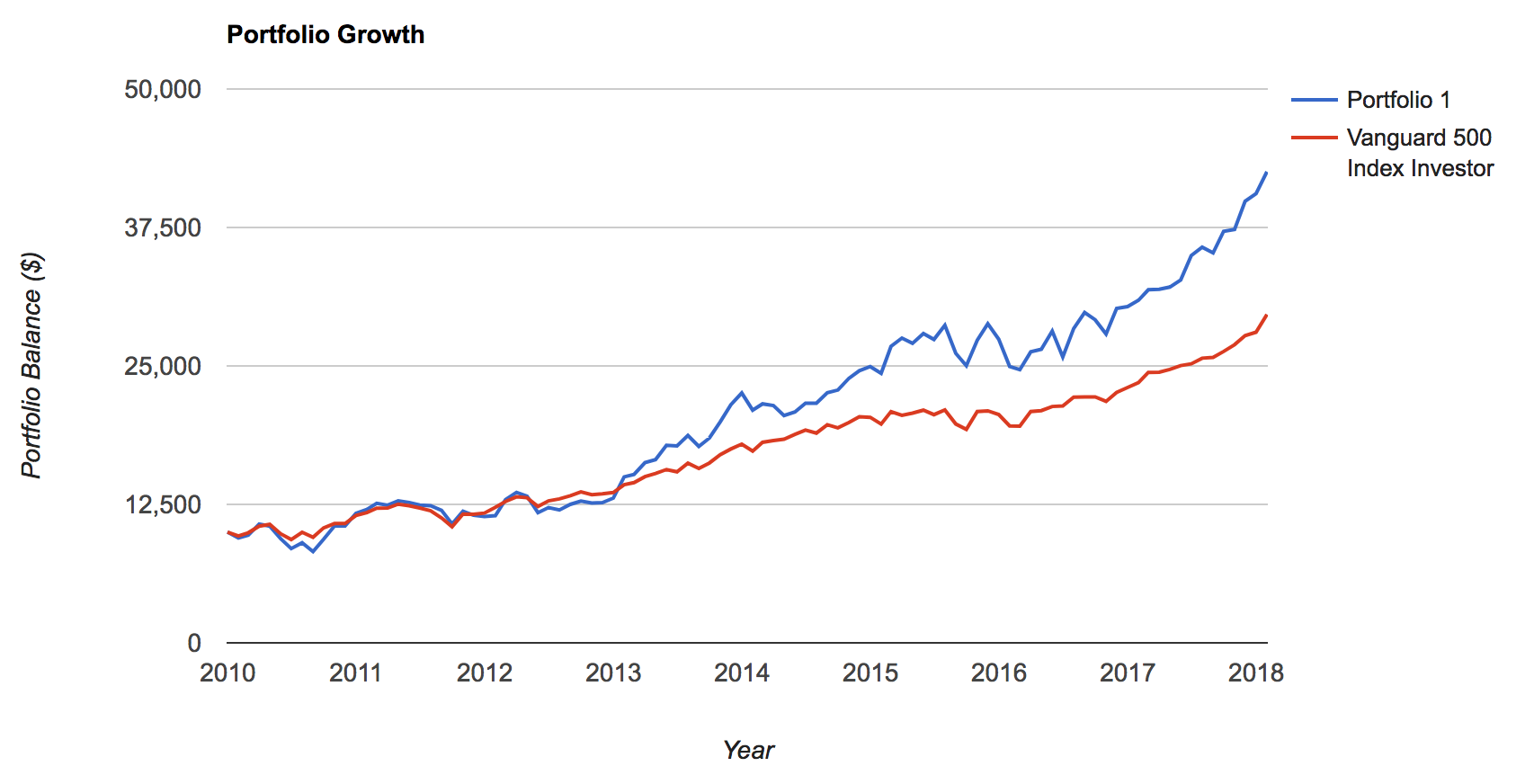

Yet this wisdom doesn't apply to the ETF industry itself. Driven by the surging popularity of ETFs, the ETF industry has hit the index out of the park the past 5 years. To prove this, we put together a simple index of ten big ETF industry companies - call it the "ETF Sector Large Cap Index". We then gave each company 10% weight and rebalanced the portfolio once a year.

The ten companies we chose include the biggest five publicly listed ETF issuers. Through management fees, issuers rake in most of the industry's gains. We added two index providers, which gain through index fees. Finally, we added exchanges, which gain through listing fees and trading costs.

As you'll see, the ETF Sector Large Cap Index shows that you can beat the index - if you invest in the industry instead of the products.