Bond ETF liquidity has been thrust into the spotlight once again following a new report that suggests the arbitrage mechanism enables ETFs to absorb shocks in the underlying bond market, however, there is a catch.

The Bank for International Settlements (BIS) report, entitled The anatomy of bond ETF arbitrage, said there are key differences between equity and bond ETF arbitrage that enable bond ETFs to prevent contagion risks to wider markets and act as a stabilisation mechanism.

As highlighted in the report, bonds are generally less liquid than their equity counterparts, trade in a market with fewer potential buyers, have maturity dates and larger minimum trading amounts.

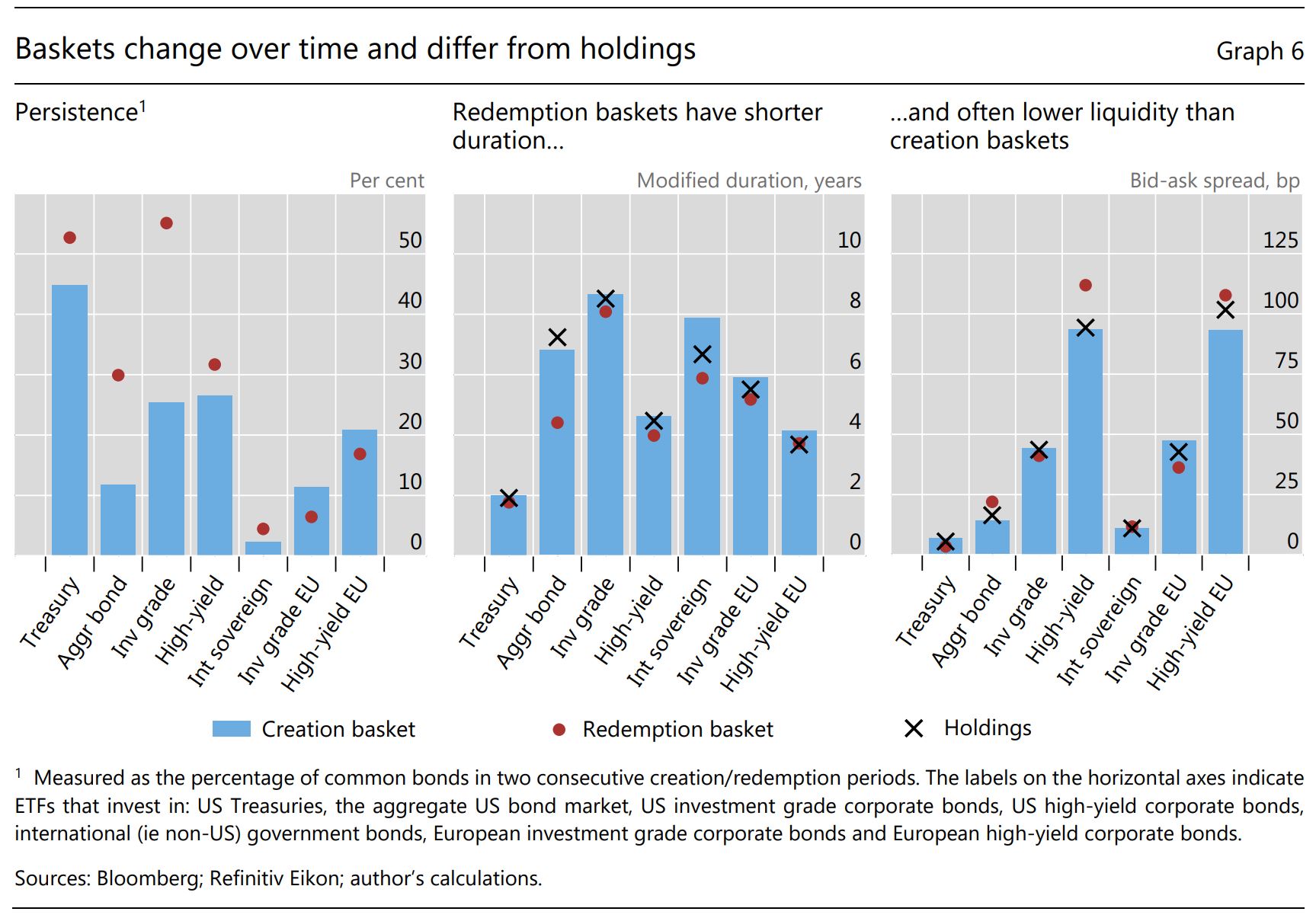

“Given these specificities of the bond market, ETF issuers need flexibility as regards the composition of baskets,” the report continued. “Issuers choose strategically which bonds to include among the available ones, with an eye on continuously matching key characteristics of the benchmark index.

“Likewise, authorised participants (APs) influence the composition of baskets and could use them to accommodate demand from their own clients rather than to close arbitrage gaps.”

Furthermore, the report added ETF issuers are incentivised to maintain long-term relationships with APs which can lead to differences between baskets and holdings with issuers even taking on bonds not in the underlying index.

With the creation and redemption basket of bonds changing rapidly, unlike in equities, the report said this weakens the potential for arbitrage, however, “enhances the shock-absorbing” capacity of ETFs.

Karamfil Todorov, an economist at BIS, and author of the report, explained the uncertainty around the basket of bonds APs will receive from ETF issuers means bond ETF baskets weaken arbitrage forces as it reduces the risk APs are prepared to take.

At the same time, this flexibility means issuers are able to discourage a run on bond ETFs by influencing the “desirability of redemptions”.

“If there is excessive selling of ETF shares in the secondary market, which puts redemption pressure on APs, the ETF issuer can include only the riskier or less liquid securities from the pool of holdings in the redemption basket,” Todorov argued.

“The lower-quality bonds that APs obtain after redeeming ETF shares would, in turn, reassure non-running investors that their shares are now backed with holdings of higher average quality. This would discourage further runs and lead to ETF discounts during run episodes.”

In other words, ETF issuers purposefully ditch the less liquid bonds from their ETF holdings which makes their product more attractive to investors still in.

The BIS report said this stabilisation mechanism was at play during the March sell-off last year when ETFs traded at all-time high discounts with APs less willing to close the gap.

There is a catch, however. Todorov said the reputation of bond ETFs can be damaged long term as investors will not want to be exposed to a strategy that only redeems low-quality bonds during periods of market stress.

What happens when the lights go out? An analysis of ETFs when liquidity vanishes

“This, in turn, could lead to lower inflows to the ETF and, as a result, decrease ETF profits from management fees, which are based on the size of AUM,” he continued.

“This mechanism is possible because of the predominantly in-kind nature of ETF redemptions, whereby shares are exchanged for securities. It is not available to other investment vehicles with cash redemptions such as mutual funds.”