A little bit over a year ago, President Joe Biden was elected, and the cyclical recovery rally kicked into gear. Low-quality stocks (lower profitability, higher debt) that had particularly suffered earlier in 2020, benefitted the most and outperformed all other parts of the market.

However, the Federal Reserve may soon be starting to taper and has hinted at a more hawkish stand, and with increasing fear of a rebound of the coronavirus this winter, investors may start to be more selective with their investments. Such mid-cycle behaviours tend to favour high-quality stocks (high profitability, low debt).

After a period where they took a backseat to their lower quality counterparts, such stocks could now benefit from their high pricing power and stronger balance sheets to help them face rising costs and compressing margins and help them potentially outperform.

Market timing the all-weather factor

We believe quality stocks could be the cornerstone of an equity portfolio. We have often described quality as the all-weather factor that can help investors build wealth over the long term and weather the inevitable storms along the way:

Since quality companies generate high revenues, they can grow and compound wealth in the future

Thanks to their solid business models and financial strength, they can withstand unexpected events such as an economic downturn or a pandemic

Of course, no factor strategy is perfect and outperforms every day and in all market environments. Quality stands out among all factors because its periods of underperformance are relatively easy to identify and because this underperformance tends to remain pretty contained. Most factors can post double-digit underperformance in a short period of time, which has been less the case historically for quality.

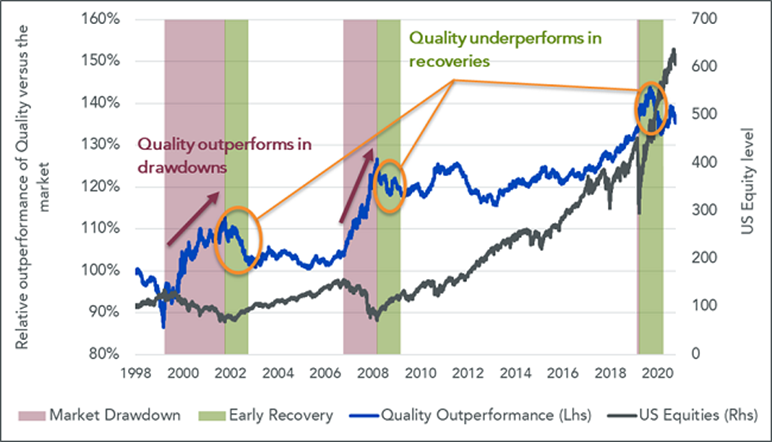

Figure 1 shows the relative performance of the 30% most profitable US equities compared to the full US equity universe. Market drawdowns (in red) are periods of consistent, large outperformance. The relative outperformance line (in blue) increases, highlighting that quality stocks are performing better than the market as a whole.

Figure 1: Historical outperformance of quality versus US equities over time

Source: Kenneth French data library. Dec 1998 to Sept 2021. Data is calculated at a daily frequency. Stocks are selected to be above the median market cap, with 'Quality' representing the top 30% by operating profitability. The portfolios are rebalanced yearly at the end of June. The market represents the portfolio of all available publicly listed stocks in the United States. All returns are in USD. Operating profitability for year t is annual revenues minus cost of goods sold, interest expense, and selling, general, and administrative expenses divided by book equity for the last fiscal year-end in t-1.

However, during the subsequent market recoveries (in green), low-quality stocks tended to recover faster than high-quality stocks, leading to some underperformance for the quality factor. The blue line goes down, meaning that the market is outperforming quality stocks.

Outside of early recoveries and drawdowns, quality also outperforms quite nicely (the blue line creeps up), even if more slowly and usually towards the middle to the end of the business cycle.

A statistical analysis of the returns over the same period highlights the same pattern. High-quality stocks outperform:

56% of business days during market drawdowns

45% of the time in the first 12 months of the recovery (i.e. the 12 months following the bear market low)

When investors get picky, quality companies benefit

“Rising tide lifts all boats” is a famous aphorism that applies very well to the market behaviour in the first month of the economic expansion. Following a recession and a market drawdown, fiscal and monetary policy end up pretty loose, and liquidity flows to all corners of the economy.

This pushes the prices of all companies up, in particular those of the companies that suffered the most in the crisis. This phenomenon usually leads to a low-quality rally at the beginning of the expansion cycle.

However, at some point, central banks turn hawkish, liquidity dries up, volatility starts to reappear, and investors start to get pickier when it comes to their investment. Investors start to look for solid companies with solid earnings and safe business models. High-quality stocks tend to benefit and see their price rise with increased demand at that point of the cycle.

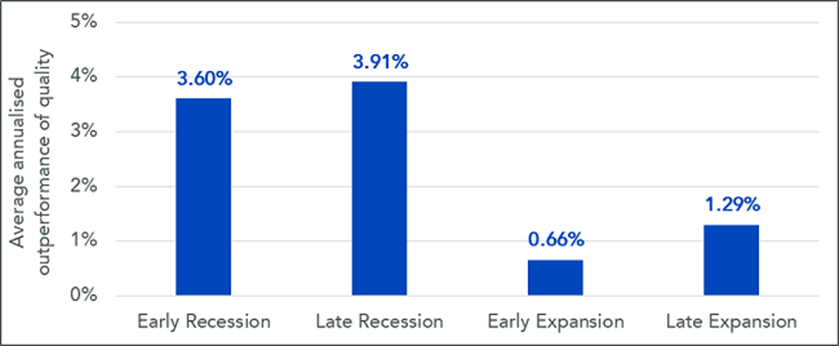

Figure 2 exhibits the average annualised outperformance of high-quality stocks (defined as the top 30% by operating profitability in the US equity universe) versus the market over four distinct parts of the cycle.

The National Bureau of Economic Research defines recession and expansion periods. Then each of those periods is split into two halves of equal duration.

The quality factor’s outperformance is the largest during recessions. However, its outperformance in late expansion is also very strong, significantly better than in early expansion.

Figure 2: Quality outperformance over the business cycle versus US equities

Source: Kenneth French data library. Dec 1969 to Sept 2021. Data is calculated at a monthly frequency. Stocks are selected to be above the median market cap, with 'Quality' representing the top 30% by operating profitability. The portfolios are rebalanced yearly at the end of June. The market represents the portfolio of all available publicly listed stocks in the United States. All returns are in USD. Operating profitability for year t is annual revenues minus cost of goods sold, interest expense, and selling, general, and administrative expenses divided by book equity for the last fiscal year-end in t-1.

The latest two years fits that pattern to the T. Quality performed very strongly at the end of the previous cycle such as in 2019 and the early part of the COVID-19 crisis in early 2020. Since the election of President Biden and the rollout of the vaccine, the low-quality rally has kicked into gear, and high-quality stocks have taken a bit of a back seat to the rest of the market.

However, as we approach the first anniversary of the Biden presidency and with the Fed starting to taper and hinting at a more hawkish stand, it appears that the early recovery phase may be ending, especially in the US.

Pierre Debru is head of quantitative research and multi-asset solutions at WisdomTree Europe

Related articles