Recent research from a wide majority of analysts such as those at Research Affiliates and more general commentary suggests that much as with Mark Twain’s wry comment,

value’s death has been “greatly exaggerated”.

But the next question – and the more pertinent one for those proposing factor-based funds with a value bias – is perhaps the more interesting one. That is, not whether value will rebound as surely it will, but by how much? And to what extent will value factor funds benefit when mean reversion takes place and what will that reversion look like?

A changed economy means a changed factor

To answer these questions we return to Research Affiliates’ head of research for Europe Vitali Kalesnik, one of the analysts behind its recent value factor research.

He makes the obvious point that the biggest contributor to the underperformance of value is the change in its relative value versus growth. He argues this has been driven by the way capital is treated in the balance sheet.

As Kalesnik points out, in the changed post-industrial landscape of today, the capital invested is different. The needs of industry have changed. “The capital needs for building a factory and very different for an IT start-up,” he says.

Research Affiliates: What is driving value’s underperformance?

It comes down to how intangibles are treated, and what that does in turn to the book value and the valuation of price-to-book. As Kalesnik points out, when price-to-book was first formulated as a measurement of a company’s value, the issue with intangible “simply was not on the radar.”

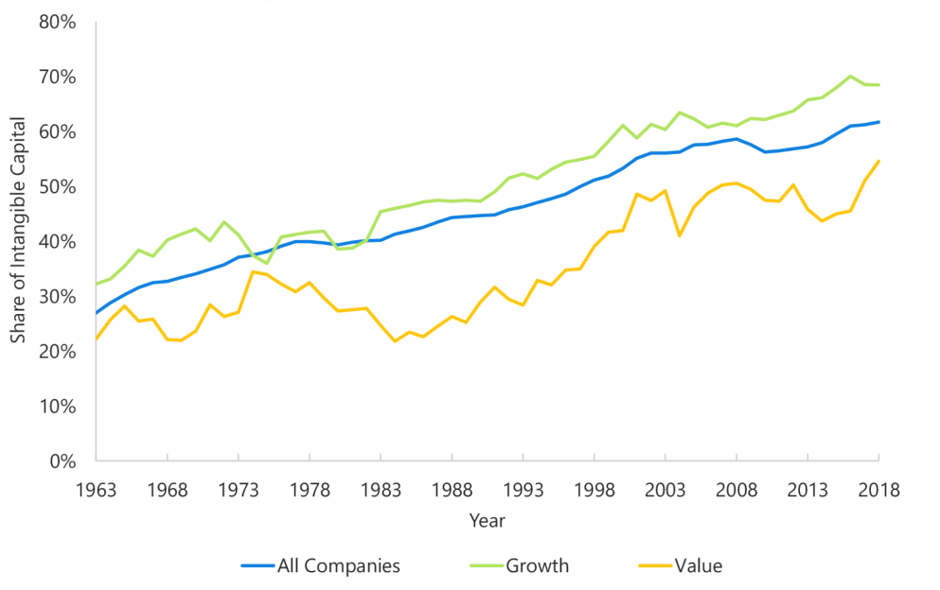

As can be seen below, the growth of intangibles has been on the rose for the past 50 years or more, but Kalesnik’s point is that formulations of price-to-book, and hence value, have failed to keep pace with this change. (See chart 1)

Chart 1: Share of intangibles in total company capital, US July 1963- June 2019

Source: Research Affiliates

As can be seen from this chart, the inflection point comes in the 1990s when computing power truly began to change the way industry worked. “It is not just the internet,” Kalesnik says.

“It is the computer revolution, innovations in biotech, pharma, and how we consume things. It is the value of brands and the ability of companies to generate cash that was a lot less dependent on physical assets and more about brands and knowhow. And the internet just sped that up.”

“So when we look at price to book, companies will look expensive because book value is not capturing up to 70% of the value,” Kalesnik says.

Change the measure, change the result

So, Research Affiliates changed the price-to-book measurement of intangibles, taking their lead from Peters and Taylor in 2017 who proposed that instream do price-to-book, another value should be used – q – which would represent the firm’s total market value (book value plus market value of equity) divided by the sums of intangible and physical capital.

Using this measures comes up with a very different relative performance of value versus growth but, as Research Affiliates are quick to point out, it “does little to insulate against the peril of revaluations: iHML, just like its traditional counterpart, suffered from the same revaluation headwind”.

Yet, “going forward, incorporating intangibles in the definition of the value factor would help protect the structural alpha because a measure that includes intangibles runs a lower risk of misclassifying value stocks as growth stocks, and vice versa”.

So, what of these ‘going forward’ prospects? Well, as Research Affiliates show, the relative valuation of value to growth has moved over the past 12 years from the 21st percentile to the 97th. That is quite a shift. This revaluation explains most of value’s underperformance. Today, the relative valuation level is close to the most attractive valuation level in history at the peak of the tech bubble in 2000.

But the big question is what rebound can we expect? Will this be a post-dotcom bubble return or something like the rebound in the mid-70s?

Stored alpha

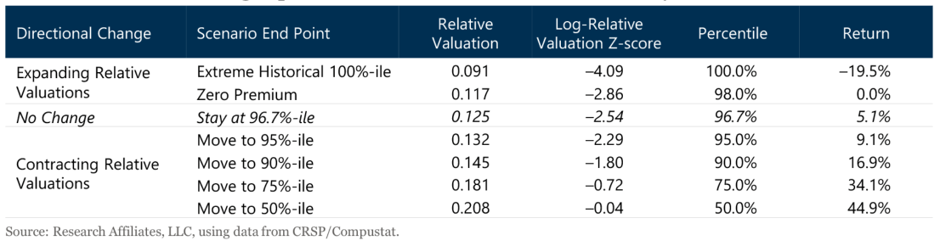

The Research Affiliates analysis suggests, using a term coined by Pimco to explain why they were staying the course in adversity and buying assets that have had a poor performance, there is ‘stored alpha’ in value. Even if value and growth stay at the same relative valuation percentile, then a 5.1% outperformance of value relative to growth can still be expected.

“The bottom line is all value companies are cheap compared with growth,” Kalesnik continues. “So an interesting question is what will happen if it starts to revert. If there is return to mean, then the current valuation is like a coiled spring. It could drive outperformance.”

If that were to move toward the historical median, then the outperformance “would be quite extreme”. (See table)

Table: Forward-looking expected returns conditional: scenarios analysis

As Kalesnik concludes: “The biggest elephant in the room is that growth is very expensive relative to value so the performance of growth is distorting how we are looking at value.

“Plus, during the Great Financial Crisis, investors got spooked by value and it was really hard to benefit from value during the crisis.”

He asks a rhetorical question: “When did people last see an allocation to value? All the flows have been to growth managers.”

Why value ETFs continue to fail

He explains how QE has been a huge factor. “There was money flowing into whatever investors perceived as safe, and that was growth. However, this is problematic because growth is reasonably priced.

“So that is the biggest driver. But at the same time, for value going forward being effective, investors and managers need to adapt to the new economy. And intangibles are a key part of it. Accounting standards were written in the 1900s and were written for legal purposes, But we are using accounting today for economic analysis and that has to change.”