Roughly half of active equity funds and one-third of active fixed-income funds beat their average passive peers during the first six months of 2020, adding to their decade-long underperformance, according to a recent report by Morningstar.

Morningstar’s European Active/Passive Barometer report compares the performance of both strategies during the past decade as well as during the increased volatility caused by the coronavirus turmoil.

To avoid significant losses during the drawdowns experienced in the first quarter of 2020, actively managed equity funds typically held more cash than passive funds.

As a result, active equity funds had a higher success rate than active fixed income funds which were significantly impacted by taking on more credit risk than their passive counterparts.

Morningstar promotes Industry 30 winner Bioy to sustainability director for EMEA and APAC

However, despite S&P Global's prediction in March that this period could be a prime time for active fund managers to outperform their passive counterparts, many failed to do so.

Out of 50 equity exposures during H1 2020, 21 saw passively managed funds have a success rate of over 25% with a further 19 having a success rate of at least 50%.

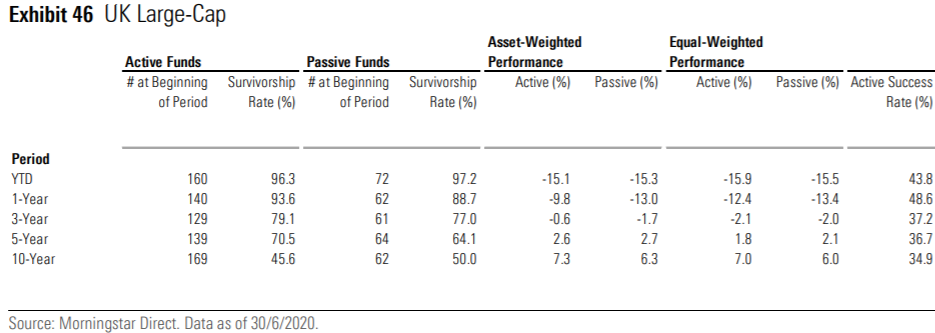

Actively managed UK large-cap funds only had a success rate of 43.8% while exposures such as Asia ex-Japan, Denmark and US large-cap growth funds had success rates of 36.1%, 23.7% and 15.3%, respectively.

Some active fund managers that had successful strategies, beating their passive peers, included Austria and Korea, the only two exposures with success rates above 90%.

For active fixed income fund managers, it was an even harder battle to beat their benchmarks. Four out of 19 fixed income categories saw active managers have a success rate greater than 50% over the same period.

Active euro corporate bond funds had a success rate of only 20.2%, behind CHF bonds funds with 22.8% and US dollar government bond funds with 27.8%.

However, over the course of a decade up to June 2020, only two out of 64 country or regional exposures found more active funds had outperformed their passive peers.

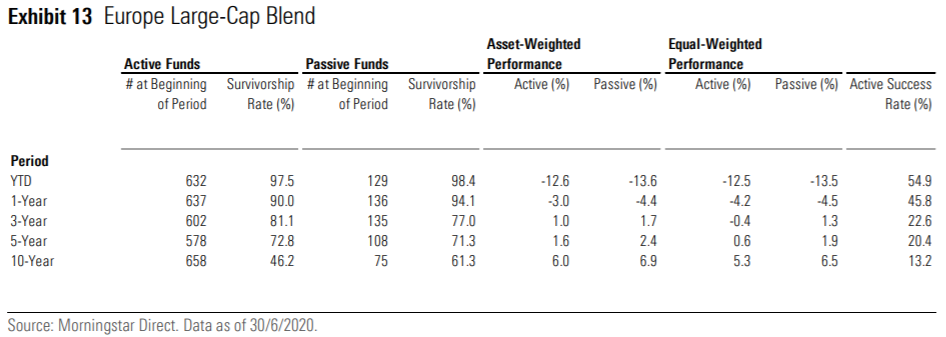

Notably, categories such as global large-cap blends and Europe large-cap blends, saw the percentages of active managers outperforming were only 6.8% and 13.2%, respectively.

Furthermore, global emerging market and Europe ex-UK saw less than a third of active funds outperform passive funds for the same period.

More granular exposures, such as single countries, still favoured passive strategies. Roughly 35% of UK large-cap fund managers beat their passive counterparts while US, Japan, France, Germany and Switzerland active large-cap funds ranged between 5.6% and 28.3%.

For some exposures, more than half of active fund managers did manage to outperform including UK mid-cap and Denmark.

Dimitar Boyadzhiev, senior analyst, passive strategies research, Europe and Ben Johnson, director of global ETF research at Morningstar highlighted how many active funds struggle to avoid closure following their underperformance.

Morningstar registers as non-EU benchmark administrator under BMR

The report said: “Survivorship rates are positively correlated with odds for success. The biggest driver of active funds' failure is their inability to survive, which is often a result of lacklustre performance.

“Comparing mortality rates between active and passive funds shows that the latter have had better odds of surviving over the long term. The contrast is starker over longer periods.”