Event: ETF Ecosystem Unwrapped May 2024

Please note registrations have now closed

Contact events@etfstream.com for any questions

The fastest-growing European ETF conference

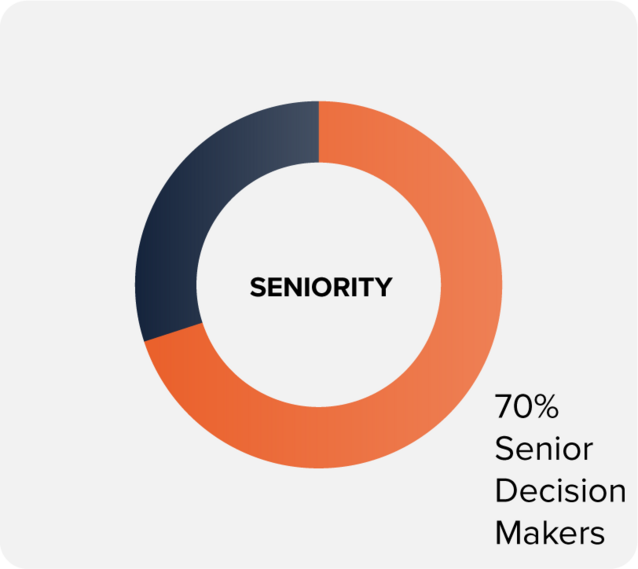

Join over 350 ETF industry professionals and ETF buyers for 2024's fastest-growing and most important event for the European ETF ecosystem.

EEU 2024 will deliver the most actionable intelligence for fund selectors to construct more resilient portfolios, and for the ETF industry to further understand the crucial developments taking place across the ecosystem.

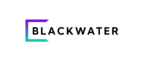

There is no better occasion in the European ETF events calendar to build meaningful relationships with senior decision makers than EEU.

With plenty of networking breaks and lively meeting spaces, this is an outstanding opportunity to grow your circle of influence in such a short space of time.

Over 50 expert speakers

Hear from the ETF industry's most innovative and forward-thinking experts, representing ETF issuers, professional investors, index providers, market makers, academics and more, all featured on a carefully curated agenda.

The intelligence shared will make a difference to your 2024.

Calling all ETF Buyers

On day one, fund selectors will benefit from an exclusive, jam-packed agenda focused on portfolio construction and asset allocation.

Our exclusive ETF Buyers Club content is without doubt the most valuable ETF investment intelligence for fund selectors across Europe. We are led by the ETF buyer for the ETF buyer.

Exhibitors providing value

A floor full of industry expert exhibitors will be at the event, ready to offer you insights into ways of accelerating your business' growth and performance.

It is invitation-only to exhibit at EEU, based purely on the value they can offer you and your business.

Be part of the ETF community

ETF Stream is the voice of the European ETF community, and nowhere does that community come together better than at EEU.

Genuine connections and lasting business partnerships can be forged when you can wind down and enjoy your time in an environment where you can feel at home.

Registration And Networking

10:45 - 11:15

Main Stage

Opening Keynote: New Evidence On Equity-Bond Premiums - The Latest Piece Of The Puzzle

11:20 - 11:45

Keynote: O Fixed Income, Where Art Thou?

12:10 - 12:35

ETF Buyers Club Debate: Where Next For China?

12:35 - 12:50

ETF Case Study: Analysing Europe’s Product Pipeline

12:50 - 13:00

Lunch And Networking

13:00 - 14:00

Stream A: Macro Opportunities

Generating Income With Active ETFs

14:00 - 14:20

Understanding Fixed Income ETF Liquidity: Do AUM And Volumes Really Matter?

14:20 - 14:40

Unpacking The Potential Of Systematic Sustainable Credit Investing In ETFs

14:40 - 15:00

Capital Market Assumptions For The Next Decade

15:00 - 15:20

Stream B: Future Disruption

AI Platform Shift: Where To Invest, Beyond The Obvious

14:00 - 14:20

Powering Progress: Harnessing Metals And Rare Earths For A Greener Tomorrow

14:20 - 14:40

Beyond The Halving: Exploring The Future Of Bitcoin And Crypto

14:40 - 15:00

Tackling Portfolio Construction In More Concentrated Equity Markets

15:00 - 15:20

Coffee And Networking

15:20 - 15:40

Main Stage

Why Investors Are More Enthusiastic Than Ever For ETFs

15:40 - 16:00

Panel: Positioning For The Pivot: Asset Allocation Ideas In Focus

16:00 - 16:35

Big swings in markets is driving short investment time horizons among fund selectors which must remain nimble amid ongoing uncertainty. While the Federal Reserve is set to cut interest rates this year, the question is how far will they go? This panel will assess how investors should be positioned as well as the latest developments in portfolio construction.

Key outcomes:

- Asset allocation ideas in focus

- Central bank outlook and how it impacts portfolios

- The role of ETFs in portfolios

The Big Interview: Disrupting The European ETF Market

16:35 - 17:00

Drinks And Networking

17:05 - 18:00

Meet This Year's Speakers

It's fantastic to bring the ETF community together to discuss all the major topics. There's been some fantastic sessions.

Savas Kesidis, Managing Director - Head of UK

Flow Traders

Gain the edge in an extremely competitive market

ETFs saw particularly strong inflows in 2023, with ETPs in Europe pulling in $143bn net new assets throughout the year, up from $67bn in 2022. Accelerated ETF adoption looks set to continue in 2024. EEU is perfectly timed to review 2024 Q1 performance, dictating the trends for the rest of the year.

Day 1 is for European professional investors only. Hear from leading experts on the latest ideas around asset allocation and portfolio construction, all through an ETF lens.

Day 2 is open to the wider European ETF industry where we will explore the crucial developments from across the ETF Ecosystem.

350+

Attendees

40+

Sessions

50+

Speakers

20+

Exhibitors

Build your network

Engage in lively debate

Develop your investment strategies

Last year's attendance

It's been very busy with all parts of the ETF Ecosystem here. I looked at the agenda and wanted to attend all of the sessions!

Antonette Kleiser, European ETF Product Manager

Brown Brothers Harriman

A carefully curated agenda

Day 1

Day 1 is for professional investors only. Hear from leading experts on the latest ideas around asset allocation and portfolio construction, all through an ETF lens.

Topics include:

- Positioning for the pivot: The latest asset allocation ideas

- The fixed income conundrum and the roll of ETFs

- What next when allocating to China?

- Analysing Europe's ETF product pipeline

Day 2

Day 2 is open to the wider ETF industry where we will explore the crucial developments from across the European ETF Ecosystem.

Topics include

- Key ETF regulatory developments

- Changes in Europe's market structure

- The shifting indexing landscape

- The future of ETF trading

Highlights from this years event

Sponsor the 2024 event

Want to stand out from the crowd? Our sponsorship packages include branding, exhibition and speaking opportunities that can be tailored to your objectives.

Packages are still available for the 2024 event. Get in touch to find out more or contact Manmeet Sehmi at manmeet.sehmi@etfstream.com

LOADING...

etc venues 155 Bishopsgate