A dominant victory for former President Donald Trump in the Iowa caucuses on Monday accompanies the likely Republican nominee taking a lead in national US election polling. The question now is what a second Trump term could mean for ETFs.

The policy agenda of the past four years differed greatly in both style and substance from the four years preceding them.

US President Joe Biden’s term has been defined by expansive fiscal support for the green agenda, infrastructure redevelopment and US allies overseas, as well as proposed banking reforms following last year’s mini crisis.

Crucially, after the first year of Biden’s premiership, the conversations driving US sentiment have been altogether less political.

In fact, owing to stark inflationary pressures and the fastest pace of interest rate hikes in four decades, Biden has successfully managed to not rock the boat further while Federal Reserve Chair Jerome Powell has assumed the role of primary tone setter for monetary policy – and by extension market sentiment.

Understated and steady are not terms most would associate with former GOP leader Trump, whose presidency can be over-simplified to protectionist, populist, tax-cutting and, perhaps most importantly, uncertain.

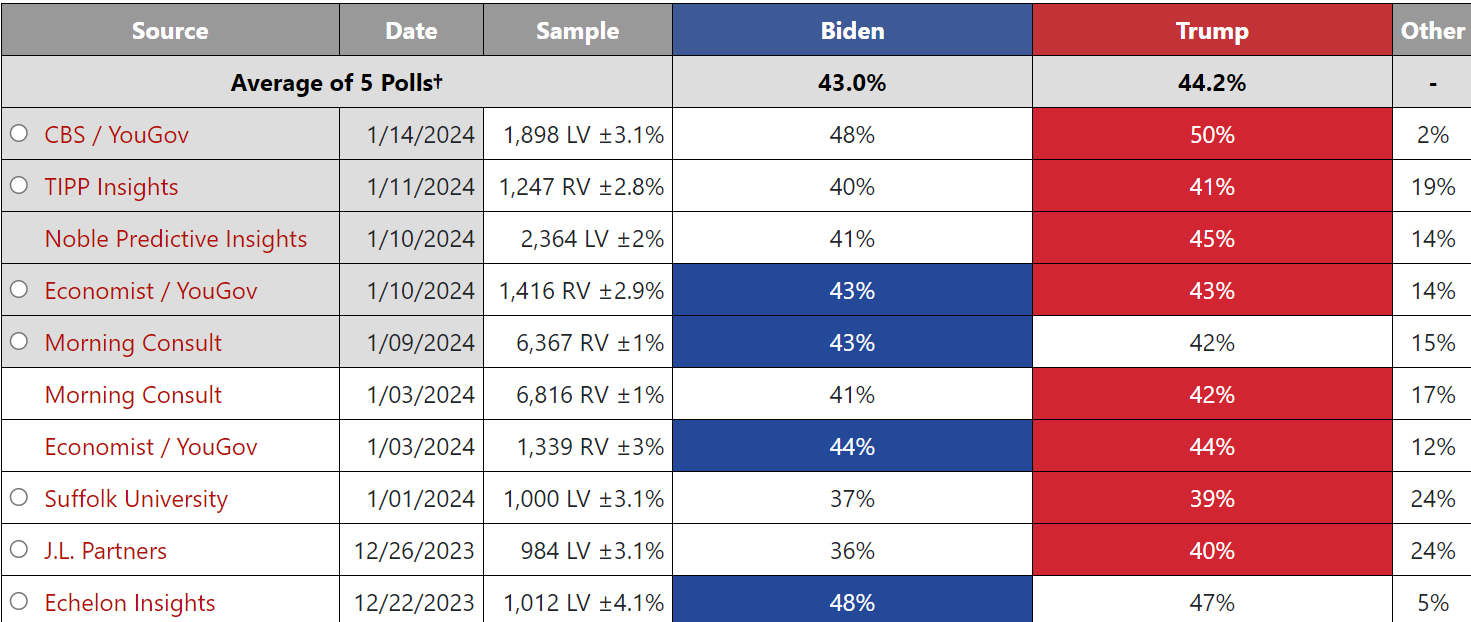

Chart 1: Most recent national polling for Biden versus Trump

Source: 270towin

Whether Trump can successfully mould the US political landscape in his own image for a second time remains a possibility rather than an uncertainty. He must first secure the GOP nomination, victory in November and even a dominant foothold in both Houses if he should hope to effectively implement his designs.

However, a pandemic, war and 40-year-high inflation in the past four years show stranger things have happened. While elections tend to be meaningful on a tactical rather than strategic basis, it may still be worth preparing for what a second Trump term would mean for ETF investors.

Rolling back Biden

A first scenario many would anticipate is a push to reverse flagship Biden policies such as the Inflation Reduction Act (IRA) and its $369bn of subsidies and tax breaks for clean energy.

Summarising his policy stance on energy, Trump underlined his intention to expand US oil and gas exploration during the speech accompanying his Iowa caucus victory this week.

“We are going to drill baby drill, right away,” he said.

While overturning the IRA would require Congressional approval, such a move would likely extend the poor form of ETFs such as the iShares Global Clean Energy UCITS ETF (INRG), which soared 134.8% in 2020 – the most of any ETF that year – on Biden’s election victory.

The IRA also contains a $7,500 tax credit for new electric vehicle purchases and $7.5bn for the expansion and maintenance of electric vehicle charging infrastructure. Amendments to these policies could impact ETFs including the iShares Electric Vehicles and Driving Technology UCITS ETF (ECAR) or the pure-play HANetf Electric Vehicle Charging Infrastructure UCITS ETF (ELEC).

Conversely, subsidies and relaxed regulation for expanding US fossil fuel extraction could prove supportive for ETFs targeting oil and gas drilling and infrastructure, including the VanEck Oil Services UCITS ETF (OIHV) and the HANetf Alerian Midstream Energy Dividend UCITS ETF (MMLP).

Outside of energy, Biden’s administration also moved to impose new requirements on banks surrounding total capital and long-term debt financing in the wake of the mini crisis last March. With the new requirements not coming into effect until 2025, their cancellation could be impactful to ETFs such the iShares S&P US Banks UCITS ETF (BNKS).

World tariff war II

Having commenced a multi-year ‘tariff war’ with China and encouraged consumers to boycott US companies shifting their manufacturing overseas during his first term, Trump’s ‘America First’ trade policy could get a new lease of life, with the presidential hopeful calling for a 10% on all imported goods and a removal of China’s ‘most-favoured-nation’ status.

Changes to the broadly supportive treatment China has enjoyed since 2001 could compound an already difficult few years for Chinese equities, with a particular impact on China ETFs with relatively large weights to exporters and manufacturers including the iShares MSCI China A UCITS ETF (CNYA).

US protectionism could also renew Chinese regulatory focus on Chinese companies with US listings, presenting unique risks for ETFs such as the KraneShares CSI China Internet UCITS ETF (KWEB), which awards top allocations to large caps listed via American Depository Receipts (ADRs).

Given the potentially indiscriminate nature of Trump’s proposed 10% import tariff, investors targeting ‘friend-shoring’ or ‘near-shoring’ hotspots within emerging markets – via India or Mexico single country ETFs – could also face headwinds.

Perhaps more significantly, Treasury Secretary Janet Yellen warned Trump’s tariff plans could prove disastrous for fighting inflation, with more expensive imports likely to feed into the price of goods and in turn consumer confidence – problematic for strategies including the Xtrackers MSCI USA Consumer Discretionary UCITS ETF (XUCD).

Protectionism could also create a ‘catch 22’ for monetary policy. On the one hand, stickier inflation would imply a higher-for-longer policy approach and shorter duration fixed income allocations, however, encouraging US manufacturing could also see Trump pressure the Fed to turn dovish in an intentional effort to weaken the US dollar, a move which would bolster returns further along the yield curve.

America alone, again

During his first term, Trump withdrew US forces from the conflict in Syria and sought to cut its contribution to NATO funding by 28%.

A second term could spell a repeat of military non-interventionism, with Trump among the GOP candidates stating they would suspend funding to Ukraine’s military efforts against Russia’s invasion. He added the US “would never help” if Europe was attacked during his time in office.

Such rhetoric could prove impactful for ETFs including the VanEck Defense UCITS ETF (DFNS) and HANetf Future of Defence UCITS ETF (NATO).

However, it is worth noting Trump actually increased US military spending by a modest margin – even when adjusted for inflation – during his first term.

Ongoing conflicts in Ukraine, between Israel and Hamas and Houthi attacks on Red Sea shipping routes also provide a supportive macro backdrop for continued defence spending. Other incursions such as China’s military exercises around Taiwan will also prompt the US and its allies to maintain a level of military preparedness.

Fiscal recklessness

Trump’s anti-establishment approach and populist appeal make it difficult to predict the extent of his spending plans, however, investors might assume additional tax cuts are on the way.

Among the most meaningful policies of Trump’s last period in office was a series of tax cuts which resulted in an estimated $1,600 of tax savings for every US household.

While these cuts are set to lapse in 2025, a Republican Senate could facilitate their renewal.

A two-pronged approach of spending and tax cuts creates a macro backdrop that lends itself to an inflationary resurgence.

Powell’s team could look to counter this by keeping the Fed funds rate unchanged for longer than markets are currently pricing in, a scenario which would prove costly to long duration exposures including the iShares $ Treasury Bond 20+yr UCITS ETF (IDTL) and ETFs exposed to highly leveraged companies such as the FlexShares Listed Private Equity UCITS ETF (FLPE).

How to price uncertainty

A more top-down consideration for investors is pricing what regulatory and political uncertainty means for the US market, namely for the premium its equities – arguably deservedly – command.

Richard Champion, deputy CIO at Canaccord Genuity Wealth Management, said at ETF Stream’s ETF Buyer London event last November: “The US remains the best market in the world. They have companies that are more profitable, they have a better legal and capitalistic framework in which to operate so they deserve a premium.”

Amid less predictable policymaking, partisan politics, delays and likely more frequent lawsuits, it bears considering whether US equity ETFs such as the Vanguard S&P 500 UCITS ETF (VUSA) can continue to justify lofty multiples versus ETFs targeting other geographical exposures.

An asset that could benefit from greater macro uncertainty is gold. While the precious metal’s 50% price appreciation during Trump’s first term can partially be attributed to the outbreak of COVID-19, a second term for the twice impeached former President could be a boon for the Invesco Physical Gold ETC (SGLD).

New figureheads from 2026

A final point to note is the next presidency will also oversee key appointments within monetary and securities policymaking.

The arrival of 2026 will mark the end of Powell’s second term as head of the world’s most influential policymaker. While first appointed by Trump in November 2017 – and although Fed Chairs can be reappointed for several consecutive terms – it remains to be seen whether the then 72-year-old Powell will be among the candidates for the next four-year term.

During the same year, current Securities and Exchange Commission (SEC) Chair Gary Gensler will come to the end of his five-year term on the securities regulator’s commission. With Democrat Gensler having been appointed by Biden in 2021, the next President will decide who helms the watchdog from 2026.

Final word

Overall, a second Trump term would undoubtedly spell the return of political unorthodoxy and surprises for markets. Whether these expectations are priced in during the next presidency – or through 2024 – it is worth considering a term in US office lasts just four years. Asset allocation considerations should be made over a longer time horizon.