FOR PROFESSIONAL CLIENTS ONLY Capital at risk. The value of investments and the income from them can fall as well as rise and is not guaranteed. Investors may not get back the amount originally invested.

Bond markets have evolved significantly since the Global Financial Crisis in 2008. Post-crisis, regulatory oversight was enhanced, balance sheet capacity was significantly reduced, funding and capital costs increased and operating models were rationalised accordingly.

Banks shifted from primarily principal-based trading to more of a hybrid model consisting of both principal and agency trading with increasing reliance on electronic trading and all-to-all platforms. Against this backdrop, the use of index,or “basket” instruments, including fixed income ETFs and fixed income index derivatives, has significantly increased.

This increasing number of institutional investors incorporating ETFs into their investment framework has necessitated rapid development in the trading ecosystem.

Technological advancements associated with ETFs furthering the modernisation of the European bond market. Relevant to this growth has been the increasing electronification of ETF trading, which has led to further automation, easier access and lower execution costs.

More and more brokers are providing automatic quotes on ETFs through request-for-quote platforms, accelerating the execution of small and recurring orders. Banks have also been building out their ETF algorithmic trading capabilities, leading to the possibility of layering ETF execution strategies based on pre-programmed instructions.

This has the potential to optimise trading by integrating multiple liquidity pools to source the best prices, minimise market impact and provide a rules-based approach to achieve pre-defined execution targets.

Beyond this, the introduction of MiFID II legislation saw a number of data and analytics companies begin to aggregate secondary trading volumes across listings and trading venues, offering a much clearer picture of total ETF liquidity.

The growth of fixed income ETFs, electronic trading and portfolio trading are all interlinked,as investors shift towards utilising baskets of bonds, as opposed to single bonds, for investment and risk management purposes. Brokers can now make markets on and efficiently execute portfolio trades in large sizes, often using fixed income ETFs.

We believe portfolio trades are a direct result of the growth of fixed income ETFs and their associated ecosystem. An increase in analytical tools has certainly aided this phenomenon.

Over the past several years, platforms such as Aladdin and Bloomberg have enabled investors to insert ETFs into their toolkit by allowing them to perform relative-value analysis across index products.

The future of the ETF ecosystem

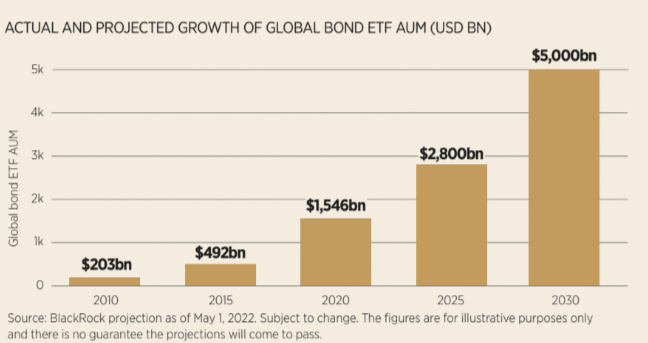

Growing adoption of fixed income ETFs and other index and portfolio-based products, coupled with growth in electronic trading, algorithmic pricing capabilities, and dramatic improvements in technology are continuing to revolutionise the way investors access European corporate bond markets.

The COVID-19 sell-off in 2020 and 2022 market volatility proved to be a catalyst for further adoption of fixed income ETFs, particularly by institutional investors.

Since then, further bond and ETF ecosystem developments in the secondary and primary markets along with the development of better tools and analytics to assess ETFs alongside other instruments are enhancing investors’ability to use ETFs as part of their toolkit, further accelerating adoption.

The growth in index vehicles is a recognition of the need for liquidity and transparency to increase or decrease exposure when making portfolio construction decisions.

Given the still opaque nature of the underlying cash bond market, coupled with the lack of a timely, unifed picture of bond trades and pricing (a consolidated tape), we believe ETFs will continue to play an increasingly integral role for investors looking to access and navigate bond markets.

Investors who embrace fixed income ETFs and other index exposures may benefit from improved transparency, liquidity and effciency.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full magazine, click here.

This document is marketing material: Before investing please read the Prospectus and the PRIIPs KID available on www.ishares.com/it, which contain a summary of investors’ rights.

Risk warnings

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

In the UK and Non-European Economic Area (EEA) countries: this is Issued by BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL, Tel: +44 (0)20 7743 3000. Registered in England and Wales No. 00796793. For your protection, calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

In the European Economic Area (EEA): this is Issued by BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded. For information on investor rights and how to raise complaints please go to https://www.blackrock.com/corporate/compliance/investor-right available in Italian.

Dubai DIFC issuing: Blackrock Advisors (UK) Limited -Dubai Branch is a DIFC Foreign Recognised Company registered with the DIFC Registrar of Companies (DIFC Registered Number 546), with its office at Unit L15 - 01A, ICD Brookfield Place, Dubai International Financial Centre, PO Box 506661, Dubai, UAE, and is regulated by the DFSA to engage in the regulated activities of ‘Advising on Financial Products’ and ‘Arranging Deals in Investments’ in or from the DIFC, both of which are limited to units in a collective investment fund (DFSA Reference Number F000738).

For investors in Israel: BlackRock Investment Management (UK) Limited is not licenced under Israel's Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”), nor does it carry insurance thereunder.

For investors in South Africa: Please be advised that BlackRock Investment Management (UK) Limited is an authorised Financial Services provider with the South African Financial Services Conduct Authority, FSP No. 43288.

For Investors in Switzerland: For Qualified Investors only. This document is marketing material.

This document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services ("FinSA").

For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa.

© 2023 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, and iSHARES are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.