In a conference hall in Sydney this February, I listened to one of Australia’s most influential financial advisers explain why he thought buying gold was dumb.

“We strongly advise our clients against buying gold,” he said.

“Gold is not an investment. It has no cash flows.”

It was one of those conference moments where a speaker gets on their soap box and talks about what they want to discuss, not what their audience came to hear. And on its own of no significance (gold is up 35% since this man’s oration).

But his sentiment is quite general. Many people feel that gold isn’t really an investment as it has no cash flows. They think that gold – unlike bonds, shares, property – is just a speculative commodity or “pet rock”. And because it has no internal rate of return, does not belong in a portfolio.

On this view, people that buy gold are effectively speculators: betting that someone will come along later and buy their gold off them for a higher price.

People who buy shares for capital growth, and bonds for diversification are “investors”, on this view. And remain “investors” even if said assets have negative cash flows. But those buying gold for these reasons are “gold bugs”, not pure investors. Or so the thinking goes.

In my view, it is time to accept that gold buyers are investors – and often very good ones at that. As in many respects, gold is one of the best investments there is. Below we have a look.

Markets think gold - not cash - is king

In times of crisis, people sometimes say that “cash is king”. By which they mean a select band of “hard” currencies from rich countries are what you want to own in a crisis. (No-one thinks that Bhutanese ngultrum, Kazakh tenge, etc. are king in a crisis).

But gold is the real king in a crisis – not cash.

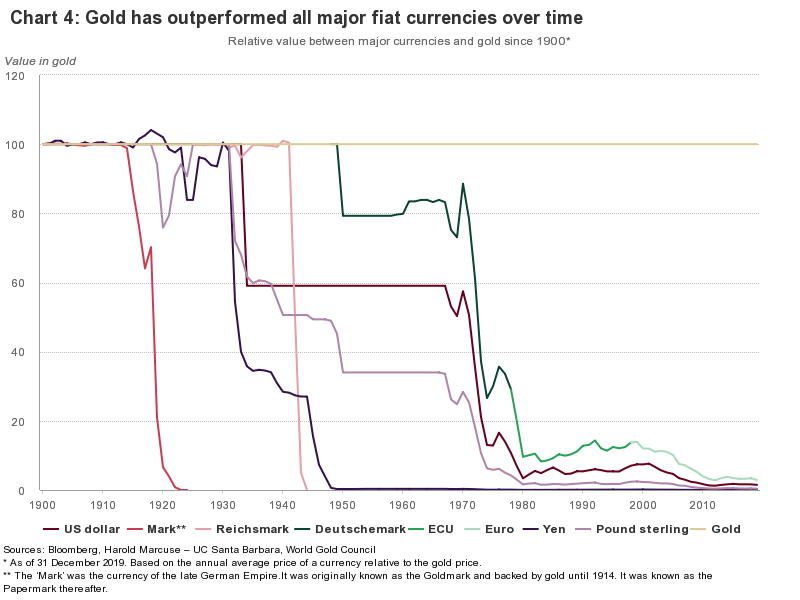

When crises come along, governments around the world respond by lowering interest rates and printing money. Lower interest rates blunt the appeal of cash and boost the gold price as people inevitably worry about currency debasement. The chart from World Gold Council below - which shows how currencies come and go, while gold always remains - illustrates the point quite neatly.

What’s been missed in much of the commentary about the gold rally is exactly this: gold is rising because the market thinks that gold is the real currency of last resort. The more governments print cash, the less that cash is king.

Gold provides better diversification than bonds

Bond markets have been around a long time. In England, they date back 400+ years. They’ve been used for all kinds of reasons.

In Jane Austen’s day, bonds were used by the aristocratic rentiers who didn’t want to work. The main bachelors in Austen’s Pride and Prejudice – Mr Darcy and Mr Bingley – would have lived off “consols”, what are known as govvies today.

But these days, with global bonds on negative yields, bond investors want diversification.

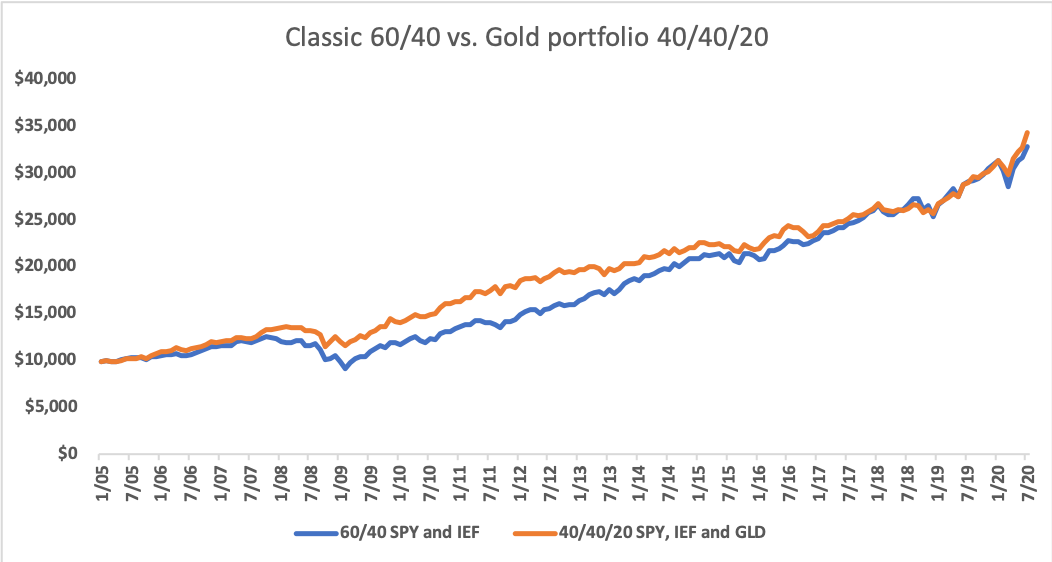

Gold’s diversification properties show up most clearly in portfolio simulations, which test how portfolios do over time. They always show that when you add a small amount of gold to your portfolio, it does better as gold tends to go up in price when other assets go down.

I've put together the above and below with Portfolio Visualizer, looking at how the classic 60/40 portfolio compares with a 40/40/20 portfolio with some gold added in.

PortfolioClassic 60/40With 20% goldStart Balance$10,000.00$10,000.00End Balance$32,846.00$34,273.00CAGR7.93%8.23%Stdev8.03%7.04%Max. Drawdown-26.78%-15.68%Sharpe Ratio0.830.98

Gold provides better returns than equities

The final reason buying gold is smart is that it has outperformed virtually every asset class. Since GLD listed in 2004, and investors could trade the spot gold price, gold has outperformed the S&P.

When shown gold’s outperformance, sceptics tend to reply that the rally is artificial or somehow fake. Therefore, we have seen a bevy of research blaming all kinds of things – from gold ETFs, to Indian weddings – for golds strong run.

Weak politicians blame voters when they fail to win elections. And weak investors blame the market when they underperform.