Last year caught many investors off guard. Equity markets were driven by the exceptional performance of a handful of tech winners and delivered strong returns, particularly in the US.

This strength has continued so far in 2024, but the rally has left investors feeling uneasy about what to do next. Many are wondering if they have missed the boat and are still sitting in cash trying to figure out when to enter the equity market.

However, it is important to remember that time in the market is far more important to the average investors’ achievable long-term returns than timing the market, which is notoriously difficult.

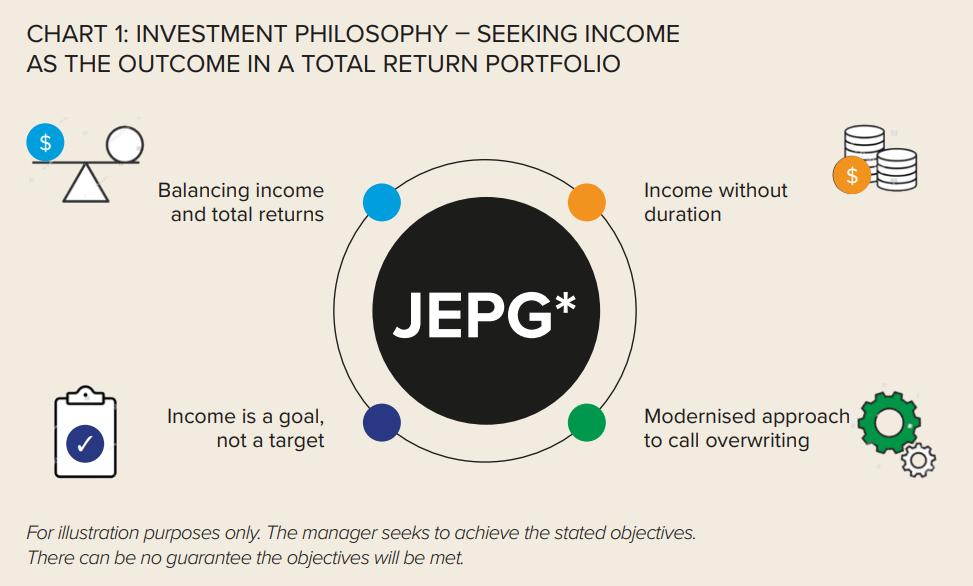

For investors looking to maintain their strategic asset allocation and get money off the side-lines and into equities, the JPM Global Equity Premium Income UCITS ETF (JEPG*) targets to achieve low beta equity exposure with high and consistent levels of income.

Achieving a total return in equities

We are so excited to bring our equity premium strategy to the UCITS space through JEPG*.

The primary investment philosophy of the strategy is generating income but it seeks to deliver total return in three different ways:

Dividends from the underlying equity portfolio

Option premiums from selling out-of-the-money calls

The potential for some capital appreciation

The portfolio starts with a research enhanced, high quality, defensive underlying equity portfolio. We then generate income through an options overlay that consists of selling out-of-the-money index-level calls and paying the premiums to investors as income.

We are willing to forego some market upside in exchange for steady monthly income, without using leverage and without taking on interest rate or duration risk.

Many use cases for an equity premium income strategy

Let us be honest, income is something that never goes out of style. Investors need or want income either to be paid out or to compound over time. Outcome-oriented investing can always benefit portfolios.

However, we have observed three common use cases for the equity premium income strategy:

Within an income model, a modest allocation can act as a booster shot to income and complement traditional income and dividend strategies.

The strategy can be used as a diversified and lower beta equity alternative. Since a large portion of the total returns will be generated through option premiums and the underlying equity portfolio looks different to the MSCI World index, we have seen many investors use this strategy to complement traditional equities.

Equity options-based strategies can replace or complement higher yielding fixed income strategies without adding duration or credit risk and offering comparable – if not higher – income potential in exchange for equity beta.

Defining our outcomes

There are five key outcomes we look to achieve when managing the portfolio [1] :

Targeting an income of 7%-9% over a cycle

Having a better Sharpe Ratio than the MSCI World index

Having a better downside market capture than the MSCI World index

Having 40-45% less volatility than the MSCI World index

Targeting a total return from dividends, option premiums and market appreciations

Looking ahead, while the direction of equity markets is unclear, there is a strong opportunity for the equity premium income strategy.

If the market rally continues and expands outside of the few mega-cap stocks – the ‘magnificent seven’ – this strategy may be poised to capture a greater portion of market upside, given its more diversified and higher quality nature.

On the other hand, should we see a market sell-off, higher volatility may provide elevated levels of income while our defensive and lower beta portfolio should participate in less of the downside.

Finally, should we see a choppy market that remains more rangebound, equity premium income strategies may still provide a healthy total return through income generated by the options component.

Hamilton Reiner is head of the US equity derivatives team at J.P. Morgan Asset Management

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.

[1] These targets are the investment manager’s internal guidelines only to achieve the fund’s investment objectives and policies as stated in the prospectus. The targets are [indicate whether net or gross of fees] and subject to change. There is no guarantee that these targets will be met.

(*) FOR BELGIUM ONLY: Please note the acc share class of the ETF marked with an asterisk in this page are not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium. This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. Investment decisions shall solely be made based on the latest available Prospectus, the Key Information Document (KID), any applicable local offering document and sustainability-related disclosures, which are available in English from your J.P. Morgan Asset Management regional contact or at www.jpmorganassetmanagement.ie. A summary of investor rights is available in English at https://am.jpmorgan. com/lu/investor-rights. J.P. Morgan Asset Management may decide to terminate the arrangements made for the marketing of its collective investment undertakings. Purchases on the secondary markets bear certain risks, for further information please refer to the latest available Prospectus. Our EMEA Privacy Policy is available at www.jpmorgan.com/ emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. In Switzerland, JPMorgan Asset Management Switzerland LLC (JPMAMS), Dreikönigstrasse 37, 8002 Zurich, acts as Swiss representative of the funds and J.P. Morgan (Suisse) SA, Rue du Rhône 35, 1204 Geneva, as paying agent. With respect to its distribution activities in and from Switzerland, JPMAMS receives remuneration which is paid out of the management fee as defined in the respective fund documentation. Further information regarding this remuneration, including its calculation method, may be obtained upon written request from JPMAMS. 09xs242604153613