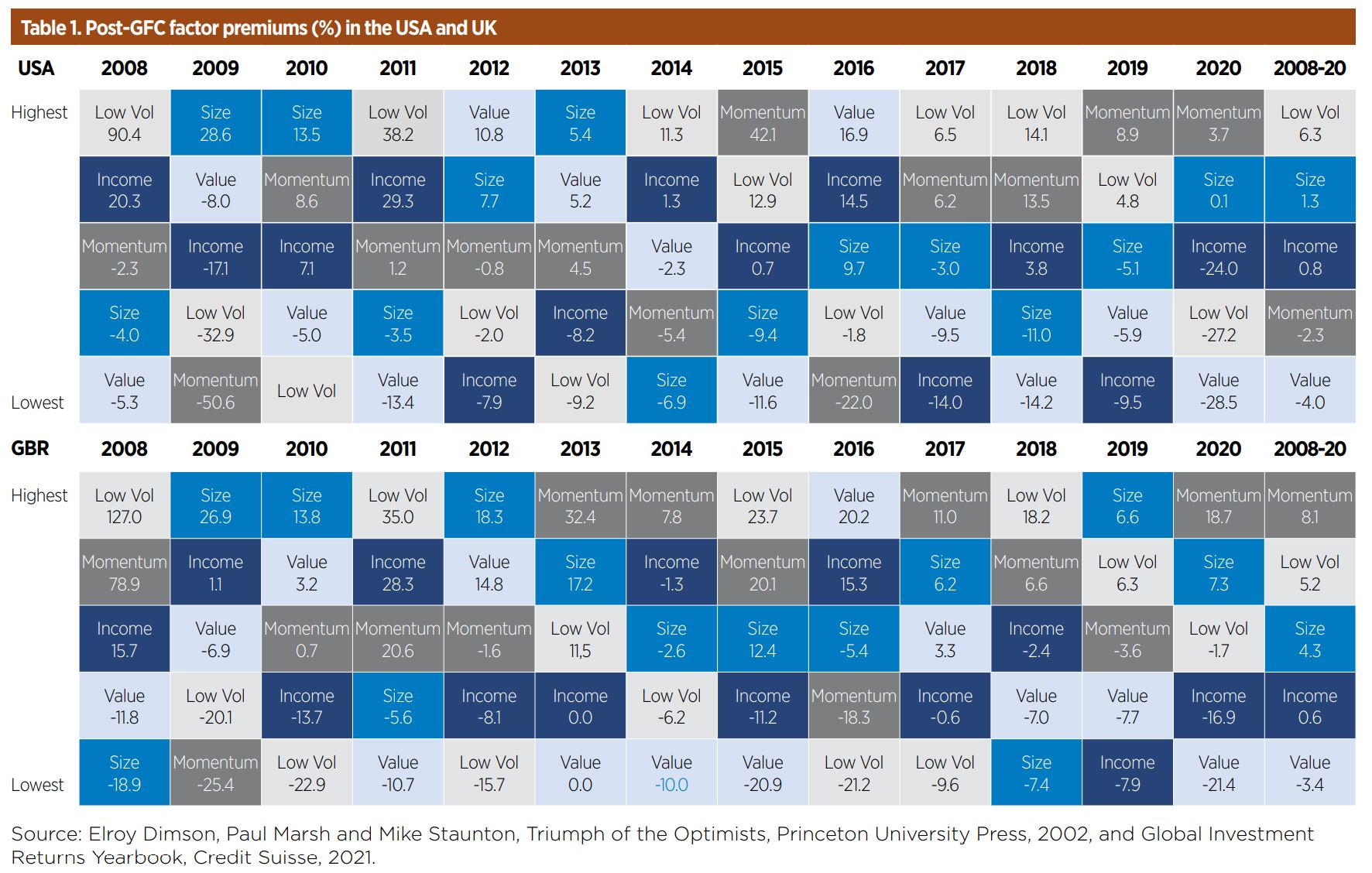

The latest edition of the Credit Suisse Global Investment Returns Yearbook 2021 by Elroy Dimson, Paul Marsh, and Mike Staunton has just been released and as we have all come to expect it contains a veritable treasure trove of revealing financial data spanning more than 100 years in the case of most developed markets. As always, there is a detailed spin through the world of factor-based investing – with what I think are potentially disquieting conclusions. Take Table 1, a heatmap that shows returns for the usual spectrum of factors from 2008 through to 2020.

On an initial surface inspection, it backs the market consensus which is that low volatility has been a winning strategy both in the US and the UK. In the US, the average post-Global Financial Crisis (GFC) risk factor premium for this strategy has been 6.3% compared to 5.2% in the UK (where it is the second most successful strategy behind momentum). Yet if we look at the heat map, we see that low volatility has, in reality, been all over the shop!

In four of these years, low vol in the UK was by a considerable distance the WORST strategy and has only been the best performing in four, obviously different, years. Again, in the US, low vol has been all over the shop. Value, by contrast, looks to be have been consistently a dreadful strategy, with an average risk discount of -4% in the US and -3.4% in the UK.

Yet if we look at the distribution of returns in say the US, we see that value has in fact been the best strategy in two of the 12 years and in second place in another two years. This confirms the oft-quoted observation that value can be a brilliant strategy but most of the long-term gains come from making sure you participate in a few, short-lived rallies.

Arguably, we are currently mid-way through another value surge. If we step back from this surface-level analysis, one conclusion becomes very clear, or at least it does in mind – factors have not been terrifically reliable ways of delivering a premium since the GFC. The Credit Suisse report in fact concludes that only 48% of annual “premiums” were positive and that those premia vary greatly over time and also countries. One could in fact take a more radical view – that the distribution of premia returns is not that far off random.

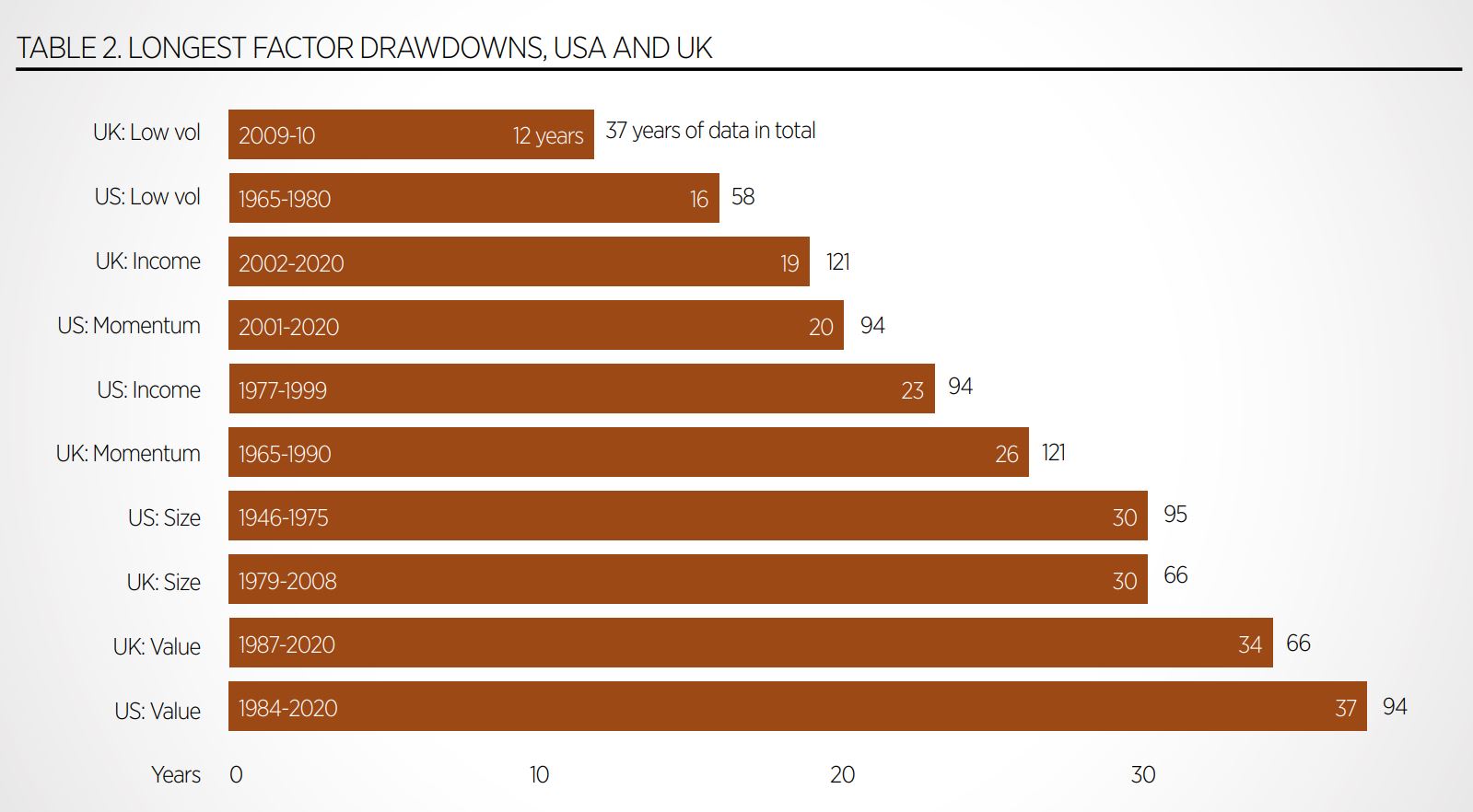

And we also need to be honest that if you pick the wrong factor, you face the very real possibility that you could be stuck in a misfiring strategy for many years or even decades. Take the second table, also from the Credit Suisse yearbook, which shows the length of many factor drawdowns. Take value as the obvious example – in the 94 years of recorded data, their global dataset suggests a grand total of 37 years of drawdowns and systematic underperformance since 1984.

Step back from this data and an obvious dismal conclusion can be drawn – not only can a robust argument be made for a random walk in terms of successful factor premia but that the cost of picking the wrong risk premia could be many years of underperformance. If that is the case, why bother with any factor led strategies in the first place?

To which, of course, the optimist could point to any number of arguments. That most value fund managers use a more complicated take on say value investing which extends beyond just say price to book measures. Or that many successful fund managers use a combination of factors to build a stock selection strategy, combining say value and size. A quant led justification might even embrace this random walk and incorporate all five of these classic Fama-French premia and then equal weight them (or a variation on active strategy selection).

These are all valid observations but they do not really quite answer my central concern – that the likely results of any selection of factor will likely produce highly variable results and that the costs of poor strategy selection can be ruinous in terms of wealth preservation.

And I would add one last thought. It is clear different factors can spectacularly underperform and test the patience of even the most determined long-term investor. At one stage value investing was the IN strategy, beloved of all the investing giants. And then it was not and in truth, it has not been for decades. What happens if a new variant on the factor strategy scene – ESG investing – starts to produce year after year, decade after decade, of terrible underperformance? Will we see, in this gloomy scenario, a wall of money exit strategies-based investing in carbon mitigation and reduction fund strategies, possibly shortchanging our net-zero targets?

It is one thing for value not to work, annoying fund managers, but if the financial system collectively undermines a global push for decarbonisation, then the results could be very real.

David Stevenson is a columnist at the Financial Times

This article first appeared in the Q1 2021 edition of Beyond Beta, the world’s only factor investing publication. To receive a full copy,click here.