Paris-Aligned Benchmark (PAB) and Climate Transition Benchmarks (CTB) set out by the European Commission have set the standard of regulatory-driven ESG indexing which could help further the adoption of sustainable investing, according to Matt Brennan, head of passive portfolios at AJ Bell.

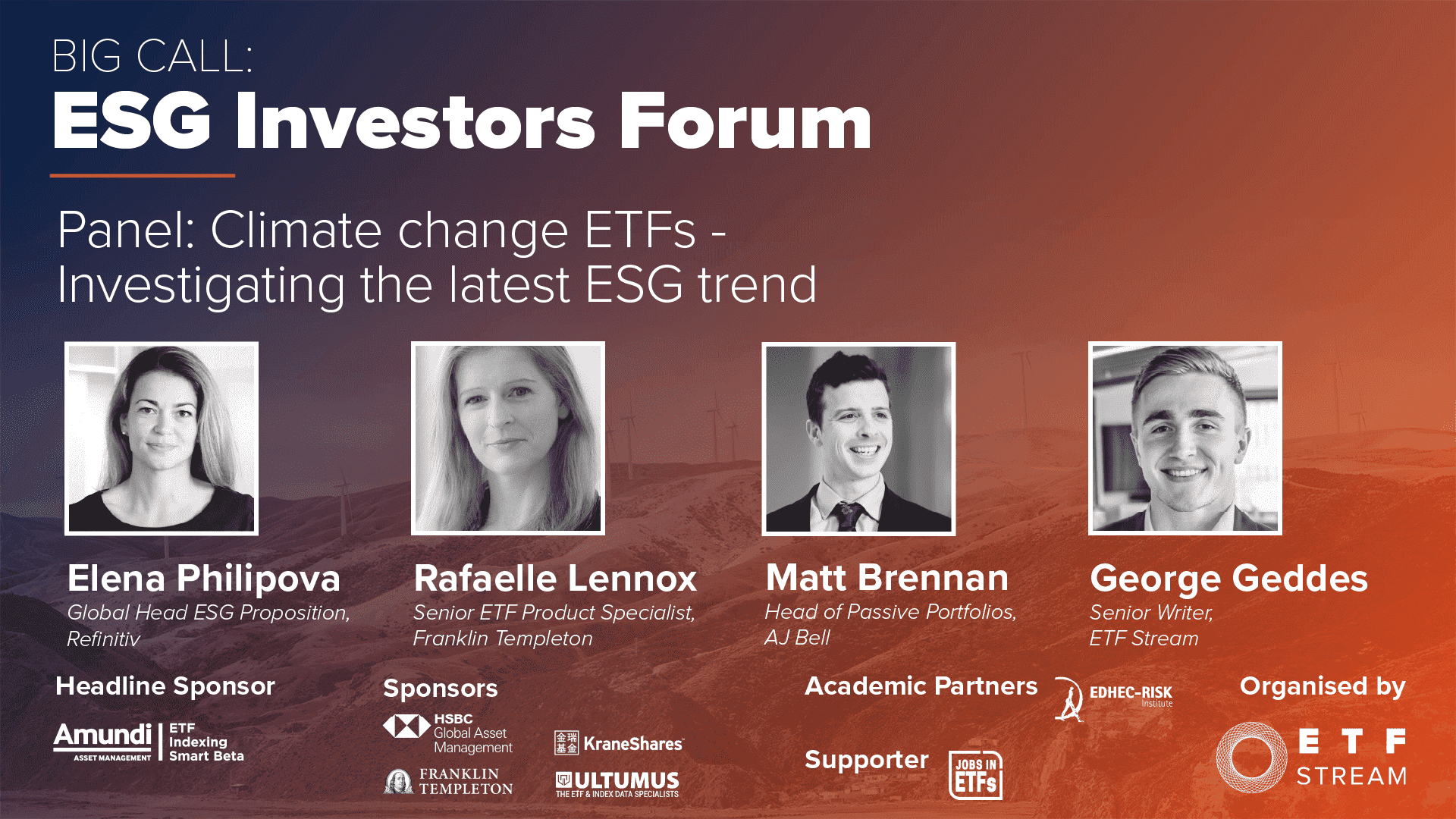

Speaking at ETF Stream’sBig Call: ESG Investor Forum, Brennan commented on the conflicting ESG scoring methods from data providers such as MSCI and Sustainalytics which have caused the biggest challenge for investors when trying to create ESG portfolios.

However, more regulatory-driven products that comply with specific criteria set out by the regulators like the climate ETFs makes it easier for investors to understand these products.

“The way these climate ETFs come in compliance with the regulator is good because it creates consistency,” he said. “The biggest challenge for us is when one provider will exclude a company when another does not. Another might use MSCI while another issuer might use Sustainalytics.”

He added that coalescence along with further education and more competitive products come to the market would be the ideal development in this unique part of the market.

Also speaking on the panel was Elena Philipova, global head of ESG proposition at Refinitiv and member of the European Union’s Technical Expert Group who echoed these views by adding the regulatory guidance on climate benchmarks is necessary to facilitate the inflow of capital into green assets in tandem with reducing the risk of greenwashing.

Reducing the possibility of greenwashing is one of the four objectives for the climate benchmarks along with allowing comparability, offering investors an appropriate tool and increasing transparency.

ETFs with these compliant benchmarks enable investors to hedge against climate transition risk but also direct investments to opportunities related to the energy transition by either the CTB strategy or PAB strategy.

Climate change ETFs: What is all the fuss about?

Philipova added: “The CTB labelled benchmarks are those where the underlying assets are selected, weighted or excluded in such a way that the resulting portfolio is in a decarbonisation trajectory.

“The PAB labelled benchmarks select their underlying assets so that the resulting portfolios green house gas emissions are in line with the long-term global warming target of the Paris Agreement.”

Earlier this year, several issuers debuted climate ETF ranges which were comprised of PAB or CTB labelled ETFs, including Franklin Templeton.

Rafaelle Lennox, vice president and senior ETF product specialist at Franklin Templeton, said: “We wanted to create a range of ETFs that would not just be a pure-play climate solution, which there are already a lot available, but also be a sustainable core solution for investors.”

Lennox explained how it was the first time she has seen a regulator release an index methodology meaning index providers were simultaneously having to create climate indices that were either in line with PAB or CTB criteria.

“These index providers were having to make sure they were getting all of the climate data, which is highly sophisticated,” Lennox said.

Franklin Templeton partnered with S&P Dow Jones Indices and STOXX for the launch of its Franklin S&P 500 Paris Aligned Climate UCITS ETF (500P) and Franklin STOXX Europe 600 Paris Aligned Climate UCITS ETF (EUPA).

“We see this as a core sustainable allocation so wanted to choose the benchmarks most relevant to our investors,” she continued. “A large portion of our clients were keen to have the higher ambition of the Paris-aligned strategy so being part of offering a solution that aligns with the 1.5°C global warming scenario is very exciting to be involved in.”