Huge outperformance from a handful of emerging market country ETFs helped to shunt the product class into the limelight in 2022 and there are signs investors are increasingly using the ETFs as a tactical play in their portfolios.

In a year of underperformance for broad markets, taking a more granular approach to single countries, particularly in emerging markets, has allowed investors to capitalise on large performance dispersion.

The MSCI Brazil index returned 14.2% last year, versus -20.1% for the MSCI emerging market index. Even more stark was the performance of Turkey, with the MSCI Turkey IMI 25/50 index posting bumper returns of 107.3% in 2022.

This outperformance catapulted single markets into the spotlight, with some investors quick to eye the opportunities on offer. For example, Brazil ETFs saw inflows of €1.3bn in 2022, with the iShares MSCI Brazil UCITS ETF (4BRZ) taking in the lion’s share at €1.2bn, according to Morningstar Direct. Brazil was the second biggest market in terms of flows, behind China, which recorded €3.6bn inflows.

Lotfi Ladjemi, senior ETF sales specialist for the UK and Ireland at Franklin Templeton, said demand has been driven by investors using potential outperformance as a strategic allocation tool.

“We have seen increased demand for single country ETFs with investors looking to add more tactical positions in their portfolio,” he said. “The ETF vehicle lends itself well to investors looking to add to their asset allocation because of its transparency and liquidity.

Ladjemi added institutional investors are looking to single-country ETFs in between mandates to get quick access to the markets. “This is becoming an increasing theme for institutional investors, while increased scrutiny on costs is driving more investors to ETFs,” he said.

However, flows last year point to a more nuanced approach by professional investors not simply chasing returns.

Brazil saw huge inflows on the back of macro tailwinds; soaring inflation, scarce resources and an energy crisis all meant the MSCI Brazil index’s 42% weighting to energy and materials helped drive performance.

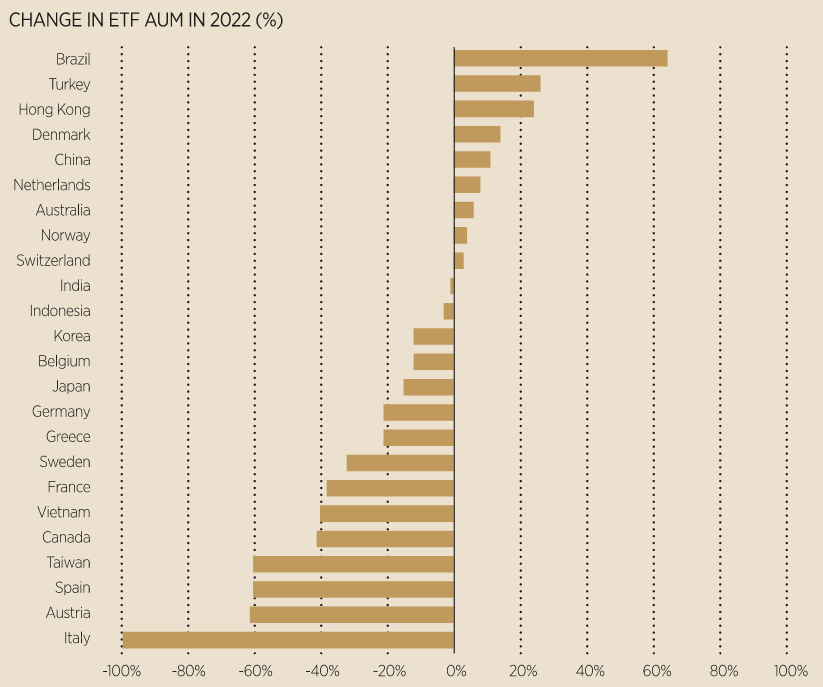

Source: Morningstar Direct

However, Turkey ETFs struggled to attract anywhere near the same amount of assets despite its exceptional performance, which was largely driven by local investors looking to safeguard their savings as inflation hit 84.4% in November 2022.

Turkey ETFs recorded €77m in 2022, highlighting the return drivers for single countries are not always appealing to professional investors.

Ladjemi added that while investors’ interest in single-country emerging markets has grown, taking a closer look at each market’s microenvironment is imperative to understanding how investable it is.

“Investors are looking at the theme of disaggregation of emerging markets, viewing single countries through a different lens,” he said. “Each market has different microenvironments and return drivers.

“As investors are looking at asset allocation at the beginning of the year, they are looking for new drivers of growth and a single country emerging markets has helped to provide that.”

Taking a broad approach

Despite this, some investors still appear wary of taking on the single-country risk.

Scott Truter, investment analyst at Marlborough said it takes a broad approach to emerging markets instead of playing single countries but would look at overweighting certain geographies with the region.

“We are not playing any specific single country at the moment, we have broad emerging market exposure,” he said. “We are currently neutral China and overweight India which is still showing positive signs even when you factor in the premium from a valuations perspective.”

Highlighting this, investor sentiment for India was strong last year, the Franklin FTSE India UCITS ETF (FRIN) posted inflows of €118.9m in 2022 and the country’s economy is set to grow by 11% this year.

James Penny, CIO at TAM Asset Management believes the market is still too inefficient to be accessed via single-country ETFs.

“Not too many people get direct exposure to India, China or South Korea,” he said. “They will buy an emerging market or an Asia ETF, the market is too inefficient for ETFs.”

As market uncertainty is likely to remain across 2023, opportunities in single-country ETFs will likely be on show again. It will be up to investors to determine whether the growth drivers make them worth the risk.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.

Related articles