It’s safe to say that green investing is very much here to stay, not only because of the ethical reasons for investing in companies which are not involved within controversial industries but also because of the significant returns the funds have to offer. But which region is thriving the most from Environment, Social and Governance (ESG) factors and offering investors the best returns?

World

The iShares MSCI World ESG Screened UCITS ETF (SAWD) is comprised of companies from 23 developed countries but has removed any companies with exposure to thermal coal, controversial weapons, tobacco or any other frowned upon industries.

On its product page, the MSCI ESG quality score for SAWD is 5.9 which is rather underwhelming as the non-ESG-screened ETF iShares has on offer has an identical ESG rating. Alternatively, iShares MSCI World SRI ETF (SUSW) has an impressive score of 8.0 as it picks out the companies with the largest ESG scores rather than just removing companies which work within a specific industry.

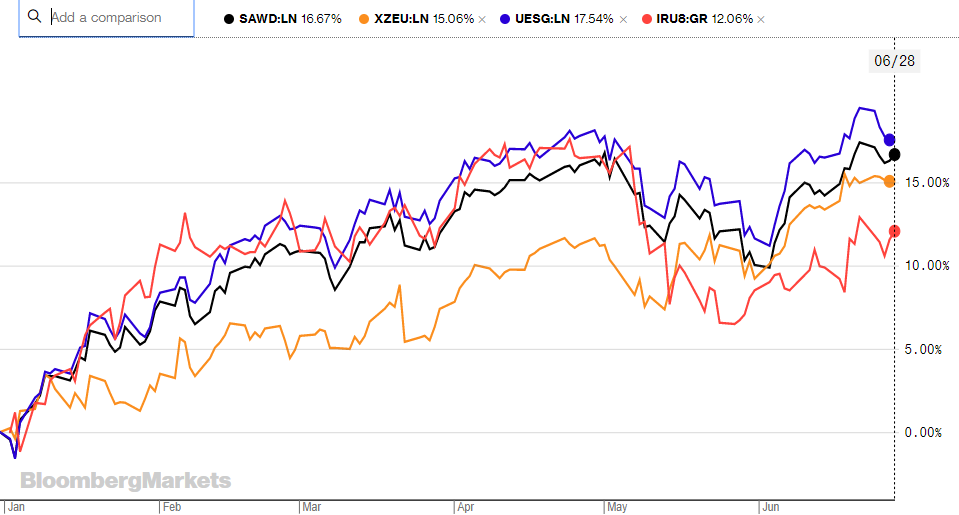

Looking at the performance of SAWD, it has an impressive year-to-date return of 16.3% and an expense ratio of 20bps. The fund is only eight months old however and has $78.5m in assets. According to Bloomberg, it also has an average yearly premium of 0.06%.

Europe

More specifically looking at regions now, Europe doesn’t differ too much from the World benchmark. The Xtrackers ESG MSCI Europe UCITS ETF (XZEU) includes a similar screening methodology as SAWD but focuses on European domiciled companies only. XZEU has a YTD return of 15.1% and has the same expense ratio of 0.2% and average yearly premium of 0.06%.

The weightings of the countries included in the underlying index are reasonably distributed. The UK hosts 20.4% of the holdings, the largest percentage, with Germany, France and Switzerland hosting 17.6%, 16.2% and 12.3%, respectively.

US

States-side, a number of US-domiciled companies which pass the ESG screening process are included in the S&P 500. The Lyxor MSCI USA ESG Trend Leaders UCITS ETF (UESG) includes industry giants such as Google, Coca Cola, Intel and Microsoft which alone has a weighting of 7.9% of the fund. The methodology for the underlying index selects the companies with the robust ESG profile relative to their sector. Meaning if it’s a poor scoring sector as a whole, the threshold to be considered for the index is also lowered accordingly.

UESG has a YTD return of 17.5%, greater than both the SAWD and XZEU but also has greater premium average of 0.17% and expense ratio of 0.25%.

Emerging Markets

Finally, the emerging markets, one would assume, are the most damaging to the environment given the yearly smog which descends on the whole of China. But the country’s policymakers have acknowledged the pollution problems and have attempted to better their ESG ratings.

The iShares ESG MSCI EM ETF (IRU8) has an ESG score of 5.8, 0.1 lower than its World-exposed counterpart. IRU8’s SRI-screened sister products, however, has an improved ESG rating of 6.8.

The fund’s performance is still strong with a YTD return of 14.0% but is the lowest on offer compared to the previously mentioned products. IRU8 also comes with the joint most expensive fee of 0.25%.

Unlike XZEU, IRU8 is more dominated by a single country which happens to be China, most likely as a result of its recent efforts this year to improve its pollution. China takes up 28.6% of the fund followed by South Korea with 12.0% and then Taiwan with 11.7%.

YTD Returns - Source: Bloomberg