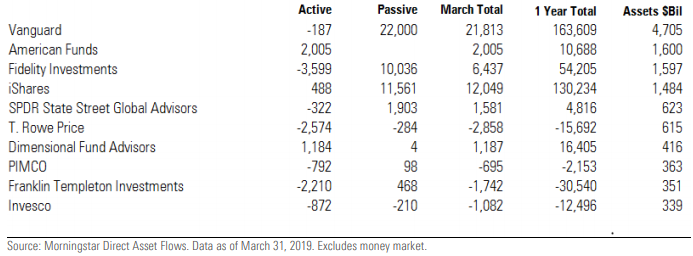

A significant portion of US asset managers have seen their active funds suffer outflows for the month of March as investors transition to passive strategies, according to Morningstar’s latest monthly flow report.

The world’s largest asset manager BlackRock forecasted otherwise, having said at the end of last month that it predicts the shift to lean more towards active strategies in the next five years.

Vanguard regained its dominance having received the largest inflows in March for its passive funds. The firm's passive funds received $22bn worth of assets as well as it seeing $187m flow out of its active funds. Its monthly flows for both active and passive was greater than iShares, SPDR and Fidelity combined.

Second to Vanguard was iShares which saw total inflows of $12bn with its active and passive funds receiving inflows of $488m and $11.6bn, respectively.

Vanguard’s strong performance is reflected with three of its index funds appearing in the top five funds in terms of monthly flows. But it was the iShares Core S&P 500 ETF (IVV) which took poll position, receiving $7.3bn in assets.

Despite IVV seeing a large positive volume in flows, iShares were also host to the three ETFs which suffered the largest outflows for the month. The iShares MSCI EAFE ETF (EFA), iShares MSCI Japan ETF (EWJ) and the iShares 20+ Treasury Bond ETF (TLT) saw outflows of $2.2bn, $2bn and $1.8bn, respectively.

One possible reason for EFA’s $2.2bn outflows, the largest of any ETF, is because investors were shifting their capital to iShares core version of the ETF, the iShares Core MSCI EAFE ETF (IEFA). IEFA saw $2.7bn of inflows and is 25bps cheaper than EFA with the same holdings but slightly adjusted weighting so it is also offers 0.24% better returns for the year-to-date.