Smart beta ETFs are becoming increasingly popular with investors this year.

covers a range of different factors

, but if you think market falls are likely soon, minimum volatility is a factor worth considering.

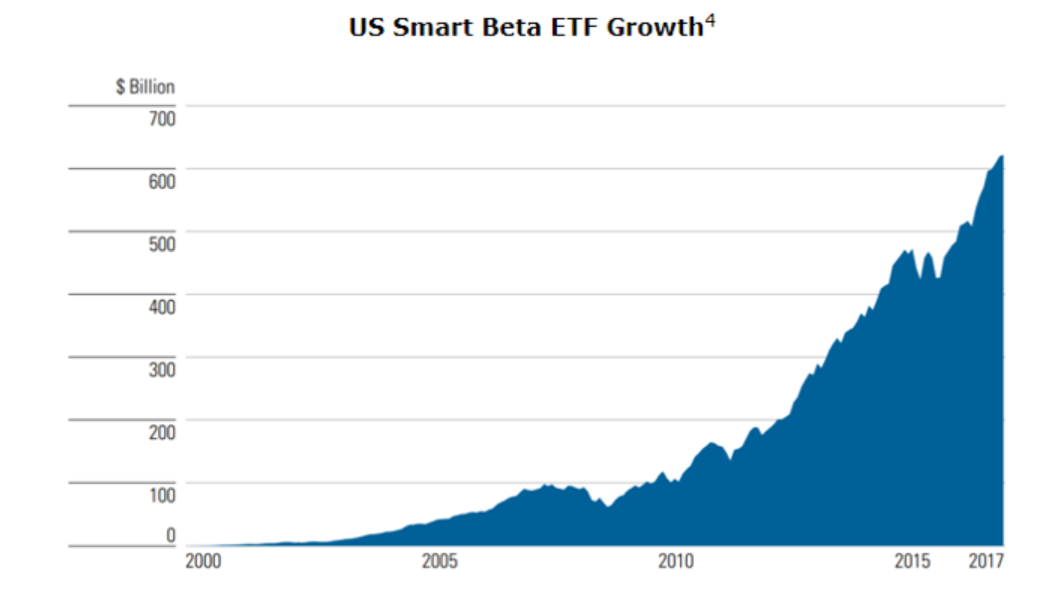

Popularity in smart beta has been huge in the last decade with investors using the ETFs to gain exposure to different index tilts to make the most of various market conditions.

The graph below shows smart beta ETF asset growth in the US.

Source: SeekingAlpha

Smart beta minimum volatility strategies have been particularly popular in the last few months. According to data from ETFGI, the iShares MSCI USA Minimum Volatility ETF (USMV) was in the top 20 ETF by net new assets last month globally.

Dave Nadig, MD of ETF.com, said at the Morningstar conference: “The big interest story was seeing what happened with min-vol funds and momentum funds…the charts started looking like they were printed right over each other, and I think that’s an important lesson for investors looking at smart beta: sometimes it’s not what you think.”

Maximum exposure to minimum volatility

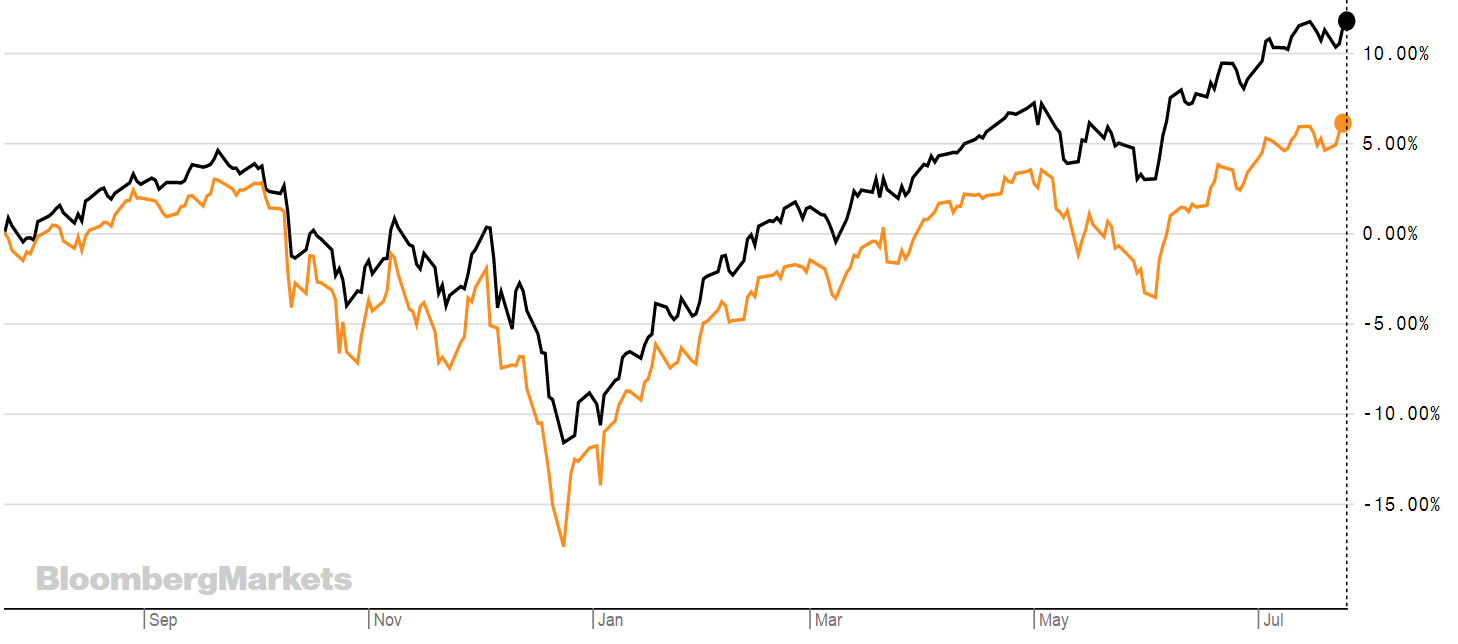

Minimum volatility typically works best in markets that are declining. For example, at the end of last year when equity markets suffered from volatility, minimum offered some level of downside protection.

The chart below shows iShares Edge S&P 500 Minimum Volatility UCITS ETF (SPMV) in orange against the S&P 500 index. During the volatility at the end of last year SPMV was down -11.6%, while the S&P 500 was down -17.4%.

So what has happened since then?

Anthony Kruger, iShares EMEA head of smart beta, explains: “The 'risk-on' equity market rally in early 2019 was characterised by the outperformance of cyclical sectors such IT, and consumer discretionary. During the same period, as expected, minimum volatility strategies lagged as they are designed to provide resilience during periods of heightened market stress.

"Following April, US-China trade tensions weighed heavily on equity markets and this led to a significant rebound in minimum volatility strategies as investors sought safety. Trough to peak (23/04 to 03/06) the strategies outperformed their respective parent benchmarks: MSCI World, MSCI Europe and S&P 500 by 6.4%, 3.7% and 2.9% respectively."

Minimum volatility can add something to portfolios in terms of protection. The current market concerns including trade war fears, political concerns and the anticipation of a downward trend in markets has seen investors looking for places to put their money.

Kruger says: “As minimum volatility strategies provide a good way to stay invested in the equity markets while building portfolio resilience, capital continued to flow into these ETFs even during the “risk-on” months, reinforcing investor’s cautious sentiment concerning the slowing global economy.

"EMEA domiciled minimum volatility ETFs accumulated $2.7bn inflows year to date capturing a large portion of the flows into the smart beta category. Adding inflows from factor ETFs such as quality increases the overall portion in 'defensives' even further.

“Looking forward, we hold a positive view on defensive factors including quality and minimum volatility. These two factors have historically performed well during economic slowdowns. Quality is arguably slightly more attractive due to its longer running positive price momentum.”

The best performing min vol ETF this year is the iShares Edge S&P 500 Minimum Volatility UCITS ETF (MVUS), which returned over 25% year-to-date. It has a TER of 0.20% and tracks the S&P 500 Minimum Volatility Index. It is slightly ahead of the S&P 500 index which has returned 20% YTD.

However, not everyone is convinced by the performance in min vol ETFs this year and it may be that you’re getting the same performance with a regular S&P 500 ETF at a lower price.

ETF providers in smart beta catch 22

Peter Sleep, senior portfolio manager at 7IM, said: “The index is designed to be fairly sector neutral – small overweights and underweights allowed at the sector level. It also tries to pick stocks that are uncorrelated with the S&P 500 as well as being low volatility. They are slightly different things. One reduces the volatility of the portfolio, the other are just low vol stocks.

“There is not any one factor that has led MVUS to do well but a combination of many things. For instance, MVUS has a small overweight to the Food Beveridge and Tobacco group and within that picked tasty stocks like General Mills and Tyson Foods while avoiding the toxic stocks like Altria.

"The same is true in Semiconductors. MVUS is overweight the signal winners like Analog Devices and Qualcom while avoiding crashes at Intel. It has not all been good news though. The ETF, for instance, was underweight some of the strongly performing stocks like Facebook and Apple. Net net, it tracked pretty close and pulled ahead of the S&P fractionally.”

Regardless of your conviction, it pays to check what the smart beta strategy is doing in the index. If you want to own a minimum volatility ETF then ensure it does what it says.

Below is a list of some of the minimum volatility ETFs on offer on the London Stock Exchange.

RTN

VMVL

XMVU

Expense Ratio0.2%

XDEB

Expense Ratio0.25%

EMMV

MVOL

IMVU

EMV

MINV

MVUS (£)

SPMD ($)

VDMV

ULOV

LOWE

ETFYTDTERINDEXVanguard Global Minimum Volatility UCITS ETF17.53%0.22%The Fund employs an actively-managed investment strategy and will seek to achieve its investment objective by investing primarily in equity securities that are included in the FTSE Global All Cap IndexXtrackers MSCI USA Minimum Volatility UCITS ETF20.89%Current Mgmt Fee0.10%MSCI USA Minimum Volatility IndexXtrackers MSCI World Minimum Volatility UCITS ETF19.22%Current Mgmt Fee0.15%MSCI World Minimum Volatility Net Total Return IndexiShares Edge MSCI EM Minimum Volatility UCITS ETF6.05%0.40%MSCI Emerging Markets Minimum Volatility IndexiShares Edge MSCI World Minimum Volatility UCITS ETF17.03%0.3%MSCI World Minimum Volatility IndexiShares Edge MSCI Europe Minimum Volatility UCITS ETF12.68%0.25%MSCI Europe Minimum Volatility IndexiShares Edge MSCI EM Minimum Volatility UCITS ETF8.32%0.40%MSCI Emerging Markets Minimum Volatility IndexiShares Edge MSCI World Minimum Volatility UCITS ETF20.05%0.3%MSCI World Minimum Volatility IndexiShares Edge S&P 500 Minimum Volatility UCITS ETF25.36%0.20%S&P 500 Minimum Volatility IndexiShares Edge S&P 500 Minimum Volatility UCITS ETF22.04%0.20%S&P 500 Minimum Volatility IndexVanguard Global Minimum Volatility UCITS ETF14.91%0.22%The Fund employs an actively-managed investment strategy and will seek to achieve its investment objective by investing primarily in equity securities that are included in the FTSE Global All Cap Index.UBS Irl ETF plc - Factor MSCI USA Low Volatility UCITS ETF20.19%0.35%MSCI USA Select Dynamic 50% Risk Weighted Total Return NetSPDR EURO STOXX Low Volatility UCITS ETF13.77%0.30%EURO STOXX Low Risk Weighted 100 Index