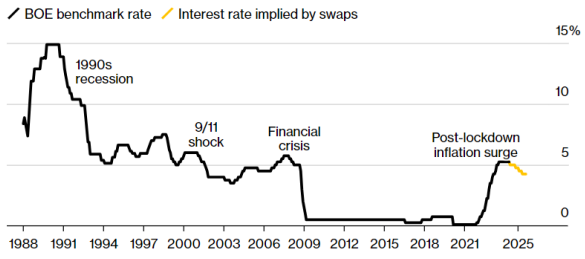

Over a decade of near-zero interest rate policy in the post-Global Financial Crisis era was followed by dramatic Bank of England (BoE) rates hikes from 0.10% to a peak of 5.25% to contain inflation which rocketed following the COVID-19 pandemic and the Russia-Ukraine war and related sanctions.

Chart 1: BoE policy rate history and market implied policy rates as at May 2024

Source: Bank of England, Bloomberg

Bond values move inversely to interest rates, so as rates soared in 2022, bonds nosedived in nominal terms. In real – inflation-adjusted – terms, the impact was even more severe.

Perfecting the pivot

One of the key themes in our 2024 Outlook was ‘perfecting the pivot’ – navigating the expectations as to when and by how much central banks would start cutting interest rates.

Interest rate cuts would ease financial conditions more generally and be positive boost for bond values specifically. And the longer the duration, the bigger the boost.

For investors in the UK with sterling-denominated assets, the BoE policy rate directly impacts savings rates, mortgage rates and the yield on gilts and UK corporate bonds.

So, for investors whose bond allocation consists of predominantly sterling denominated bonds, the BoE pivot is more relevant than the Federal Reserve pivot.

Our expectation was that the European Central Bank would cut rates, followed by the BoE, followed by the Fed, owing to their very different trade-offs between inflation, employment and growth.

So far, the ECB and BoE have cut rates. The Fed pivot is expected in September.

Navigating interest rate volatility

Through this year, we have been recommending to our clients – UK investment managers and financial advisers investment committees – to extend bond portfolio duration gradually in anticipation of the BoE to pivot and start cutting interest rates.

On platforms, this can be done using by blending bond index-tracking funds with different durations and is subject to the usual platform dealing cycles.

Within managed bond funds, this can be done by blending bond index-tracking ETFs with different durations.

This has the advantage of speedier implementation, more granular exposures and a secondary layer of liquidity making them an efficient way to construct a bond portfolio.

Watching the curve

We look at market-implied interest rates to understand what institutional investors are expecting at any point in time as regards the likely path for policy rates. These are derived from the futures and swaps markets.

Futures and swaps are used both for interest rate hedging and speculative purposes and are therefore a broad efficient market.

Market implied interest rates have been pointing to a series of cuts, but expectations have fluctuated as regards the timing and depth over the course of the year.

Bond investing using ETFs

There are plenty of bond ETFs to choose from enabling investors to select what issuer type, credit quality and maturity profile they want to choose from.

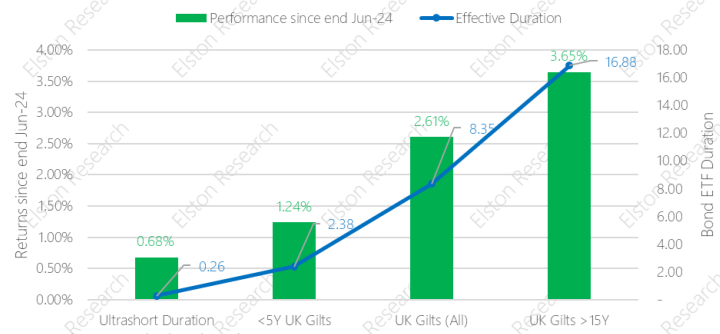

The relationship between longer bond duration and stronger performance in a falling interest rate environment has played out as expected.

Chart 2: Bond ETF performance versus effective duration

Source: Elston Consulting, Bloomberg

Since the of end June 2024 and just prior to the BoE rate cuts, longer duration gilt ETFs such as the SPDR Bloomberg 15+ Year Gilt UCITS ETF (GLTL) – with a duration of 17 years – has been top performer, followed by vanilla gilt index exposures such as the iShares Core UK Gilts UCITS ETF (IGLT) – with a duration of 8 years – followed by sub 5 year gilt ETFs such as the iShares Corp Bond 0-5yr UCITS ETF (IS15), with a duration of 2 years.

For the same rationale as we recommended our clients to go into very short – under 1 year duration – ultrashort bonds (like ERNS) and Floating Rate Notes (like FLOS) in a rising interest rate environment back in November 2021, it made sense this year to extend duration in this falling rate environment.

Summary

Whilst interest rates were low and stable, navigating bond duration was less relevant, hence the focus was predominantly on credit quality in the quest for yield.

Now that interest rates are normalised and dynamic, adaptively navigating bond portfolio duration – as well as credit quality control – is critical.

Thanks to the transparency, liquidity and cost-efficiency of bond ETFs, it is straightforward to implement a managed duration strategy both in a portfolio and fund-of-funds context.

Henry Cobbe CFA is Head of Research at Elston Consulting

This article first appeared on the Elston Insights blog