Chances are you’ve never heard of First Trust, or its billionaire boss James Allen Bowen -- which is a shame. The sixth largest ETF provider in the United States, with $72 billion in its ETFs, First Trust has done a lot to shape the global industry.

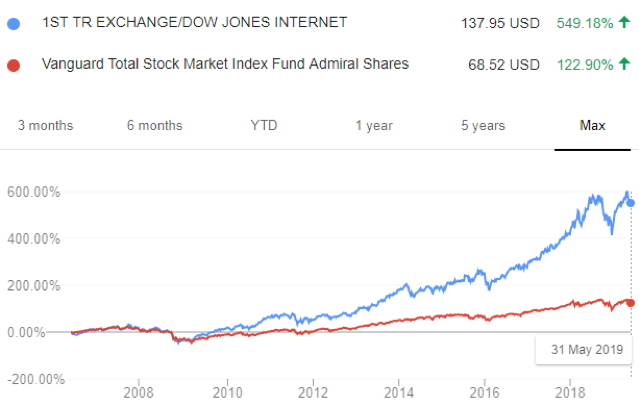

It was one of the first ETF providers to offer smart beta funds. It reinvented commodity ETFs. It was one of the first providers, if not the first, to push thematic ETFs. It houses the world’s best performing ETF the past 10 years: FDN, which has delivered an incredible annualised average return of 22%.

The company generates $475 million in ETF revenue a year, our estimates show, not far behind Vanguard, which makes about $620M a year. But given their high fees their profit margins are a multiple of Vanguards. (Vanguard, it must be said, runs a “revenue neutral” operation and does not try to be profitable).

Despite its achievements, the Wheaton, Illinois, based company is very private, almost secretive. Unlike most big ETF providers, First Trust has no Wikipedia page. There is no big building with the company’s logo embossed on it. It does little media and has a limited online footprint. Professionals can spend years working in the ETF industry without knowing First Trust exists.

Given the paucity of public information, outsiders – or nosey journalists – looking to find basic information on First Trust (like who owns it) have to trawl through SEC filings.

Here one finds the company is mostly owned by James Allen Bowen, the CEO. Bowen bought the company from the family of Robert Donald Van Kampen, deceased bible collector and finance luminary, for $3 million in 2010. Back then First Trust was much smaller and the financial crisis had depressed asset values.

However, these facts, together with the company’s staggering growth the past ten years, suggest that Bowen could be the richest man in the ETF industry, with a personal net worth well into the billions.

Fee war? What fee war?

Much of First Trust’s success owes to its willingness to avoid – and even ignore – the fee war.

Source: ETF Stream, Ultumus

The company has 141 ETFs, of which only one has a fee less than 40 basis points. Conventional industry wisdom states that fees need to be low, as advisors like low fees. To this end, the weighted average fee on American ETFs hit a new low of 18 bps last year.

But there is no sign of price pressure whatsoever in First Trust’s suite. The average fee on a First Trust ETF is 73 bps. While the average fee incurred by a dollar invested in one of their funds is 66 bps. (This compares with 11 and 7 bps for Vanguard, respectively).

First Trust relaunches its smartphone fund as a 5G ETF

The company appears intent to keep things this way. This week, First Trust launched a 5G ETF, by converting its unloved smartphone ETF, FONE, into the First Trust Indxx NextG ETF (NXTG). The fund, which mostly invests semi-conductors, telecoms equipment and data centre REITs, is the third of its kind in the market. Yet NXTG entered the market with a 70 basis point fee, overpricing incumbents Pacer and Defiance, which offer the same exposure for 60 and 30 bps, respectively.

But the high fees are only one part of First Trust’s breath-taking success, Ryan Issakainen, senior Vice President at First Trust told ETF Stream. Most of their success owes to a laser-like focus on the retail advisor market.

“We’re very focussed on providing tools for advisors. We don’t tend advertise much to the retail public. Retail investors are best served by financial professionals in our opinion. That’s why we’re a little bit under the radar,” he said.

He adds that the company is very talkative and very available, but only to industry professionals. There is no intention to be secretive.

Key: Advisors

Every American ETF provider tries as much as possible to hawk their wares to financial advisors. But with First Trust the commitment to the advisor market seems much more focussed.

Most ETF providers will try to grab voice share in the media and maximise search engine optimisation. They want to be able to speak to end-investors and retail buyers. They see the media, internet and search engines as a way of getting there.

With First Trust, however, the communication lines run only B2B. This helps signal loyalty, Issakainen says, as advisors can be suspicious when product manufacturers talk too much to end investors.

“There is always the danger [in asset management] that the client comes to the conclusion that they can cut out the investment advisor from the process. So our approach has been to provide ETF models but provide them to investment advisors to use at their discretion. We provide that without expense to professionals but we don’t make them available to the public.”

Robo-advice: a stab in the back?

Where the company’s loyalty to advisors really works well is in its refusal to offer advice services or robo-advice, Issakainen says.

Many have commented that the bulking up of advice services by ETF issuers in recent years looks something like a stab in the back. The ETF industry got big thanks to financial advisors, who sent their clients’ money into ETFs. In an effort to sell products to them, ETF issuers have always told advisors that they are “indispensable” and provide “advisor alpha”.

Yet now some ETF providers offer advice services that compete directly with retail advisors. Vanguard, the primary offender, has sworn to bring advisor fees “down to index fund levels”. While many others provide model portfolio services that can cut out the need for advisors.

“Unlike some of the large ETF providers our strategy has not been to develop robo-advisors or other solutions that compete with investment advisors. We want to be very clear to the investment advisors and financial advisors that we are partners not competitors,” Issakainen says.

Going forward

Beyond its continuing mastery of retail advisor distribution, the company’s plans going forward are to innovate, with products in niches away from the fee war. And to copy the products of its smaller and potentially weaker competitors, often at higher fees.

Examples of copying include NXTG (above) but also a recent filing for a defined outcome ETF, which copies Bruce Bond’s Innovator ETFs. Examples of innovating include plans to crack multi-asset and multi-manager offerings, Issakainen says.

“As a follow-on from ETF model portfolios we’ve had requests to bring some of our models into a sort of fund-of-funds single ticker approach.”

Regardless of the specifics, if First Trust maintains its winning product innovation and the company’s low profile continues, one images James Bowen will continue being a silent ETF kingmaker, and the richest man no-one has ever heard of.

Editors note: This article was updated to more accurately reflect NXTG's benchmark. (18/6/19)

Editors note: The headline to this article was amended on request from First Trust. (21/6/19)

ETF Insight is a new series brought to you by ETF Stream. Each week, we shine a light on the key issues from across the European ETF industry, analysing and interpreting the latest trends in the space. For last week’s insight, click here.