Introduction

ETFs have gained significant popularity in Europe due to their low cost, liquidity, transparency and ease of trade.

Execution plays a vital role in being able to realise these benefits and achieve optimum investment outcomes for investors, known as ‘best execution’.

As the ETF wrapper has evolved, so have the ways it is traded. There has been a significant shift away from trading at net-asset value (NAV) and towards ‘risk’ via request-for-quote (RFQ) platforms instead of exchanges.

RFQ platforms accounted for 53.5% of all trades in Europe in 2023, up from 43.4% in 2020, driven by the fragmented nature of the European market, according to Jane Street.

There has also been an uptick in algorithmic – or optimised – trading, which allows for a diverse mix of options when executing an ETF trade.

Source: BlackRock

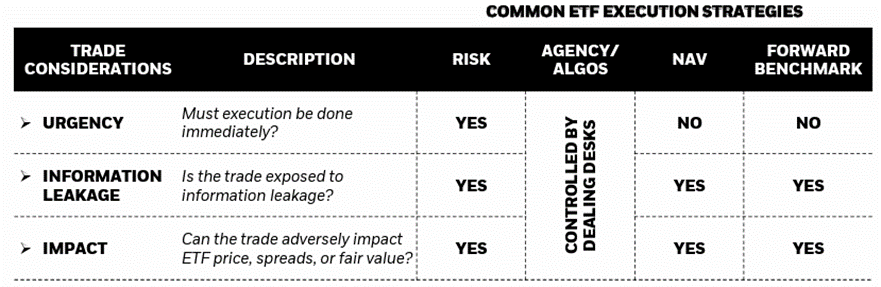

Commonly used execution strategies

Risk

Buyside traders send a request for immediate execution with multiple liquidity providers put into competition.

Traders will then receive a quote – bid, offer or two-way – for the entire trade at once. The risk transfer will take place immediately once the best price is selected by the trader, with the ETF liquidity provider taking on the risk of managing the position.

Algorithms

Buyside traders will appoint an automated trading algorithm to limit the impact of the execution.

This can be particularly important for institutional investors looking to execute large trades efficiently.

Algorithms will help break down large orders into more manageable trades and can be benchmarked to ETF price, fair value, volume or completion time.

Risk exposure to market fluctuations until risk-transfer, the publication of NAV.

NAV

Trading at NAV allows buyside traders to set an execution price benchmarked to an ETF’s future NAV.

Dealers can send an entire order to multiple liquidity providers and receive quotes priced at a ‘spread’ to the ETF's future NAV.

The final execution price is not known until the official NAV is published at the end of the day. Traders are exposed to market fluctuations until then.

Forward benchmark

Buyside traders can request an execution to be benchmarked to an ETF’s price at a specific time which is priced at ‘spread’ to the targeted benchmark.

Liquidity providers can trade the entire order at the targeted time and are exposed to market fluctuations until this point.

Selecting an execution strategy

There is a diverse array of execution strategies available to dealers when it comes to trading European ETFs, each with its risks and benefits and these must match the underlying investment objectives.

Different execution strategies allow traders to access different components of European ETF liquidity.

However, the sheer number of ETF listings across various exchanges has created a fragmented market in Europe where many ETFs trade very little on the secondary market.

Because ETF volumes on the secondary market are lower versus the US, buyside traders currently favour executing ETF trades via RFQ platforms where they benefit from competitive pricing and immediacy of execution, instead of relying on on-exchange liquidity which is typically thin.

This development is slowly starting to change with the rise of retail adoption in European ETFs and the introduction of ETF algorithms, however, there is still a long way to go before volumes shift on-exchange.

Key takeaways

ETF execution has evolved over the past few years with more options available to dealers

RFQ platforms are currently the most dominant method of ETF execution in Europe

An ETF’s liquidity profile is important to understanding how to execute efficiently