While 2023 was touted as fixed income’s comeback year, many of the broad macro risks driving asset allocation decisions have continued into early 2024.

Speaking at a recent ETF Stream Breakfast Workshop, Lukas Ahnert, senior Xtrackers product specialist at DWS, said despite the challenges remaining similar, portfolio implementation has become more granular, requiring investors to use the full fixed income tool kit available.

This includes three key positioning considerations; rates curve, yield pick-up and diversification.

On the rates side, two of the biggest questions facing fixed income investors, many of which still have a bias towards the shorter end, are when to extend duration and where to allocate along the yield curve, according to Ahnert.

“It is a good time to add selective duration,” he said. “We expect the US Treasury curve to reinvert over the next few quarters, but given the current volatility of the yield curve, investors may view long duration as a risk factor rather than a source of term premium.

“Right now, the one to three-year maturity segment and the five to seven-year segment are the interesting elements to consider.”

Credit yield pick-up

Ahnert said there were several yield pick-up opportunities across the credit sector ranging from roughly 90 basis points (bps) in the euro-denominated government sector to 300bps for high yield credit. He added there are also interesting prospects for single-currency investors.

“Even sterling investors can benefit from global credit opportunities,” Ahnert said. “If you were to take a euro exposure and hedge the currency, you could pick up approximately 1.4% per annum, making euro corporates an attractive and diversified complement to a sterling corporate allocation.”

However, he cautioned against moving too far up the credit ladder given the current risk of recession coupled with structural headwinds in some areas of credit, adding that “US dollar and euro investment grade could be a sweet spot right now”.

“Why would investors increase allocations now, given this outlook?” he said. “Because rates are up, and the spreads are wider which may provide decent compensation for risk scenarios.”

For example, current spreads of around 100bps in US investment grade bonds and an underlying US Treasury yield of around 4.4% provide a robust cushion for index returns over the next few months, especially as interest rates are again able to move against spreads in times of stress.

“Even though quite a lot can happen, there are many stress scenarios in which index returns are expected to remain positive over the next 12 months,” he said. “There is however a challenge for investors to make current yields levels also investable over shorter timeframes.”

Target maturity ETFs

One of Xtrackers’ solutions to this challenge is its launch of target maturity ETFs.

“The idea of the target maturity ETF is to invest in a basket of bonds that all mature at a similar time and holding them to maturity, meaning you remove the duration risk over time and make yield-to-maturity more realisable,” Ahnert said.

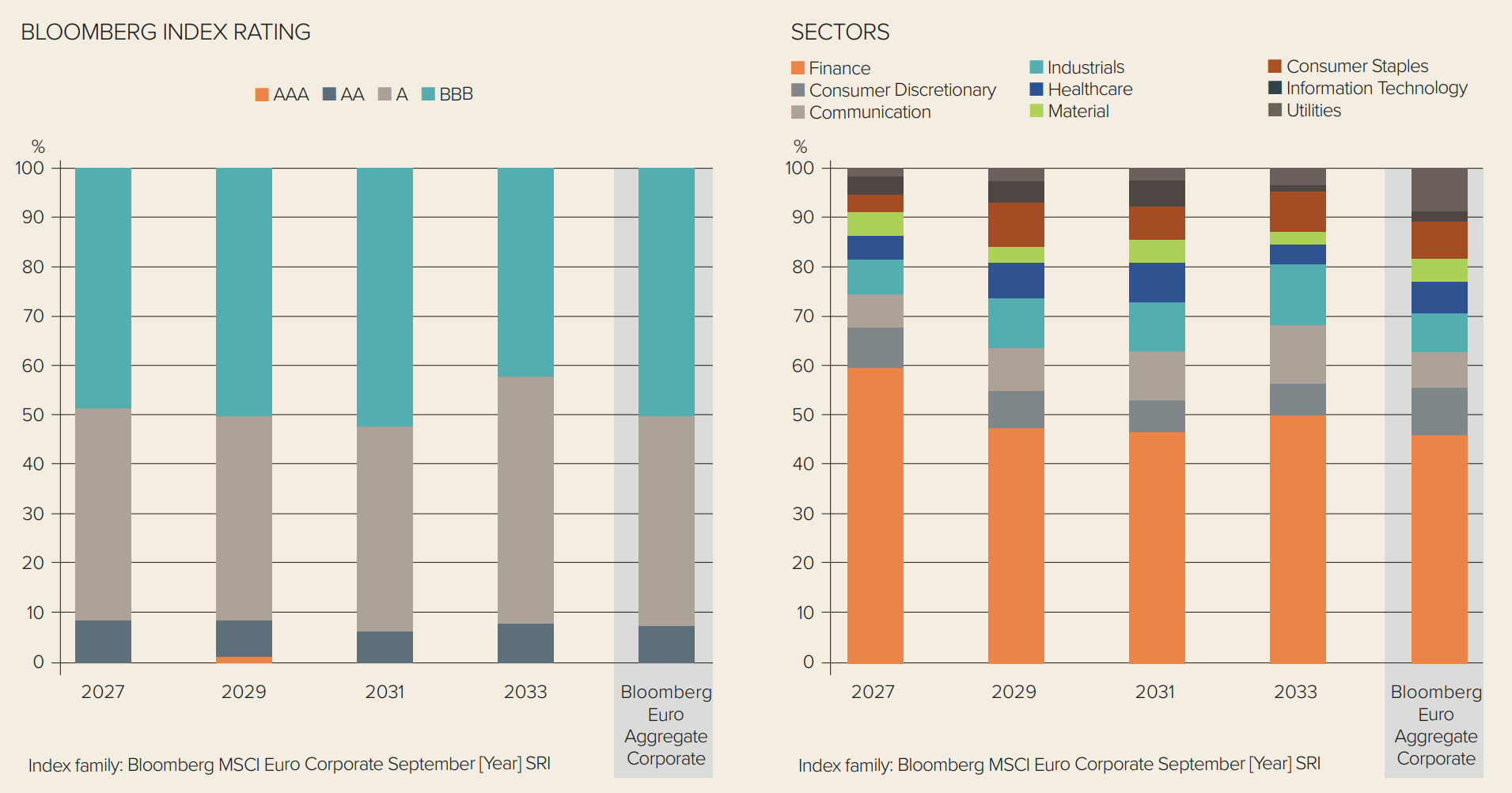

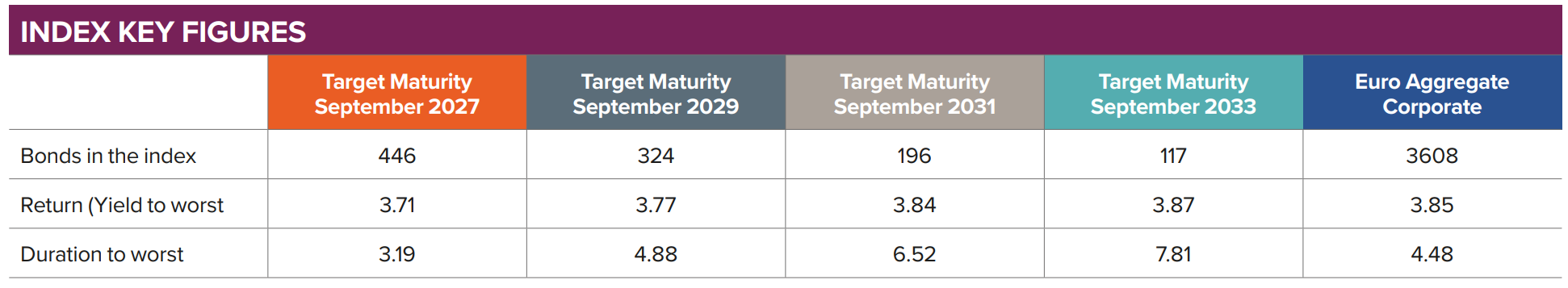

The group’s current target maturity range currently covers euro corporates allowing investors to access euro corporate yields until one of four target maturities.

“There are many more use cases for portfolio construction for those target maturity ETFs and we are actively engaging on which exposure we can launch next,” he added. “When it comes to credit these are one of the key tools to make current yields investable.”

Emerging market debt

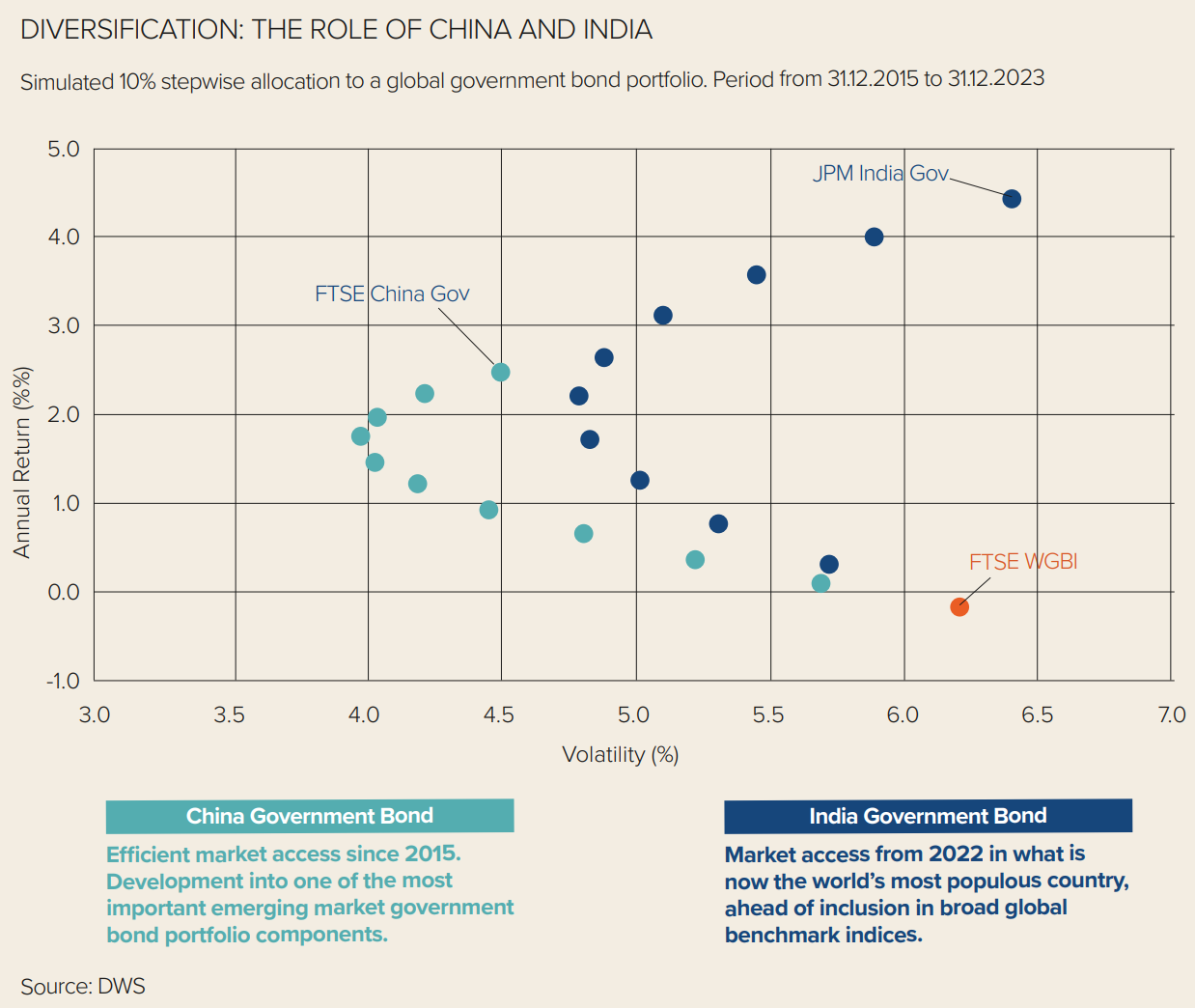

With fixed income allocations rising in portfolios, Ahnert said diversification is becoming an increasingly important factor for portfolio construction. One area he suggested investors can turn to is local currency emerging market debt (EMD).

“The EMD space has always been a good opportunity to see rapid portfolio diversification,” Ahnert said. “Already incremental allocations can make a difference. A 10% allocation to India or China government bonds would have decreased a global government bond portfolio’s volatility by 0.5%.”

Ahnert said there is increased demand for local EMD, driven by a narrowing inflation differential, which has historically been a headwind to EMD local currency performance and the upcoming benchmark inclusion of India.

“The other big driver is emerging market central banks that were forced to act far less than those in developed markets, leaving scope for them to cut interest rates,” Ahnert said.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.