Emerging markets continue to be one of the most complicated areas for investors to navigate and although broadly diversified emerging market ETFs still claim most of the assets, investors are increasingly turning to country-specific ETFs to grow performance.

Compounded by various headwinds such as supply-chain issues, volatile geopolitics and rising inflation, it has never been more important to take a granular approach to emerging markets.

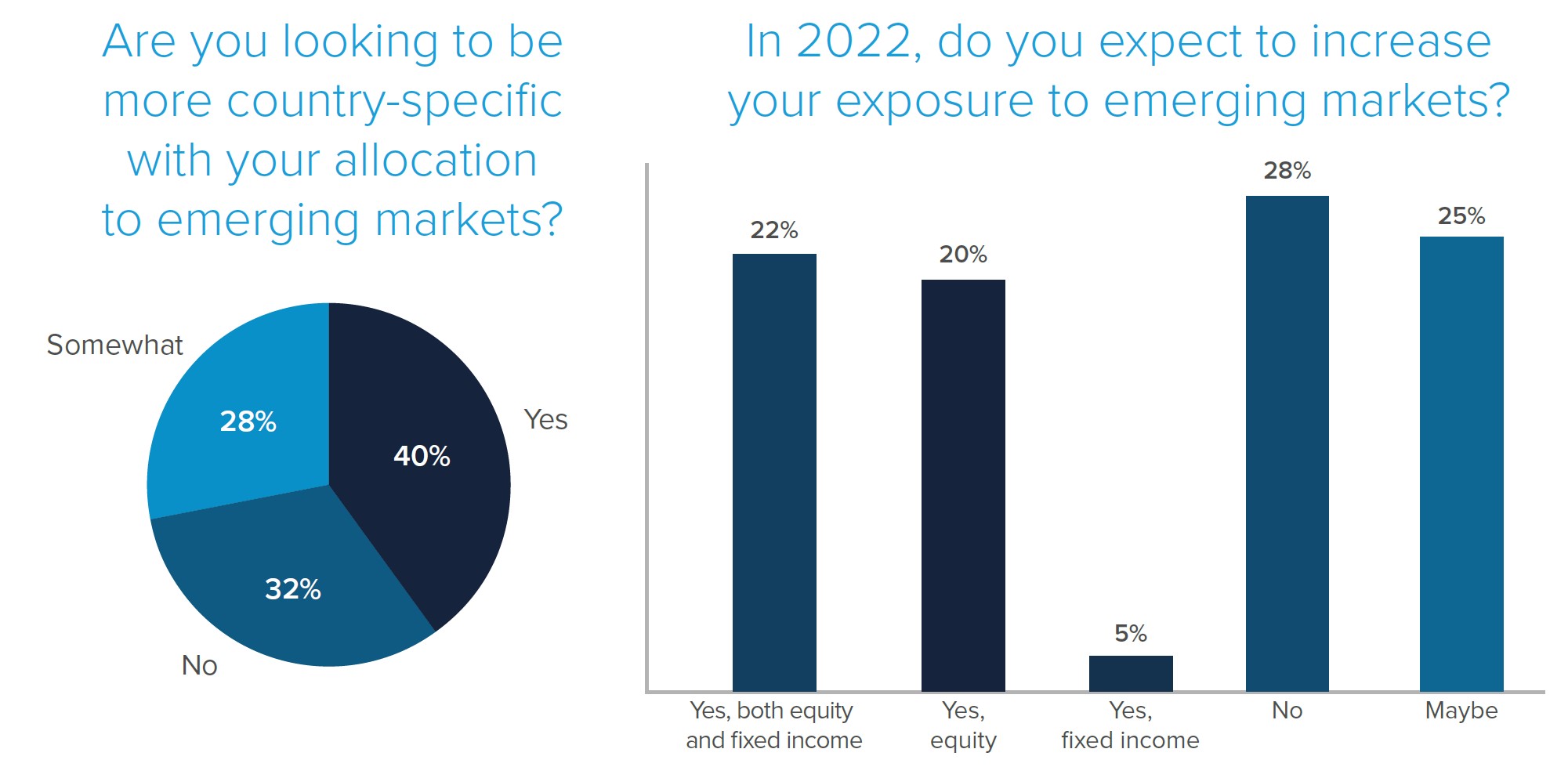

Highlighting this, research conducted by ETF Stream and Amundi last December found most investors – although even split – were more likely to be targeted with their allocations, with 40% stating they would be while 28% stated “somewhat” and 32% said they would not.

Source: ETF Stream and Amundi

No more has this trend taken hold with the country synonymous with emerging market investing, China. In 2019, Lyxor launched the Lyxor MSCI Emerging Markets ex-China UCITS ETF (EMXC) – the first of its kind in Europe – encouraging buyers to invest in China via single-country ETFs.

In November last year, Amundi followed suit with a double launch comprising of Europe’s first emerging markets ex-China ETF with an ESG tilt, the Amundi MSCI EM ex-China ESG Leaders Select UCITS ETF (EMXG), alongside a China ESG strategy.

Whatever their preference, investors are now better served than ever. Issuers have been more proactive in offering whole lines of single-country ETFs, including Franklin Templeton, BlackRock, DWS and Amundi all offering single-country ranges.

Caroline Baron, head of ETF distribution for EMEA at Franklin Templeton, said investors are starting to appreciate not all emerging markets are the same.

“There are some quite severe distinctions between some of them and if you look at how they have performed, there are also some stark differences,” she said. “If you are an investor and you really want to generate performance you have to take a more targeted approach.”

Performance drivers

According to Baron, investors now have the opportunity to generate performance in different parts of the market based on their view of the geopolitical and economical backdrop.

“Investors now have the understanding of what each country is about and role it will be playing in the portfolio, particularly in a growth allocation to emerging markets,” she said. “You had Latin America (LATAM), eastern Europe, Asia and now it is getting much more granular. So even in LATAM, people are thinking Mexico is not Brazil and Brazil is not the same as Peru.”

Baron said investors are becoming savvier and more knowledgeable, particularly in the retail space, which is also helping to drive a more precise approach.

“If you look at some of the retail investment platforms they are talking about this phenomenon as well. Two years ago, you wouldn’t have spoken about investing in Korea for example,” she said. “But when you look at the growth potential of these economies you cannot ignore them anymore.”

Highlighting this growth, and one of the main reasons investors have been attracted to a more granular approach is the outperformance in single countries such as India.

Over the past three years, the iShares MSCI India UCITS ETF (IIND) has returned 50.8% versus 29.6% for the iShares Core MSCI EM IMI UCITS ETF (EIMI), according to data from ETFLogic.

Baron added investors are likely to look at India this year because of its stellar performance.

Briegel Leitao, associate analyst at Morningstar, said: “India and China both stand as some of the fastest growth emerging market single countries. Some investors remain skittish about valuations in India which have certainly been a popular alternative to investors who looked to avoid the fallout in China.”

It’s still EM, it’s still risky

Following a turbulent 2021, the tide is now turning on Chinese stocks with some investors choosing to believe the market is looking relatively undervalued.

It is the only market that has even come close to broad emerging markets in terms of flows, with China equity and China equity A-Shares recording €3.7bn inflows over the past two years, despite fears over a government-led tech crackdown and debt-laden property developers.

Flows into broad-based emerging market strategies have still outstripped single markets, totalling €8.4bn in 2021, a significant increase on the €723m posted in the previous year.

While timing the run in the right market might give investors some well needed alpha, volatility is still a big issue with single-country ETFs which arguably leaves investors less diversified and more exposed.

Baron said investors should understand emerging markets are riskier than some developed markets and less sophisticated investors should be wary.

“You have to understand as an investor, particularly on the less sophisticated side of the spectrum that there are risks,” she said. “However, if you go with something more transparent like an ETF, which also tend to be large-cap, you give yourself a better chance of going forward in terms of managing risk.”

Related articles