Exchange traded funds that buy bonds with the lowest credit ratings – known as “junk” – have always drawn critics.

Critics say that the bonds these ETFs hold rarely trade, or are illiquid. And this is a problem, they allege, because when market conditions deteriorate junk bond ETFs will be unable to sell their holdings, causing them to trade at the wrong price.

At the extreme end of this scenario are high-yield municipal bond ETFs, which buy the bonds of small and local US governments with junk credit ratings - or no credit ratings at all. These bonds are obscure, and hardly trade. But ETFs that buy them have found large audiences, as low interest rates have sent investors searching to all over for yield.

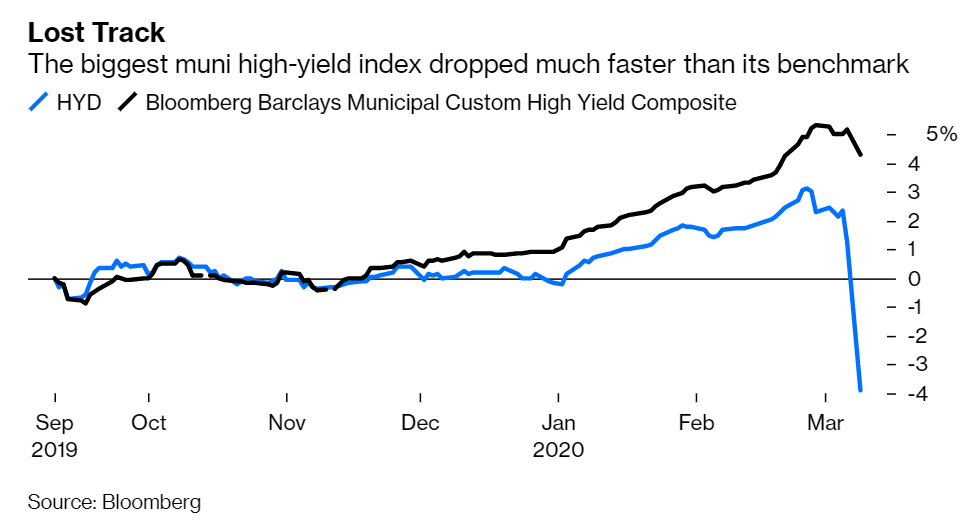

Among ETFs that track this corner of the market, the biggest is the $3.8 billion VanEck Vectors High-Yield Municipal Index ETF (HYD).

As critics would expect, the fund has hit some trading snags this week. According to data provided by VanEck, the fund is trading at a price 5% below its benchmark – in a manner common of closed-ended mutual funds.

The reason for the discount is partly that the bonds HYD holds are so illiquid that a wedge has emerged between where the ETF trades and where the index is measuring the market. (Mid market price and exit prices, in the jargon).

Junk bond ETFs are getting short sold en masse

These wide spreads mean that traders cannot remove the discount in the way they can with ETFs with liquid holdings, such as S&P 500 ETFs. This is because when spreads get wide, taking advantage of the difference in prices between an ETF and the investments it holds, called arbitrage, becomes too expensive.

It is also partly because there are no obvious alternatives – like futures, in the case of S&P 500 ETFs – that traders can use to try and fix junk bond ETF prices.

But how much of a problem are these junk bond ETF discounts? And are the critics right to sound the alarm?

Source: Van Eck

On the surface at least, they seem to have a point. After all, the job of a passive ETF is to track its index. A failure to do so – be it through discounts or tracking error – seems to grate against the fund’s investment objective.

This might be less of a problem for finance professionals and gun traders, who welcome these discounts as “price discovery”. But retail investors who buy into these ETFs expecting index-like performance might feel a bit misled.

Yet there are other factors that can count in favour of junk bond ETFs.

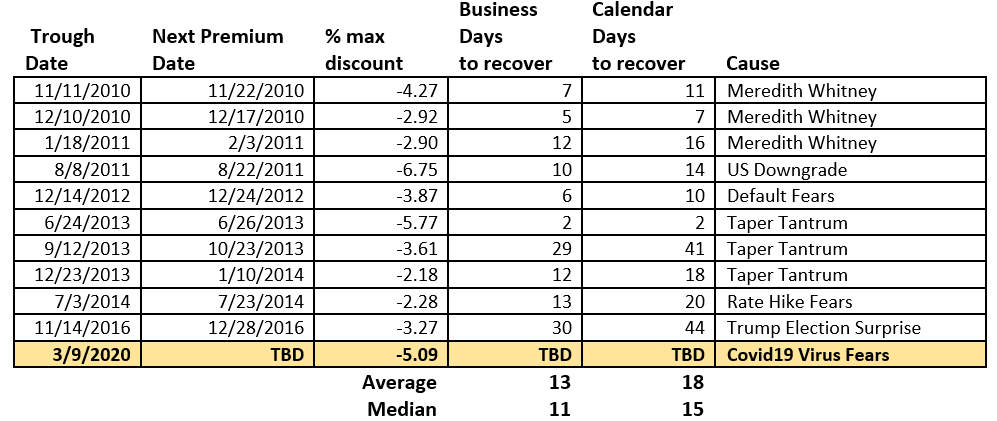

The most important consideration is that the discounts almost always prove short-lived. If the past is any guide, the discounts on HYD will be gone within 2-5 weeks, Van Eck has indicated. On most other kinds of junk bond ETFs, discounts are even shorter lived.

Another consideration is that there are not really any better alternatives. Open-ended mutual funds are also impacted by junk bond illiquidity. When investors try to leave, these funds become forced sellers, and the fund takes the spreads on the way out. With ETFs, at least, investors can sell on exchange when buyers are available, protecting the fund from forced selling.

The final consideration is these discounts will likely get smaller in the future as technology improves. To this day, much bond trading is still done the old fashioned way, over the phone. As electronic market places grow, and as more bonds become open for electronic trading, the benefits will flow through to junk bond ETFs.

Editor's note: This piece has been updated to clarify how junk bond mutual funds sell. 16/3/20