Talk to academics focused on factor-based research and the concept and merits of equal-weight indices are clearly supported by academic evidence and seem incontrovertibly logical and rational.

Equal weighting is one of the most obvious, simple and compelling ways in which indices can be constructed, theoretically. Back in the real world, however, the vast majority of mainstream investable indices are market capitalisation weighted, and even amongst factor premia-based adaptations, equal weighting is rare.

As we will explore in this article, the reason for this is that there are practical challenges that have made equal weighting difficult to implement and manage, for the mutual funds and ETF world. But the structured products sector can and does offer investable equal weight index propositions for investors, as Tempo’s product suite for professional advised investors proves.

Given a choice, would investors choose market cap weighting?

Market capitalisation weighted indices have clearly become the most common passive investment approach for many investors around the world.

This article is not seeking to challenge the fact that market capitalisation weighted indices rationally and incontrovertibly reflect the market as a whole, as ‘market benchmarks’, the merits of which are widely recognised, evidenced and accepted. However, it is important to recognise that market capitalisation indices effectively, implicitly embed some features, rules, factor exposures and potential issues as ‘passive investments’, which investors need to consider.

To highlight these points, it is interesting and thought provoking to imagine how market capitalisation weighted indices might be regarded, if presented and considered as smart beta propositions. Let us imagine that you are a professional adviser or investor who has happily been using an equal-weight version of the FTSE 100 for many years: let’s say, e.g., since 1984, imagine that the FTSE 100 index you’ve been using since its inception was always equally weighted.

FTSE Russell contact you, as a recognised expert on passive investing, and explain that they are thinking of launching a market capitalisation weighted version of FTSE 100. They provide you with detailed input and academic evidence, highlighting and explaining that market capitalisation weighting, as a rules-based index methodology, as an alternative to equal weighting, will result in some or all of the following:

Stock (and usually sector) concentration in the larger, ‘mega cap’ companies in the index (eg., in the FTSE 100, the top 10 companies may typically account for 40%-50% of the index in total), despite academia evidencing the merits of diversification.

Underweighting the smaller companies in the index (eg., in the FTSE 100, the bottom company may typically account for just 0.1-0.2%): despite academia identifying that these companies historically outperform, i.e., the small companies effect.

Increasing the weighting in companies when their share prices rise and decreasing the weighting in companies when their share prices go down, i.e., buying high and selling low, despite academia pointing to the long term merits of value investing.

… oh, and best point last, they highlight that historical analysis shows that market capitalisation weighting the FTSE 100 means that, more times than not, it underperforms the elegantly simple equal weight index.

They do, however, draw attention to the efficient markets hypothesis, which loosely states that markets are efficient; everything is in the price; the only thing that can move prices is unknown information, and that consistently beating markets is impossible ... which they suggest highlights the merits of market capitalisation weighting. Patiently listening, you, however, may counter that while it is, of course, interesting to consider the principles of EMH, there is no information value to knowing everything is in the price: it does not provide or improve the ability to actually forecast anything about future performance. Arguably, EMH does not point to market capitalisation weighting, it points to the agnostic and elegant case for equal weighting.

Put simply, if we started with a blank sheet of paper, and thought about the best ways to invest passively in the market, as opposed to the best benchmark for the market, we might not conclude that market cap weighted indices are the optimal passive investment methodology!

Equal weight indices make sense

Equal weighting is generally considered to be the most obvious and straightforward alternative to market capitalisation weighting an index. The rules and factors which are explicit in equally weighted indices effectively reverse rules, factor exposures and potential issues which are embedded implicitly in market capitalisation weighted indices, including, but not limited to the following:

Concentration risk at company (and potentially also sector) level is immediately exchanged for diversification, eg., in the FTSE 100, 100 x 1% weights means that the top 10 companies account for 10% in total.

Smaller company ‘underweights’ are equalised, eg., in the FTSE 100, 100 x 1% weights means that the bottom 10 companies account for 10% in total (as per the top 10 companies). In the FTSE 100, over 70 companies may increase weighting when equally weighted. 3. Periodic rebalancing to maintain equal weighting embeds a ‘buy low/sell high’ approach, as a rule, in contrast to market capitalisation weighting, which does the opposite.

It is immediately apparent that there is logic and investment merit to equal weighting.

Extensive academia highlights two factors which can contribute positively to portfolio performance, which benefit from equal weighting: size/smaller companies and value (attractive fundamentals) stocks. Let us look at each in turn.

Starting with the ‘size’ factor, in simple terms equal weighting increases exposure to smaller companies in an index. Academic studies have long identified that smaller companies have historically outperformed larger companies, over the longer term (even the major stocks in the world today were smaller companies at some point in the past). The higher return premium of smaller companies is usually associated with increased risk: less information, less certainty, lack of liquidity, etc. But it is worth noting that smaller companies in the FTSE 100 are still considered large companies. The increased weighting to smaller companies in equal weight indices can also be expected to lead to higher volatility. But again, the FTSE 100 analysis highlights that this may be less than might be anticipated, given that the smaller capitalisation end of the FTSE 100 is still considered large capitalisation.

The other key factor at work is the ‘value’ factor. In an equal weight index, re-balancing imposes a ‘buy low/sell high’ rule, which captures elements of value. Over recent years there’s plentiful evidence that value investing has been out of favour, while growth stocks have driven the performance of certain stock market indices. However, academia identifies the potential merits of value investing.

I would cite a non-exhaustive list which includes Basu (1977); Rosenberg, Reid and Lanstein (1985); De Bondt and Thaler (1987); Fama and French (1992)

In academic theory, therefore, an equal weight index should capture the returns premium of these two factors. But do the real world facts bear out this academic observation?

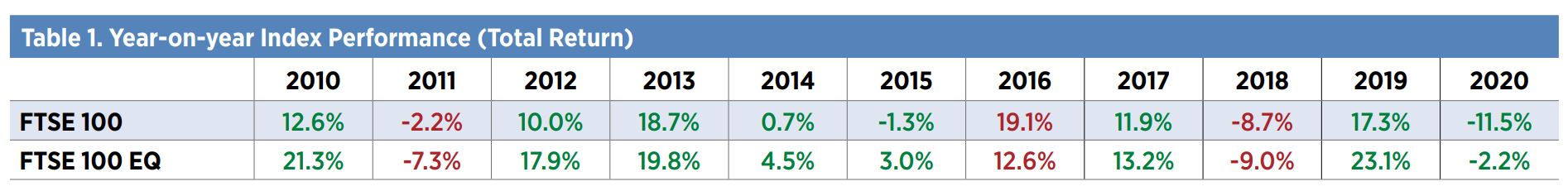

The evidence is persuasive. Focusing on the UK, Tables 1 and 2 highlight analysis of the benchmark UK index, the FTSE 100, comparing the market cap and equal weight versions. As can be seen in Table 1, at least over the time period used in the tables, we can surmise that equal weighting can produce superior returns more often than it doesn’t; in this example, using the FTSE 100, in eight years out of the last 11 years. Table 2 highlights that the superior performance was achieved with slightly higher volatility and slightly larger drawdown (which was during the Q1 2020 COVID-19 sell-off).

Notably, it’s worth considering that this type of outperformance would be the making of an active fund manager aiming and claiming to offer ‘alpha’ against the market cap index benchmark.

However, this is ‘smart beta’ in practice: the same index provider, with the exact same stocks, simply implementing a different, rules-based weighting methodology, as a passive proposition, i.e., alternative beta, to deliver outperformance of the benchmark index.

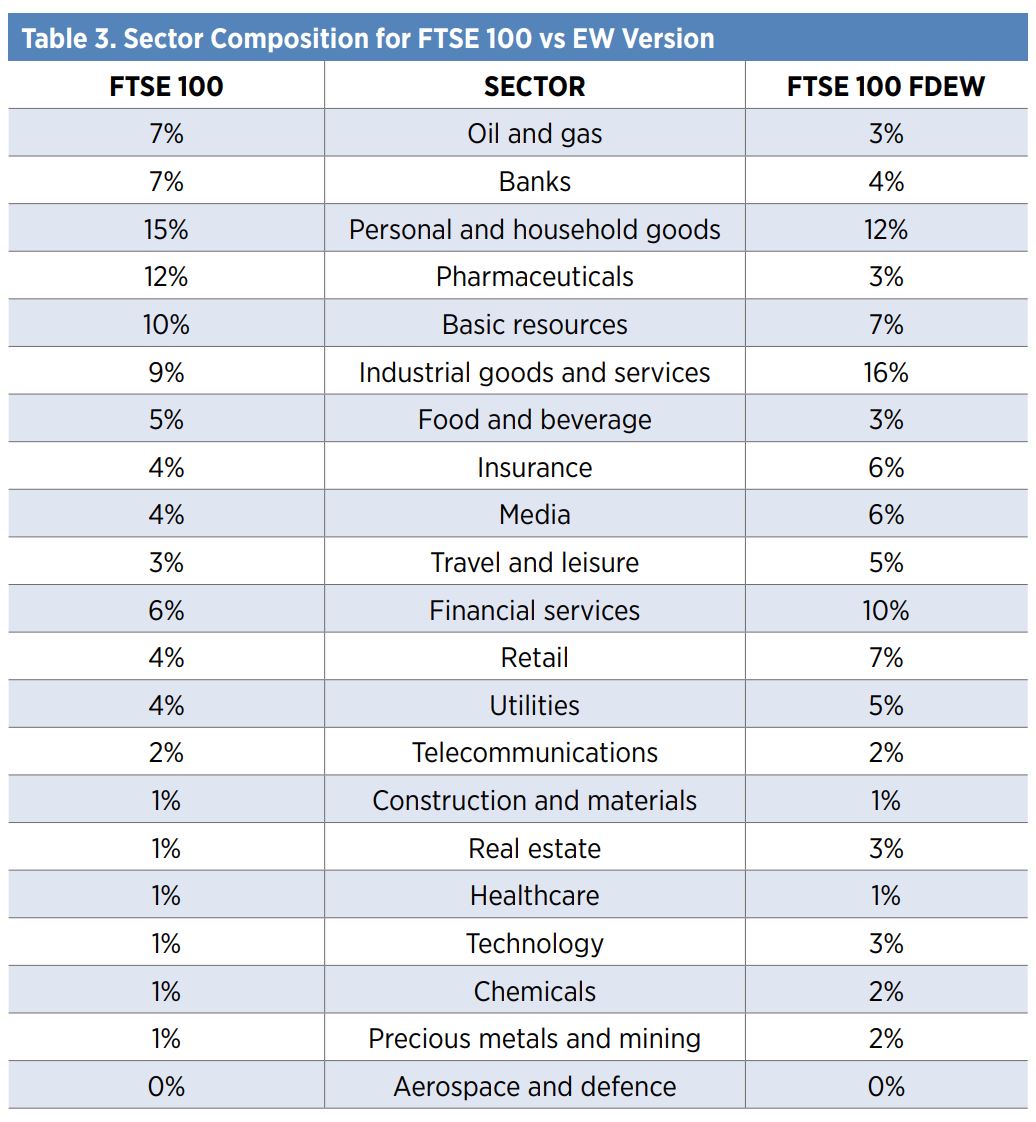

Table 3 reminds us why the returns (and the underlying volatility) might vary: it compares the sector composition of the main benchmark market capitalisation weighted index to the equal weight version. What is obvious here is that the sector composition is noticeably different – currently, in the UK FTSE 100, equal weighting means lower exposure to resources and financial stocks, for example, and higher exposure to industrial goods and retail.

The challenge for mutual funds and ETFs offering equal weight indices

To be fair to mainstream index providers, they fully recognise the academic and real-world merits of equal weighting and offer both market capitalisation and equally weighted methodology options on the main indices, i.e., FTSE 100, S&P 500, MSCI World, Euro STOXX 50.

But given how compelling the evidence and rationale for equal weighting indices is, the question which arises is where are all the equally weighted index mutual funds and ETFs? The answer is that there are practical challenges for mutual funds and ETFs in implementing and managing investable equal weighting. The increased weighting and trading in smaller companies – especially as a result of regular rebalancing to maintain the equal weighting – can present liquidity, trading costs and tracking error challenges.

In fact, in the UK, in respect of the FTSE 100, which I have used to draw attention to the merits of equal weighting, there isn’t a single mutual fund or ETF option available to investors.

However, these challenges do not affect all areas of the investing universe. In particular, these challenges do not affect structured products. Structured products are based on contracts, issued by banks, with product returns based upon the level of an index, without investing directly into the stocks in the index.

Let us unpack that last statement. In a structured product, issuing banks may arrange to hedge themselves against the legal obligations upon them to deliver the terms of the bonds which they have issued, i.e., to deliver the returns they stated, but they do not necessarily replicate the index or need to do so in the way that a passive fund or ETF must.

Structured products do not, therefore, suffer the liquidity challenges, turnover costs or tracking error issues of mutual funds and ETFs replicating indices. This means that structured products can employ smart beta strategies, including equal weighting, in ways (and with risk-return profiles) which mutual funds and ETFs cannot.

Structured products can offer investable equal weight index propositions for investors

In 2017, FTSE Russell launched an equal-weight version of the FTSE 100, known as the FTSE 100 Fixed Dividend Equal Weight Custom Index (‘FTSE 100 FDEW’), which was developed in collaboration with Société Générale, which has an exclusive license for the index (with Tempo, in turn, having an exclusive arrangement with Société Générale to use the FTSE 100 FDEW in structured product plans offered to UK professional advisers).

Launched in March 2017 (with simulated data to 2001), with a starting level of 1,000, the FTSE 100 FDEW comprises the same 100 stocks as the FTSE 100, uses the same methodology regarding quarterly reviews and constituents, and adheres to the same FTSE Russell FTSE UK Index Series Ground Rules as the FTSE 100. But as its name suggests, it differs to the FTSE 100 in two important ways:

The ‘FD’: the FTSE 100 FDEW is based on a total return index, including dividends paid by the companies: however, a fixed dividend of 50 points per year is deducted when FTSE Russell work out the index level.

The ‘EW’: the 100 companies in the FTSE 100 FDEW are all equally weighted, at 1% by FTSE Russell, instead of being weighted according to their market capitalisation.

The FTSE 100 FDEW captures the equal weight performance of the FTSE 100, including dividends paid by the companies in the index, without any tracking error. This is the ‘EW’ aspect of the index name. However, in addition to developing the index so that it could offer the benefits of equal weighting to investors, the ‘FD’ aspect was built into the methodology in order to optimise the terms of structured products linked to the index. The FTSE 100 FDEW is based on a total return index.

This means that dividends paid by the constituent companies are included in its calculation: however, a fixed dividend of 50 points per year is deducted in the calculation of its daily level. Specifically, it is this total return/fixed dividend approach of the FTSE 100 FDEW which addresses an issue which banks may encounter when structured products link to the FTSE 100, which provides the potential to improve structured product terms.

When structured products are linked to the price return of the FTSE 100, issuing investment banks may seek to hedge the dividends which are not accounted for within the index, which they can do by selling dividend futures in the futures market.

However, future dividend levels are unknown and uncertain and thus the futures market typically discounts the levels that it expects to be paid out, particularly in the longer term. In addition, dividend futures are not very liquid and the swathe of structured product-issuing investment banks selling dividend futures, in the absence of many natural buyers, creates a supply/demand imbalance.

As a result, ‘implied’ dividend levels seen in the dividend futures market are often lower than ‘realised’ actual dividend levels actually paid by companies. This ‘discounting cost’, linked to the need for banks to hedge through the futures market, can negatively impact the terms of structured products linked to the FTSE 100.

The ‘FD’, i.e., the fixed dividend, of the FTSE 100 FDEW is designed to address this issue, avoiding the discounting costs of the futures market, and removing the hedging uncertainty, allowing issuers to improve product terms. However, it is important to understand that the FD operates in tandem with the ‘EW’, i.e., the equal weighting, in the FTSE 100 FDEW. So, without going into the minutiae of our products, how is the FTSE 100 FDEW performing, compared to the FTSE 100? Is the return profile of the index compelling, based on using equal weight methodology, modified with the fixed dividend?

We have now had these products in the UK market for professionally advised investors for a number of years, and we can also point to 2020 as a particularly good year in which to observe the index, given the market sell-off following the outbreak of the COVID-19 pandemic and the environment for company dividends which followed.

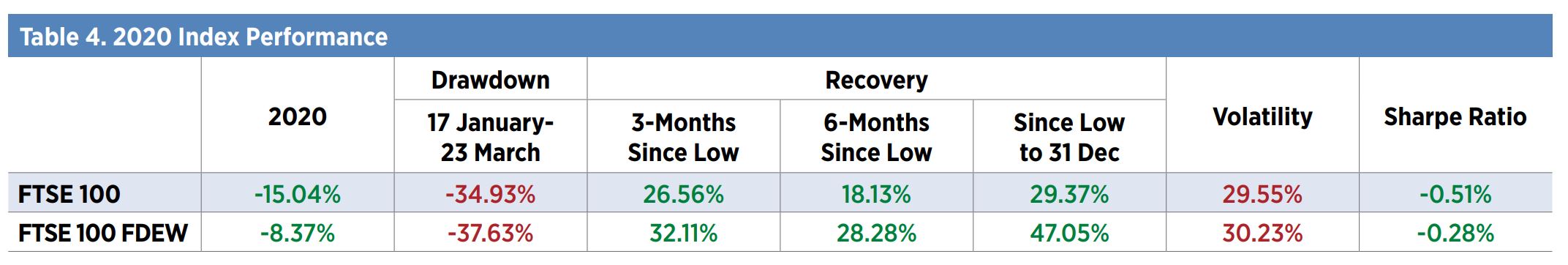

As already highlighted, equal weight methodology may lead to increased drawdown and elevated volatility. Focusing on 2020, Table 4 shows that this can be the case, during the Q1 market fall. However, the recovery since the drawdown low of 23 March may surprise many readers the equal weight FTSE 100 FDEW materially outperformed the market cap weighted FTSE 100 through the remainder of 2020.

In conclusion

While market capitalisation weighted indices rationally reflect markets as a whole, as a benchmark, it does not automatically or necessarily follow that market capitalisation weighted indices are also the best/optimal way to passively invest in markets.

This is a subtle but important distinction and point to recognise and understand, because market capitalisation-weighted indices effectively, implicitly embed rules, factor exposures and potential issues which passive investors should be considering.

It is certainly not the case that market capitalisation weighting is the only way to invest passively in markets. Advancing academic research and modern index construction capabilities offer various alternative index methodologies.

Equal weight indices offer one of the simplest and most straightforward alternatives to market capitalisation weighting, with academic and real-world evidence of their merits. However, the mutual funds and ETF world struggles to offer investable equal weight index-based propositions, due to implementation challenges.

Structured products, however, can offer viable, investable equal weight index propositions for investors…with the added appeal of structured product features, which can optimise risk and return profiles, in ways that mutual funds and ETFs cannot.

Chris Taylor is global head of Tempo Structured Products

This article first appeared in the Q1 2021 edition of Beyond Beta, the world’s only factor investing publication. To receive a full copy,click here.