Introduction

The role of authorised participants within the ETF ecosystem has been a point of contention for critics of the wrapper and regulators alike over the years.

As a result, understanding their vital role in enabling the ETF wrapper to trade as efficiently as possible is important for anyone investing in ETFs.

Creation-redemption

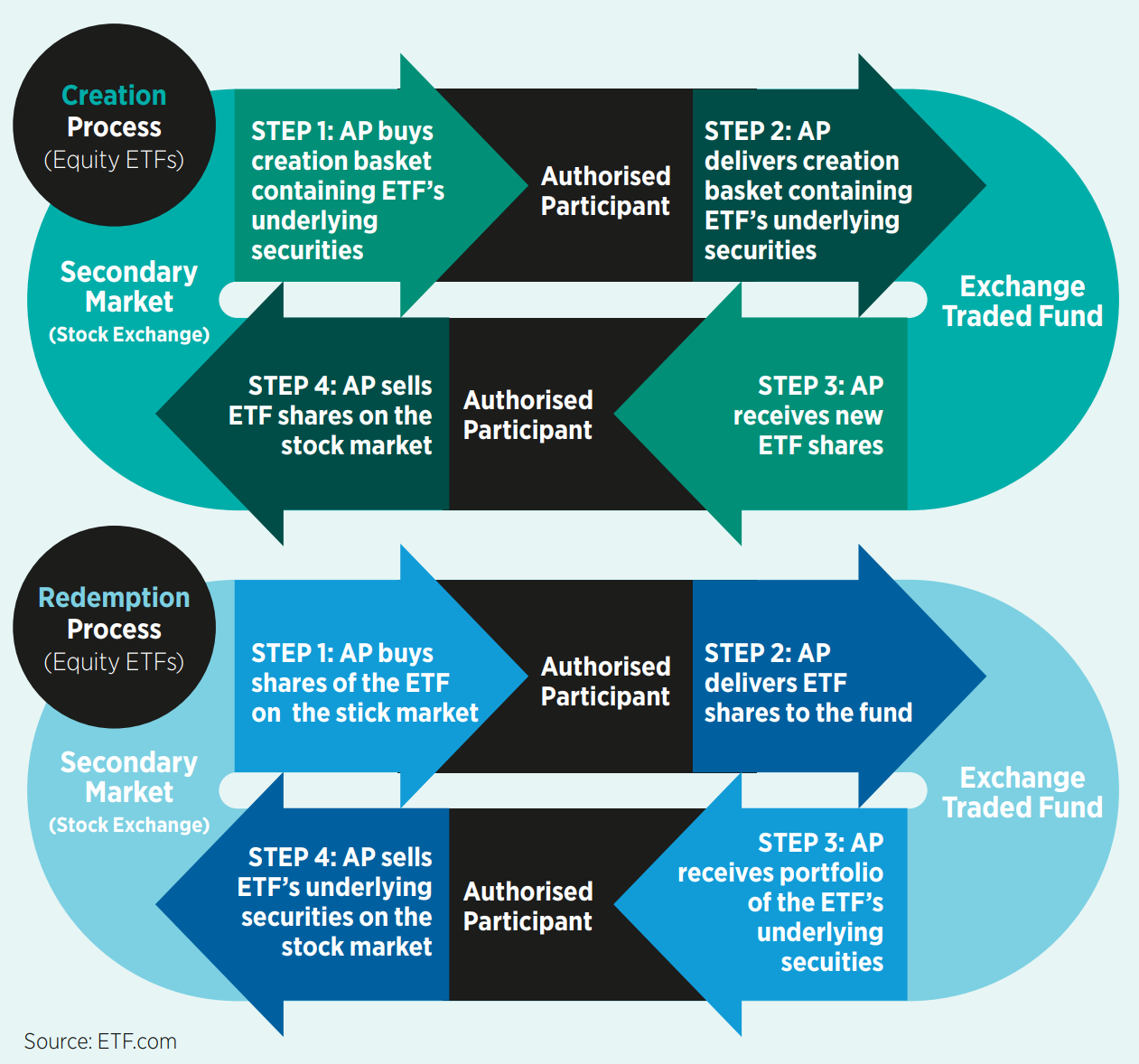

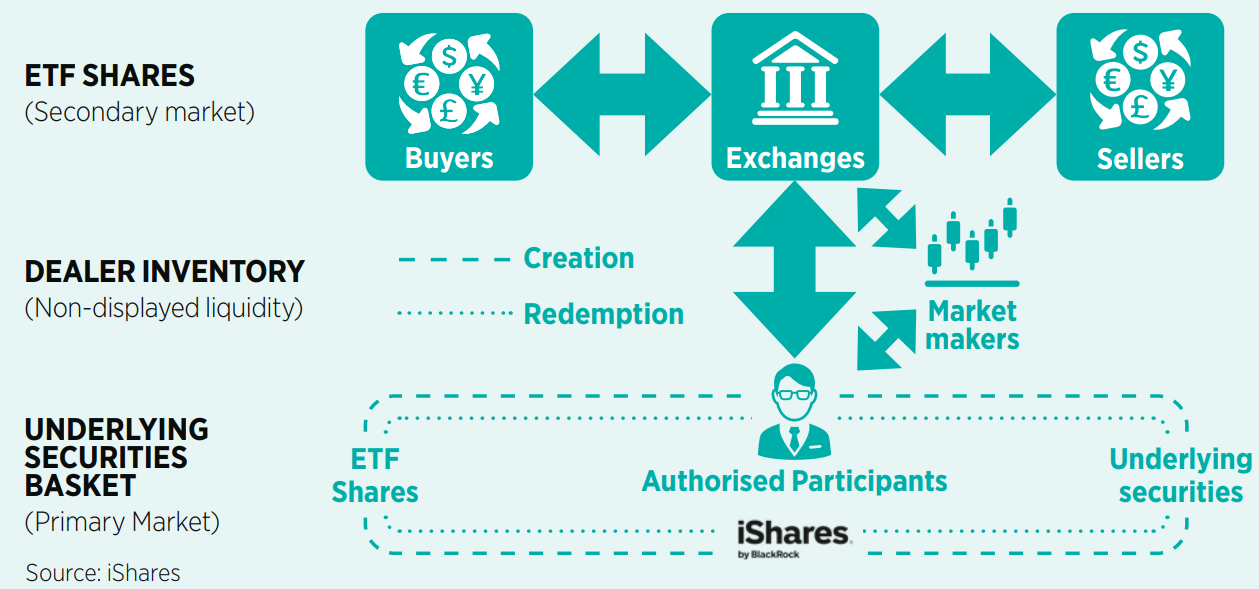

Primarily, authorised participants are responsible for creating and redeeming ETFs. If an investor owns shares in an ETF, they can be sold on the stock market to another investor. Matching buyers and sellers in this way is the role of market makers.

However, if an investor wants to sell its ETF shares and there is no buyer, authorised participants can go into the primary market to create more ETF shares.

Conversely, if there is an excess supply of ETF shares on the market, they can reduce this number by delivering the shares to the issuer in exchange for the underlying securities.

It is this creation-redemption process that helps keep ETFs priced at fair value – typically the net asset value (NAV).

For example, if demand for an ETF increases and a premium to NAV develops, authorised participants step in to create more shares and push the ETF’s price in line with the NAV.

If an ETF is being sold and a discount develops, authorised participants purchase ETF shares on the open market and redeem with the ETF issuers to reduce supply. Each ETF will have a number of designated authorised participants.

In principle, the more authorised participants pricing an ETF the better as this force of competition is more likely to keep the ETF trading close to fair value. This method of creation and redemption is the biggest difference between ETFs and mutual funds or investment trusts.

ETFs vs investment trusts

With investment trusts – or close-ended funds – shares are only created and redeemed at the discretion of the investment trust’s board.

There are no authorised participants and therefore, no arbitrage to keep the share price trading close to fair value.

Without the arbitrage mechanism provided by authorised participants, ETFs would effectively trade like investment trusts which can trade at significant premiums or discounts to NAV.

Although this is a relatively straightforward process for liquid ETFs such as those tracking the S&P 500, it can become a challenge during periods of rapidly vanishing liquidity. Sometimes markets can be difficult to access or there may be zero liquidity in the underlying holdings.

While authorised participants are not obliged to create and redeem ETFs, the arbitrage opportunity should always provide enough incentive for them to take part.

This has been a key concern for regulators over the years but the sell-off in March 2020 proved the resilience of the ETF structure and the increased involvement of authorised participants in the market.

Key takeaways

Authorised participants play a crucial role in enabling efficient trading of ETFs. They create and redeem ETF shares, keeping the price close to fair value through arbitrage.

This mechanism is absent in investment trusts, leading to potential premiums or discounts to NAV

The role of authorised participants has been a point of contention for ETF critics and regulators alike over the years, but the sell-off in March 2020 proved the resilience of the ETF structure and the increased involvement of authorized participants in the market