Many years ago, I had the enormous pleasure to spend an afternoon with

Jack Bogle founder of Vanguard

, at their Malvern office campus on the East coast in Pennsylvania.

Bogle was one of a dying breed even a few years ago. Deeply cautious about the role of financialization in the US economy and a liberal Republican – the latter is now an almost extinct species in Trumpian America.

The strongest sense I had coming away from the wide-ranging intellectual discussion was that too much activity within the investing process was counterproductive. Bogle was, rightly in my view, hugely cautious about a whole bunch of things that are now popular.

Market timing (dynamic asset allocation in the jargon) was a waste of time. Regular rebalancing didn’t obviously provide much value. Active fund management was unlikely to deliver long term above benchmark returns. Smart-beta sounded a bit too smart for his taste. And ETFs were a potentially dangerous weapon of financial mass destruction in that they encouraged over trading and speculation.

Instead of this feverish, frenetic activity, we should adopt a more zen-like passive approach. Buy the broadest version of the market as possible. Keep costs low. Diversify sensibly. Don’t fall for the siren calls of active returns.

His deeply held view was that most investors had much better things to do with their time than chase risk premia or the illiquidity uplift. Keep it simple, keep it passive.

I recount this at length because I think it encapsulates an investment world view that is in danger of dying out, largely fuelled by the rise of the ETF industry – a sector which Bogle’s firm Vanguard has now come to dominate along with BlackRock and State Street. Innovation has fuelled an arms race in new ideas, many of them based around the idea of harvesting risk premia from factors or illiquid asset classes.

These trends are fleshed out in the detail of the latest Edhec European ETF and Smart beta survey. Clearly this report is aimed at an institutional readership – as its survey base.

More to the point my guess is that most of the respondents don’t belong to that bit of the investment profession – private and wealth advisers – most likely to be addicted to a more active approach to investing.

If any market participants should understand the passive message, my guess is that it would be big pension funds, endowments, and sovereign funds.

This is a group that has long understand the underlying validity of Bogle’s message and implemented via very low cost institutional passive funds – with no ETFs to be seen anywhere in sight. Innovation is likely to be limited to clever risk management strategies designed to counter equity market volatility.

Back in the real world, I suspect that the siren call of active fund management in its various guises is pulsing strongly within this institutional community, even after all the academic evidence and anguished debate. One small example, focusing on a new bugbear of mine.

Over the last decade, I’ve seen the growth of a new subclass of investment professionals usually entitled Heads of Asset Allocation. This breed of newspaper reading pointy heads has proliferated despite the singular lack of any evidence that dynamic asset allocation provides any uplift whatsoever in long term investor returns.

This new class has propagated a notion that clever dynamic asset allocation, much of the time using ETFs, can somehow beat the passive approach.

The EDHEC surveys indicate ETFs are proving popular with asset allocation activists. Time and time again respondents suggest that ETFs are being used for a more active purpose.

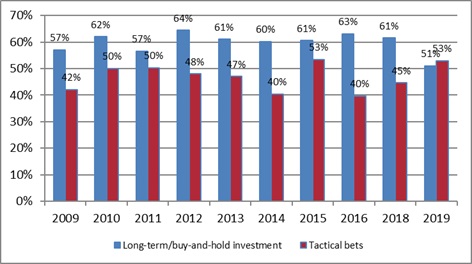

My first indicator comes in tactical usage of ETFs by institutional advisers – the EDHEC report observes: "Over the years, our survey results have consistently indicated that ETFs were used as part of a truly passive investment approach, mainly for long-term buy-and-hold investment, rather than tactical allocation.

"However, over the past three years the two approaches have gradually become more balanced, and for the first time this year, the use of ETFs for tactical allocation is actually greater than their role for long term positions (53% and 51% respectively) (see Exhibit 1)."

Exhibit 1: Use of ETFs for long-term investment vs tactical allocation

These results would, I humbly observe, horrify someone like Bogle. Use ETFs to tactically produce an asset allocation outcome sounds like an activity that is suspiciously like the active stock pickers who say that moving back between say Google/Apple and JPMorgan/Exxon for a growth/defensive pair enhances returns. Pace Bogle, the evidence suggests it doesn’t.

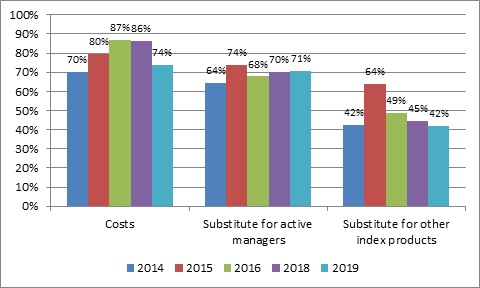

My next pointer is the question focused on using ETFs to replace active managers. The chart below shows that over the last few years more and more investors are using ETFs to replace active managers.

My pious hope is that this is a recognition of the utter futility of chasing alpha, opting instead to cut costs and just track a broadly diversified market. The cynic suggests the active aspiration has simply migrated up the value chain from individual stock selection to asset class selection.

Exhibit 2: Motivations for Increasing the Use of ETFs

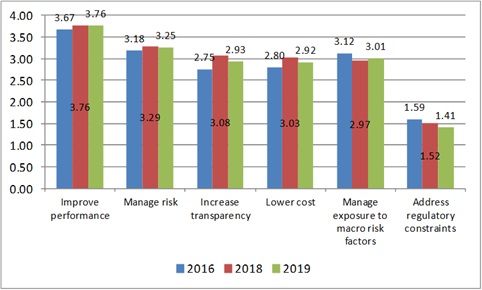

My penultimate piece of evidence emerges in the rise of smart beta. In the good old days, passive purists imagined that using factor strategies might just be a way of reaping risk premia in a very diversified, sensible fashion, with an emphasis on risk reduction.

My hunch is that it is now turning into alpha chasing – or in the language of one question in the Edhec report, a way to ‘improve performance’.

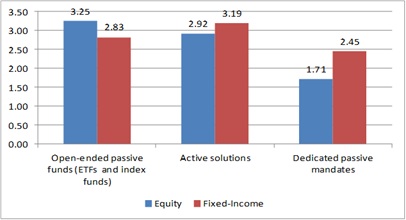

I will not bother dwelling on the numbers in the report which suggests that in the growth of fixed income smart beta a growing number of respondents are chasing active solutions. No, my last point is the most worrying, at least as far as this professional contrarian is concerned.

When asked by surveys such as this, most institutional investors admit they’d like to see more development of alternative indices and ETFs.

In the EDHEC report, the favourite category is for long/short strategies based on factors. In other reports I’ve seen the enthusiasm for accessing illiquid asset classes using liquid vehicles.

This exposes what I think is the last great myth of active investment theory – that active managers can reap a huge reward from illiquid private investment structures such as private equity, real assets and such like.

I have no doubt there is a kernel of truth in this and we can certainly see it applied to any number of endowments, pension funds and sovereign wealth funds as they chase private capital.

But this is a fraught exercise except for anyone who does not have a truly long term view involving true, permanent capital. If you are not willing or able to sit tight for 20 or 30 years, many of these asset classes are in effect fool’s gold. At some stage, that illiquidity will kill you. And pace Bogle, god help if you are in a liquid ETF structure.