There has been a recent explosion of multifactor ETFs on exchanges around the world.

This month alone several multifactor ETFs have launched. Fidelity launched its ESG multifactor ETF in Canada, while Ossiam launched its US ESG Low Carbon Equity Factors UCITS ETF (OUFE) on Xetra, and iShares launched the iShares Edge MSCI Multifactor USA Mid-Cap ETF (MIDF US) on NYSE Arca.

These products give investors a way to simultaneously invest in a number of stocks with different factors. Meaning, you don’t have to choose just one e.g value or momentum or value. You can have access to all of them and they are designed to help investors reduce the risk of losing it all when stocks crash.

They effectively work by selecting stocks and then weighting them based on the various smart beta factors available. Different funds have different weightings and exposures. Some track an index, while others are actively managed such as HSBC’s Multi Factor Worldwide Equity UCITS ETF. It’s returned 11.86% year-to-date.

However, while this year has been good for multifactor ETFs, last year wasn’t.

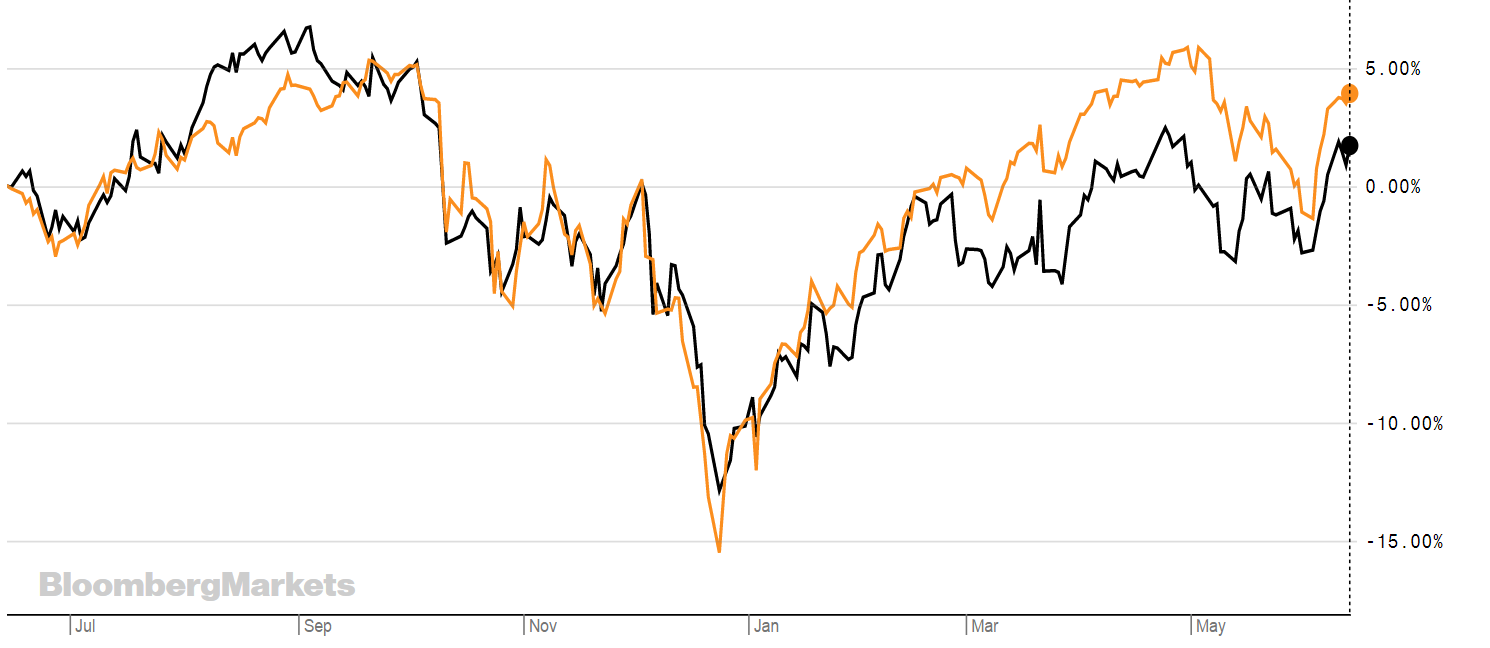

For example, one of the best performing ETFs, iShares Edge MSCI USA Multifactor UCITS ETF (FSUS) has returned 13.21% YTD but over a one-year period it’s at 1.44%. The graph below shows its fall and then rise (in black) and it’s pitted against the S&P500 as part of its fall to the end of last year is a result of the volatility felt in the equities market. Both follow a similar pattern.

Source: Bloomberg

One characteristic of these products is that they are sold as helping to minimise losses, but as the graph above shows, this doesn’t really seem to be the case.

This is largely in part to them both tracking equities, there is going to be some loss, but as the graph shows, it’s not as bad as that seen from the index. But is also means that you have to do your due diligence when it comes to choosing the ETF that is right for your portfolio.

The WSJ reported Anthony B. Davidow, Vice President, Alternative Beta and Asset Allocation Strategist for the Schwab Center for Financial Research (SCFR), who suggests that investors and advisers who don’t want to take the time to scrutinize the sometimes complex approaches used by multifactor funds might follow a more basic approach: owning a very inexpensive market-cap-weighted fund tied to a broad index such as the S&P 500 and pairing it with a narrower ETF. That, he says, would provide diversification in a more cost-effective manner since the higher expenses associated with multifactor funds tend to cancel out some of the benefit of focusing on more than one factor.

“Two individual components would give you a similar outcome, rather than layering in the additional fees and complexity,” he says.

But there are benefits to these products as Christopher Gannatti, head of research Europe at WisdomTree explains.

“The markets have changed dramatically in a short period of time. Most surprising to us was just how low interest rates have gone globally. The main issue with that is low volatility as a factor usually does better in falling rate periods. However, who knew 100 percent that would happen? Prior to that, markets had run to all-time highs or close to them from December to around end of April 2019. So on runs, an investor might prefer momentum. As things shift, maybe low volatility tends to do better.

“The benefit of multi-factor approaches is you don’t need to make a call on the market or a call on the factor. Since you’re exposed to all factors all the time, you’re at a lower risk of dramatic under performance. This makes portfolios more liveable and the investor is less likely to abandon the strategy due to discomfort. The key is giving investors the tool to maximize time in the market, rather than trying to time to market."

And they are proving popular.

According to FTSE Russell’s latest annual ESG & Smart Beta survey, the proportion of institutional asset owners who have adopted a multifactor strategy has grown from 49% in 2018 to 71% in 2019.

These strategies are also proving popular with new smart beta users as 69% of asset owners who have implemented a smart beta strategy for the first time within the last two years have opted for this approach.

If you want access, then there are several ETFs available on the London Stock Exchange.

The best performing of these YTD is WisdomTree’s Wisdomtree US Multifactor UCITS ETF (FCTR). It has a TER of 0.30% and tracks the WisdomTree U.S.Multifactor Index. The index strategy includes 200 U.S. companies with the highest composite scores based on two fundamental factors, value and quality measures, and two technical factors, momentum and correlation.

HWWA

HWWD

IEEU

IFSD

IFSU

IFSE

IFSW

UFSD

USMF

FCTR

FSEU

FSWD

FSUS

LYX5

ETFsYTD RTNTEREXPOSUREHSBC Multi Factor Worldwide Equity UCITS ETF11.86%0.25%The ETF is actively managed and uses a proprietary multi factor investment model which considers factors such as Value, Quality, Momentum, Low Risk and Size. The fund will invest anywhere in the world, including emerging markets.HSBC Multi Factor Worldwide Equity UCITS ETF11.03%0.25%The ETF is actively managed and uses a proprietary multi factor investment model which considers factors such as Value, Quality, Momentum, Low Risk and Size. The fund will invest anywhere in the world, including emerging markets.iShares Edge MSCI Europe Multifactor UCITS ETF11.60%0.45%MSCI Europe Diversified Multi-Factor IndexiShares Edge MSCI Europe Multifactor UCITS ETF13.15%0.45%MSCI Europe Diversified Multi-Factor IndexiShares Edge MSCI USA Multifactor UCITS ETF12.31%0.35%MSCI USA Diversified Multi-Factor IndexiShares Edge MSCI Europe Multifactor UCITS ETF13.06%0.45%MSCI Europe Diversified Multi-Factor IndexiShares Edge MSCI World Multifactor UCITS ETF11.10%0.50%MSCI World Diversified Multi-Factor IndexiShares Edge MSCI USA Multifactor UCITS ETF12.30%0.35%MSCI USA Diversified Multi-Factor IndexWisdomtree US Multifactor UCITS ETF14.57%0.30%WisdomTree U.S.Multifactor Index NTRWisdomtree US Multifactor UCITS ETF14.59%0.30%WisdomTree U.S.Multifactor Index NTRiShares Edge MSCI Europe Multifactor UCITS ETF12.42%0.45%MSCI Europe Diversified Multi-Factor IndexiShares Edge MSCI World Multifactor UCITS ETF11.90%0.50%MSCI World Diversified Multi-Factor IndexiShares Edge MSCI USA Multifactor UCITS ETF13.21%0.35%MSCI USA Diversified Multi-Factor IndexLyxor J.P. Morgan Multi-Factor Europe Index UCITS ETF12.29%0.40%The Fund aims to track the performance of the J.P. Morgan Equity Risk Premia - Europe MULTI FACTOR Long Only Index